|

| real estate appraisal,neighborhoods,david towne,real estate appraiser,mary cummins,real estate,appraisal,census tract,california,appraiser,los angeles, |

Another great article by real estate appraisal expert Dave Towne cited below. He states what many have noted since the government started mentioning census tracts and appraisal values. Appraisers can't and don't use census tract report data in selecting comparables or valuing properties. We are not allowed to consider personal demographics. We can only consider properties in a market area similar to the subject property. Neighborhoods, market areas do not correlate with census tracts! Census tracts were made by the government to gather personal demographics of the inhabitants in specific tiny areas to compare changes over time. They are a more recent artificial constructs of government which have nothing to do with determining appraisal values.

The first census tracts in the US were made in 1906 in New York. In 1934 they were standardized and expanded to a few major cities. "The goal of the criteria has remained unchanged; that is, to assure comparability and data reliability through the standardization of the population thresholds for census tracts, as well as requiring that their boundaries follow specific types of geographic features that do not change frequently. The Census Bureau began publishing census tract data as part of its standard tabulations beginning with the 1940 Census."

For all we know the original tracts may have included some type of "redlining" based on race, nation of origin, primary language spoken, income levels... The "redlining" may have just been a correlation of less wealthy people living near the railroad tracks, polluted industrial areas and wealthier people living near the city center or a beautiful lake. Income, wealth correlate with race but race is not the cause.

The 1934 tracts have not changed but neighborhood boundaries, home values and real estate have definitely changed. Sometimes even the physical boundaries have changed with new freeways, aqueducts, dams, large government projects, dedicated parks, removal of train tracks... These areas also change as different areas go through the real estate cycles of growth, stabilization, decline and revitalization. Home values go up and down. Different people move in and out.

Appraisers use market areas sometimes called neighborhoods to selected comparables to value a subject property. WE DO NOT USE CENSUS TRACTS! The census tract number is auto-filled by a software program in the report. That's the only mention and use of census tracts. The government is the one who requested that data for their own loan use which is why it's in the form. Now they are misusing it to mischaracterize appraisers as alleged "racists" who "lowball" blacks and Latinos. Independent research by AEI has proven that race is not a factor in appraisal values. Whites make more money than Latinos and Blacks. If you make more money, you have more money and wealth. If you have more money, you will buy a more expensive home in a more expensive area. The main value of real estate is LOCATION, LOCATION, LOCATION.

When we search for comparables for a subject property some use a half mile radius from subject. Some go one mile. In rural areas they go a few miles. For a high density condo area you might just use 1/4 mile radius. Some appraisers use known neighborhood boundaries which could be two streets, railroad crossing, major boulevard, freeway or the ocean. It depends upon the subject property. If I were appraising a home in the N 600 block in the flats of Beverly Hills, I would search N 500-700 then probably go two blocks east and west of the subject for starters. If I needed to go wider, I'd only go east or west and not north or south. North is much more expensive because they are larger estates. South is much smaller tract homes on much smaller lots. I don't look at or search census tracts. I'd have to figure out how to do that if my MLS could even do that. In fact this census tract of Beverly Hills is the first one I've ever looked at in my life just now. There are ten census tract maps in the map below.

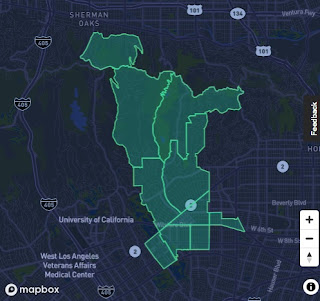

Below is the census map which includes Beverly Hills, zoning map of Beverly Hills and zip code map. They're all different. I'm using this because I grew up here and know all the different market areas very well. Some of the areas in the census maps are commercial only and worth trillions of dollars. People don't live in those areas. They are stores, offices, medical centers in the golden triangle. Some of the areas in the census map are Beverly Hills and some are the city of Los Angeles. Beverly Hills property is easily worth twice Los Angeles property even if it's just across the street for many reasons yet they're in the same census tract.

There's a thick line running down the middle of two census tracts. That's Sunset Blvd. Properties north of Sunset are worth 2-3x as much as properties south of Sunset. I could go on and on. The purpose is to show you that census tracts have nothing to do with real estate appraisal values. Three homes in the same tract could easily be worth $300,000 (small studio condo in Los Angeles), $2,000,000 small tract house south of the long gone rail road tracts on Santa Monica Blvd or $50,000,000 home above Sunset. Census tracts don't correlate with value. They should only be used to talk about people.

I think the problem with census tracts and home values first started with fraud Andre Perry. He used Zillow Zestimate home values in different census tracts and compared them with the predominant race of people in the census tract area. His goal, agenda was to show that black owned homes are worth less than white owned home due to "old white racist male" appraisers intentionally low balling black people. No appraiser appraised any homes in his paper. He used only inaccurate Zillow values. He also just used the majority percentage of blacks in each area. He then cherry picked and twisted the results to fit his agenda. The results of his fraudulent study showed that whites make and have more money than blacks, latinos. Whites can afford to buy more expensive homes in more expensive areas. We've known about the income and wealth gap for years. It's caused by income and socioeconomic factors but not race or real estate appraisers. AEI research which disproves Andre Perry's fraudulent paper.

|

| Census map of Beverly Hills. Ten maps which include Century City, Sherman Oaks and Los Angeles cities. |

|

| Map of the city of Beverly Hills broken up by zip codes just so you can see the outline of the city. |

Below is Dave Towne's article. I asked his permission to share it. I'd link to it but he posts it in an appraisal group which is not public.

"Not to gloat, but I seem to be the only appraiser in the US who has observed and reported how people-oriented DEMOGRAPHIC CENSUS TRACT DATA reported by FHFA, the GSE’s and other entities is being used to tar and feather appraisers. I have written about this topic at least 2x in the past.

The latest is this 8/01/23 INSIGHTS newsletter, in the link, from FHFA ...... the ‘conservator’ of Fannie Mae and Freddie Mac:

Blog | Federal Housing Finance Agency New Measures in the UAD Aggregate Statistics: Opportunities to Explore Data on Comparable Properties and Structural, Lot, and Neighborhood Characteristics (fhfa.gov)

Here’s what’s in that (screen shots of the document):

Appraisers don’t appraise properties with CENSUS TRACTS as a paramount data point. Most of us don’t even know where the tract boundaries are.

The Census Tract Number on the appraisal form is only there so that the LENDER and their regulators can track loans made in Tracts.

Because the ‘researchers’ cannot get into the minds of appraisers to determine how comps are selected, all the ‘researchers’ can do is fall back on this DEMOGRAPHIC metric. That’s unfair to appraisers. “We” appraisers are not allowed to use or consider people-oriented DEMOGRAPHICS in reports.

But what’s conveniently overlooked in this metric is the econometric status and other factors that play into where people choose to live and how baseline property valuations are done, starting with the local jurisdiction Assessor. Those baseline factors started decades ago, long before most appraisers got into the business.

Buyers also don’t use Census Tracts as a determining factor on where to buy their home, unless magically the Tract corresponds with other geographic or personal factors the buyer considers important. Builders/developers in most cases don’t purposely put up new housing based on Census Tract demographic info.

What’s been happening since 2018 or before is the likes of Andre Perry and Elizabeth Corver-Glenn, Ph.D, etc., have incorrectly used Census Tract people-oriented DEMOGRAPHIC info to inform Congress and others that “We” appraisers are valuing properties all wrong and it must be stopped.

Because of this, Census Tracts are becoming the de facto element “We” must acknowledge and that other people think is proper.

In short, using only this people-oriented DEMOGRAPHIC based data item to judge appraisers is just plain wrong.

Dave Towne, MNAA, AVAA, AGA "

About David Towne

Certified Residential RE Appraiser at Towne Appraisals

AGA, MNAA, Accredited Green Appraiser - Licensed in WA State since 2003

https://www.linkedin.com/in/dave-towne-4a65226/

https://www.towneappraisals.com/

http://www.e-appraisersdirectory.com/Washington_Appraisers:Towne_Appraisals-48-2989-0-0-1864.html

Mary Cummins of Cummins Real Estate is a certified residential licensed appraiser in Los Angeles, California. Mary Cummins is licensed by the California Bureau of Real Estate appraisers and has over 35 years of experience.

- Mary Cummins LinkedIn

- Mary Cummins Meet up

- Cummins Real Estate on Facebook

- Mary Cummins Real Estate blog

- Cummins Real Estate on Google maps

- Mary Cummins of Animal Advocates

- Mary Cummins biography resume short

- Mary Cummins Real Estate Services

- Animal Advocates fan page at Facebook.com

- Mary Cummins

- Mary Cummins Animal Advocates on Flickr photos

- Mary Cummins Animal Advocates on Twitter.com

- Mary Cummins on MySpace.com

- Mary Cummins on YouTube.com videos

- Mary Cummins of Animal Advocates on Classmates

- Mary Cummins on VK

Mary Cummins, Mary K. Cummins, Mary Katherine Cummins, Mary, Cummins, #marycummins #animaladvocates #losangeles #california #wildlife #wildliferehabilitation #wildliferehabilitator #realestate #realestateappraiser #realestateappraisal #lawsuit real estate, appraiser, appraisal, instructor, teacher, Los Angeles, Santa Monica, Beverly Hills, Pasadena, Brentwood, Bel Air, California, licensed, permitted, certified, single family, condo, condominium, pud, hud, fannie mae, freddie mac, fha, uspap, certified, residential, certified resident, apartment building, multi-family, commercial, industrial, expert witness, civil, criminal, orea, dre, brea insurance, bonded, experienced, bilingual, spanish, english, form, 1004, 2055, 1073, land, raw, acreage, vacant, insurance, cost, income approach, market analysis, comparative, theory, appraisal theory, cost approach, sales, matched pairs, plot, plat, map, diagram, photo, photographs, photography, rear, front, street, subject, comparable, sold, listed, active, pending, expired, cancelled, listing, mls, multiple listing service, claw, themls, historical appraisal, facebook, linkedin

DISCLAIMER: https://mary--cummins.blogspot.com/p/disclaimer-privacy-policy-for-blogs-by.html