https://www.consumerfinance.gov/about-us/events/appraisal-subcommittee-hearing-on-appraisal-bias/

https://www.youtube.com/watch?v=QW8ADw9vOSc

Appraisal Subcommittee Hearing Meeting about Appraisal Bias in Residential Real Estate Market ASC notes, comments by Mary Cummins. Part of the meeting was on C-SPAN 2.

Time: 2:10:35

“Streamed live on Jan 24, 2023. Join the Federal Financial Institutions Examination Council’s Appraisal Subcommittee (ASC) for a hearing about appraisal bias. Invited witnesses representing key stakeholder groups will share their views with the ASC during the hearing.”

Official information and files.

The Federal Financial Institutions Examination Council’s Appraisal Subcommittee (ASC) held a hearing about appraisal bias.

"This first-ever ASC hearing was led by Deputy Director Martinez and ASC Executive Director Jim Park. HUD Secretary Marcia L. Fudge, CFPB Director Rohit Chopra, and FHFA Director Sandra Thompson also participated in the hearing. Panel witnesses included:

Dr. Junia Howell, Visiting Assistant Professor of Sociology at the University of Illinois Chicago; Witness Testimony. It'd be better to read her testimony because she was extremely nervous, waving her arms around wildly, misspeaking and acting agitated. Most upsetting and more importantly she stated some totally false and ignorant things. She said the sales comparison approach was developed in the 1930s by whites in the US government to intentionally value white owned property higher than POC owned property. She doesn't even realize that most living in areas which were, are primarily POC especially back then were, are renters and not owners. There are also poor white areas in the US. How does she explain that? The sales comparison approach to value is the main method used to value all assets all over the world since the beginning of time. She said the government should basically give more money to her to do more deeply flawed "research." It appears that all speakers had to swear to the host of the meeting that they will only agree with the government's incorrect and preconceived ideas on the issue of the alleged "appraisal" and wealth gap. She's so ignorant she doesn't realize it's caused by the income gap and not appraisals. Lots of independent research out there to prove this. People buy homes they can afford. People who make less money but less expensive homes.

Paul Austin and Tenisha Tate-Austin, homeowners from Marin, California; Witness Testimony

Michael Fratantoni, Senior Vice President of Research and Technology and Chief Economist, the Mortgage Bankers Association; Witness Testimony

Craig Steinley, President, the Appraisal Institute; Witness Testimony

More information about the Appraisal Subcommittee can be found here"

MEETING START

Time: 6:29 Introduction by Zixta Martinez Chair of Board of ASC and CFPB. Jim Park will talk about ASC. We’ll hear from a panel of witnesses, a home owner, lender, appraiser and academic. She introduced Marcia Fudge head of HUD.

Time: 9:28 Honorable Marcia L Fudge of HUD and PAVE. I'm only going almost word for word what Fudge said because it's so important. Fudge makes her own personal bias very clear in what she said and the falsehoods she stated.

Fudge said “good morning” and got a mild response. She basically responded she didn’t like the mild response and again said “GOOD MORNING!” and everyone then responded with “GOOD MORNING!” It set the tone.

Since day one the Biden Harris administration has worked to root out bias in the appraisal system. The work is critical to advance racial equity. It’s important to me as secretary of HUD and as a black woman. I know first hand what it’s like to be told that your home is worth less than the house down the street because of the color of your skin. It’s heartbreaking to hear the stories of black and brown families who feel forced to remove family mementos and photos in hopes of receiving a fair and accurate valuation. I do not intend to do that!

Fair Housing Act of 1968 was to end housing segregation. Owning a home should provide a path to the American dream. Instead this country does not see us as equitable. June 1, 2021 100 years after Tulsa Race massacre Biden and Harris established PAVE task force a first of its kind initiative to root out racial discrimination in the home buying process so families of all backgrounds and neighborhoods can have a better chance at building generational wealth. Less than a year after PAVE was established we delivered an action plan which constitutes set of reforms to advance racial equity in the home appraisal process. We want to cultivate a well trained and diverse work force, to make sure technology doesn’t perpetuate bias. HUD made $28M available to fund testing, education, and outreach to communities on appraisal bias. Next week we will start a three part webinar on training for appraisers and housing professionals on how to identify bias and protect homes. We, (pointing to herself), know how to identify it as we see it every day. We are giving an avenue for FHA loan seekers, if they believe their appraisal was skewed by racial bias. You can make comments on our drafting table platform. Please, make comments.

I’m going to say things not in my script because I live this every day. I live in a black community by choice, BY CHOICE! I want kids in my neighborhood to get same schools as properties next to me. You do that by property tax even though I think it’s unconstitutional, that we fund schools by property tax. I want same police, fire protection but you can’t do it if my house is valued at $50,000 less than the house next to me. Two doors from me there is a neighborhood that is all white. My house is bigger, my lot is bigger, my house is nicer (laughter). That (other) house is valued more than mine. This is not the America that we should be living in, in the year 2023. It is a travesty, outrageous and we must change it. I’m hopeful the ASC will do what is right for the American people.15:44.

Mary Cummins comments. Homes are not valued differently because of the color of the skin of the owner, borrower or occupants. It's a mathematical formula based on most recent similar sales in the same neighborhood. Appraisers don't know the color of skin of homeowners, borrowers, tenants, buyers, sellers. We don't see the borrower, buyer and definitely don't know who owns properties in the area we use as comparable sales. We don't look at census tracts. We don't know race or color. It's possible all the owners of the homes we used as comp sales for a property owned by a black person were white. That would mean Fudge's false narrative holds no water.

Fudge states she wants home values and their property taxes to increase. Many poor people would be forced to sell their property and move if property taxes were increased to the level of newer more luxury expensive neighboring properties.They wouldn't even be able to sell their property for the higher non market value. That would be beyond unfair and cruel.

All real estate agents tell all home owners of every color to remove personal articles such as photos, collectibles and other items from their home.It shows the home bigger and better. Buyers don't want to see any homeowner in the home. They want to envision themselves in a blank slate of a home. It's not about race.

HUDs PAVE report was late. It was due in six months. Fudge acts like she finished it early in less than a year. Nope. Late.

Appraisal appeal, reconsideration of values have ALWAYS been available to borrowers forever. They can appeal based on any reason. They have done this. This is not about bias. Research by AEI based on government loan documents proved there is no effect of race on home value. They used the government's own data to show this. AEI presented this to the government in the meeting about the PAVE task force.

AVMs Automatic Valuation Methods do not consider race or color of homeowner or borrower. It's a math formula, technology computed by robots. No human is involved. The math formula is not based on race or color. It's based on location, size, age. It does not know condition, view, upgrades, amenities, true size, additions, lot type, location in neighborhood... AVMs value homes in poor condition higher than market. It values upgraded homes with views lower than market. AVMs aren't accurate. They are BIASED against everyone.

Fudge brought up her home value previously. She said her home is worth less BECAUSE SHE IS BLACK. I included it in a past article with address and attributes. I included a valuation of her home and of the NEW, LUXURY homes up, across the street from her. It's a private development of new luxury homes tucked away off the main street. I have no idea if the homeowners are all white. I doubt Fudge does either. Has she visited all of them personally? They're new so they're not in the census report. There is a reason why those homes are worth more. They're new, luxury, in a new development, with a clubhouse, off the main street... Not all homes of the same size in the same county are worth the same. An old run down home in South LA is worth less than a new one of the same size in Beverly Hills. If Fudge doesn't know this, she must resign because she's unqualified. I know she knows this and is just lying for effect. She's a politician working for politicians selling lies for votes, money and promotions.

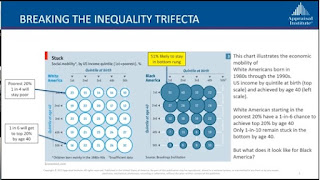

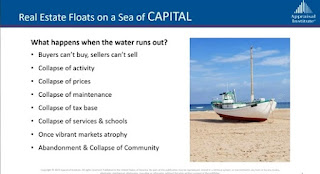

The real reason why homes owned by whites are worth more than homes owned by black, brown people is the income gap. People who make more money have more money, more generational wealth and can buy and own more expensive homes. THIS IS THE REAL ISSUE! The government needs to fix the income gap then the wealth gap would solve itself. Men also make more than women. Blaming appraisers will never fix the real issue. The government can't fix the problem (if there even is one) until they admit the real cause of the problem. The first step Scientific Method to solving problems is to determine the actual problem.They clearly don't want to fix the real problem. That means the government doesn't really care about POC or the poor. They need to stop pretending like they do care when they clearly don't. You can yell at appraisers all the live long day and that won't solve the problem.

I'll post notes from rest of the meeting letter. I will also be sending in a comment. I see some of the speakers are the Austins from California. I have covered their case since the beginning. In their linked statement they said they wanted the appraiser to use comps from the "white area" instead of their immediate neighborhood which they said is a "black area." Who are the racists here?

There were five witnesses who basically read word for word their submitted statements linked above except AI Craig Steinley. He omitted a large portion of his written statement. I think he omitted it because he didn't want questions and to get under five minutes. While other speakers said we need to get rid of the "racist" government mandated sales comparison approach AI's statement said they are adamantly opposed to that. Their statement says the approach is based on valid and accurate economic principles which it is. That is how all assets in the world have been valued forever because it is based on supply and demand between buyer and seller. I'll do a short summary in a few minutes anyway.

After that ASC members were allowed to ask ten minutes worth of questions each.

Email after the meeting

“Yesterday the Appraisal Subcommittee held its first ever Hearing on Appraisal Bias, hosted at Consumer Financial Protection Bureau headquarters in Washington D.C.

The event opened with remarks by U.S. Department of Housing and Urban Development Secretary Marcia L. Fudge. ASC’s Executive Director James Park spoke on the agency’s role in the appraisal regulatory landscape.

Attendees, both in person and on the livestream, heard testimony from Dr. Junia Howell, University of Illinois-Chicago, homeowners Paul Austin and Tenisha-Tate Austin, Michael Fratantoni, Chief Economist, Senior Vice President, Research and Industry Technology, Mortgage Bankers Association, and Craig Steinley, President of the Appraisal Institute.

Now ASC wants to hear from you! You are encouraged to provide a comment on your perspective on or experience with appraisal bias; comments can be submitted to AppraisalBiasHearing@asc.gov until February 8, 2023.”

Mary Cummins of Cummins Real Estate is a certified residential licensed appraiser in Los Angeles, California. Mary Cummins is licensed by the California Bureau of Real Estate appraisers and has over 35 years of experience.

- Mary Cummins LinkedIn

- Mary Cummins Meet up

- Cummins Real Estate on Facebook

- Mary Cummins Real Estate blog

- Cummins Real Estate on Google maps

- Mary Cummins of Animal Advocates

- Mary Cummins biography resume short

- Mary Cummins Real Estate Services

- Animal Advocates fan page at Facebook.com

- Mary Cummins

- Mary Cummins Animal Advocates on Flickr photos

- Mary Cummins Animal Advocates on Twitter.com

- Mary Cummins on MySpace.com

- Mary Cummins on YouTube.com videos

- Mary Cummins of Animal Advocates on Classmates

- Mary Cummins on VK