UPDATE: The Fair Housing Alliance just stated they prepared the report with their partners. "The federally-funded report produced by the National Fair Housing Alliance and its partners raises serious concerns about the standards and criteria related to the appraisal of residential real estate, which often represents a family’s largest asset." IWoodruff@nationalfairhousing.org

How does one go about getting a federal government grant to write an "independent study" which uses false and misleading data to promote their organization's agenda? Must be nice.

ORIGINAL: Jim Park of the Appraisal Subcommittee (ASC) just released a press release which states,"Findings Released in Independent Study on Real Estate Appraisal Standards and Appraiser Qualifications Funded Through a Cooperative Agreement Between the Appraisal Subcommittee (ASC) and the Council on Licensure, Enforcement and Regulation (CLEAR) report titled "Identifying Bias and Barriers, Promoting Equity: An Analysis of the USPAP Standards and Appraiser Qualifications Criteria."

It's an 84 page pdf. I assume this will be part of the PAVE Task Force report due February 2022? Send comments to jim@asc.gov

https://www.asc.gov/Documents/OtherCorrespondence/2022-01-14%20NFHA%20et%20al_Analysis.pdf

The National Fair Housing Association, Fair Housing Advocates of Northern California, Fair Housing Center of Central Indiana, Andre Perry contributed to this report. They promoted the false narrative of alleged appraisal bias in the case of Paul Austin, Tenisha Tate in Marin, California besides a few others. Andre Perry has been peddling his non-peer reviewed, non-published false research to sell his books. I'm glad that Christensen Law and Peter Christensen also contributed to this report. Christensen understands real estate appraisal, regulations and the law. It doesn't look like he was allowed to contribute much at all.

I won't go over the entire report in great detail though I will note a few things.

Pg 5, paragraph 2, "Until recently, however, the appraisal industry seems to have escaped the type of regulation and scrutiny faced by other participants in the mortgage market. Our analysis finds that the appraisal industry has operated in a relatively closed, self-regulated framework."

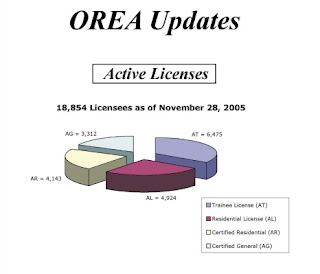

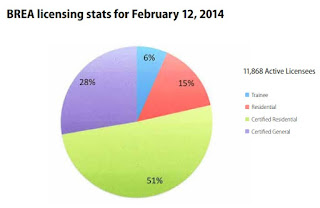

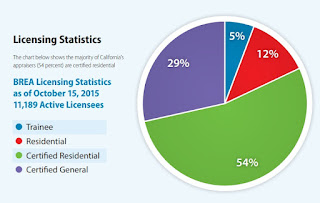

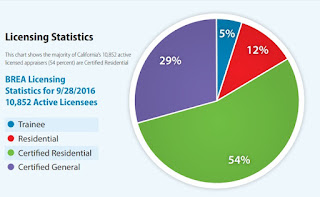

Real estate appraisers are extremely regulated. We are more regulated than loan agents, real estate agents/brokers and others in the mortgage market. Real estate appraisers (brea.ca.gov) need a college degree, 200 hours of college level classes, 1,500 hours of experience with licensed experienced mentor, must pass exam and background check. Loan agents (nmls.org) only need a 20 hour course, must pass exam and background check. Real estate agents (dre.ca.gov) only need three college level courses, must pass exam and background check. These people act like Appraisers are the ones who made it so difficult to become an Appraiser to keep others out. It was the government who mandated this after falsely blaming Appraisers for the Savings and Loan Crisis, Great Recession and other real estate busts caused by other players in the market including the government.

We are regulated by the federal and state governments and are not "self-regulated." People are under the misconception that the private non-profit the Appraisal Institute (AI) who is supposed to represent Appraisers actually regulates Appraisers. They don't. We're regulated by multiple federal and state government agencies, see this article. Appraisers have to pay to join the AI. If you want to be an AI MAI Appraiser, it will cost you about $15,000 and take a couple of years. Only wealthy appraisers with $15,000 laying around and lots of extra time can afford to join. I'm not a member.

"Recent news stories have presented the shortcomings of the appraisal industry in stark relief, where individual homeowners and researchers have demonstrated that discriminatory bias continues to plague the appraisal industry, undermining value and breaking a key rung on the ladder to the middle class for families of color."

The recent news stories have proven to be false. The real reason people of color own homes which are worth less than the homes of white people is income. POC make less money. Women also make less money as do other groups. Of course they will buy and own homes that cost less. I've written about some of the major cases in the media, see below.

Cora Robinson, Oakland, California. HUD complaint most likely already dismissed.

Paul Austin, Tenisha Tate, Marin, California No HUD complaint, lawsuit will most likely be dismissed.

Carlette Duffy, Indianapolis, Indiana HUD complaint most likely already dismissed

Abena Sanders Horton, Alex Horton, Jacksonville, Florida New FOIA request. No info yet.

I did FOIA requests for all of the above cases. Only three actually filed complaints. I believe two complaints have already been dismissed. I'm just trying to get a hold of the final report which they will not release unless I get a signed and notarized form signed by the complainant which states their full name, date of birth, country of origin, nationality, home address ... stating they agree to the report being released. I'm obviously appealing the FOIA case because that is ridiculous. I think they are withholding the reports because of the PAVE report coming out. These people publicly posted their complaints with their information online and in national press releases. The cases appear to be over per FOIA. If they won, they would have released another national press release and more media articles. This is why HUD doesn't release cases where no discrimination was found. They try to blame it on FOIA regulations which is false. Asking for the "country of origin" of the complainant seems discriminatory. I don't need or want to know that. It has nothing to do with the complaint.

From the Outline.

The report suggests Appraisers need more training on Fair Housing. We already have lots of repetitive training on Fair Housing to get your license and renew it every two years. That is not an issue.

Duty of Care, pg 11. They suggest adding the borrower as an "intended user" of the lenders appraisal report to increase accountability to the borrower. No much for appraisal independence and undue influence. Then the lender who ordered the appraisal will also be liable to the borrower. I see great push back on this issue. The purpose of the appraisal is to secure the loan for the bank and anyone who buys the loan or mortgage backed securities based on the loan. The borrower doesn't have to get a loan. A private loan is not a right but a privilege. The borrower can hire their own appraiser to do their own appraisal. Then they can be the intended user of that report.

"To increase the accountability of appraisers to borrowers who have been injured by appraisal negligence, the Appraisal Standards Board should consider amending the USPAP Standards to require appraisers to identify mortgage borrowers as “intended users” of appraisals prepared in relation to residential mortgage transactions."

Part I, Background, A, Bias in the Industry, "Redlining."

Adding race, nation of origin to the map data was dead wrong. Most of the other loan risk factors in the maps were based on many other factors besides race and nation of origin. The main factors were income and wealth of inhabitants. If you removed race and nation or origin from the data which they did, the risk stayed the same. These are the same risk factors we use today for credit scores. There is/was a correlation between POC and income. People with less income, less money live in areas with lower priced housing because that is what they can afford. These properties are more likely to be older, less well maintained, near industrial property and other less desirable features. That's why they were cheaper. When people have very little money, it's easy for them to not be able to make loan payments if they suffer one emergency. The solution to this problem is the same, increase the income of POC and others. More income, less risk.

"Discrimination in Appraisals Continues on an Individual and Systemic Basis," pg 17.

They mention some of the alleged discrimination cases in the media. They don't bother to do any investigation into the cases to determine if there was indeed any discrimination. They don't post the results of the HUD complaints two of which were most likely already dismissed. Instead they link to press releases and false and misleading news articles. I will check out the Colorado and Connecticut cases.

"Discrimination in Appraisals Exists on a Systemic Basis," pg 18.

They mention the Freddie Mac research on Appraisal Gap. I wrote an article here which explains Appraisal Gap. You are more likely to have appraisal gap in areas which are revitalizing and quickly appreciating due to the historical nature of appraisal reports. Areas which are revitalizing are more likely to have POC. That is the correlation. At least they do note that the effect was shown across the nation and across appraisers. This shows it was not individual appraiser bias.

They mention FHFA report on keywords found in appraisal reports, pg 19.

FHFA stated they searched millions of reports for what they feel are discriminatory words and found thousands had words which could be considered discriminatory. Just to get a ballpark figure here, 1,000/1,000,000 = .001 or .1% of reports. They did not review the reports and find the values were low or not market value.

I agree that no one should have discriminatory language in the report. I disagree with the word "gentrification." I don't use it because it's not accurate.The proper term is revitalization. Still, it has nothing to do with race but money. Socioeconomic classes aren't protected. Lenders can discriminate based on money. FHFA itself uses the word all of the time as do other government agencies. Is it only discriminatory if an appraiser uses it?

Andre Perry's misleading report, pg 19. This report has been debunked here. It's not peer reviewed or published research. If you read Andre Perry's book, he is biased against certain people. He admits it. He also has an agenda to sell books.

Pg 19, "Howell/Korver-Glenn. A 2020 study of American Community Survey homeowners’ estimates from 1980 to 2015 found that neighborhood racial composition was an even stronger determinant of a home’s value in 2015 than it was in 1980."

That's because there is still a strong correlation between income and POC. The government and others haven't done anything about this. POC make less money. For this reason they buy and own homes in less expensive areas. They also own less expensive cars. Is that also the fault of real estate appraisers? FTR all the values came from inaccurate Zillow. Zillow has stated their values are not appraisals or accurate. Appraisers did not contribute the values in Andre Perry's paper or the other research so you can't blame appraisers.

Pg 22, They basically state the Sales Comparison Approach is biased because it's based on the sale prices of similar homes in the same area. Everyone knows the main three factors of home valuation are location, location, location. Should we use comps in Beverly Hills to appraise a home in South Los Angeles? No. Even if an Appraiser appraises a $100,000 home for $200,000, it doesn't affect the market value. The home is not worth $200,000.

Pg 22, This is utter nonsense to cite in a government report! In the book "Race Brokers, Dr. Korver-Glenn details the results of interviews with appraisers, including appraisers of color, regarding the steps they use to value a home based on their interpretation of the sales comparison approach.27 Many of the appraisers in the study “assumed that White buyers were the standard for determining an area’s desirability, with White areas meeting this standard and receiving the highest values and non-White areas falling below the standard.“

Who the hell did this person interview?! Did they not interview appraisers in low income white areas like Florida, Virginia, California...every state in the nation? The sales comparison approach will show you the area's desirability based on money. It has nothing to do with color but income. AVMs, Appraisers don't see the occupants. We don't know the races of the people. There is no race reference in the data we research.

Pg 24, "Appraisal Discrimination Is One of the Key Drivers of Today’s Wealth Gap." No, income gap is the main driver of the wealth gap! If you make less money, you have less money, buy and own a less expensive home. This discriminatory language should have never been allowed in a government report. People who complain about discrimination discriminating against others again. If the tables were turned, these people would be screaming bloody murder.

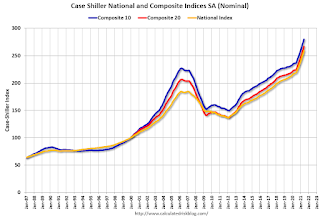

Pg 24, "Appraisals Can Also Raise the Unique Challenge of Overvaluation." After the great recession everyone lost home equity. It affected poor people with subprime loans even more because the loose lending regulations by the government caused these people to have mortgages they could not afford. They lost their homes. If they met proper income, savings requirements, they would have been able to afford to pay their mortgage even though they were upside down like everyone else. If they weren't less wealthy, they would have had money to weather an emergency.

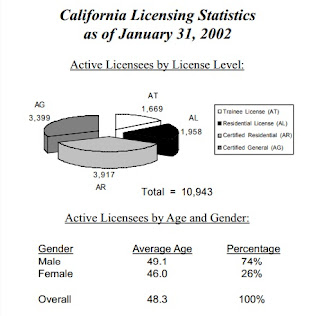

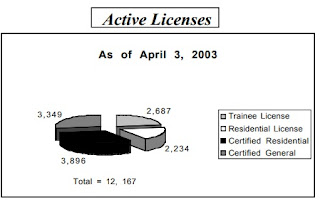

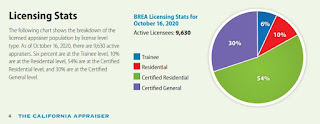

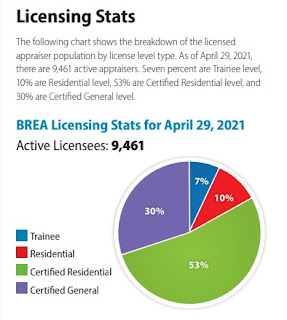

Pg 26, "The Appraiser Workforce Suffers from a Lack of Diversity." Appraisers are just about as diverse as real estate agents, loan agents yet no one complains about them. They don't complain because agents can't kill deals with low appraisals but appraisers can. Here is an article I wrote about race and appraisers. That said I'd love to see race of appraisers match the nation. We need more diverse appraisers. The race of appraisers won't affect values because it's based on math and numbers.

Part II.

C. Governance of Appraisal Industry.

They bring up the fact that the Appraisal Institute is a private organization not part of the government, and doesn't legally have to abide by all government regulations. They suggest investigating the relationship between AI and the government. In the meantime they suggest AI add more diverse board members including consumers and civil rights people. In light of who actually made the report they basically want their own people on the board to control the AI. They said nothing about race, gender ... diversity. Here is their white board. Leadership is also 100% white. Six of 29 board members are women. I think they're all Appraisers. They should have others on the board. The government should keep in mind that the AI must follow their non-profit mission statement. Their mission is not to promote the government but appraisers and the industry. I didn't realize that people have to pay to appoint a trustee. That's ridiculous. AI should offer USPAP to anyone for free. Most of the other recommendations are already being done.

D. Gaps in Fair Housing Requirements and Training

"As described above, the evidence clearly shows that the current appraisal system can result in biased valuations, both at the individual and neighborhood level. The causes of such bias are varied and complex."

I disagree that evidence has shown bias in the current system. The Market Comparison Approach to value shows the market value. It's based on willing sellers and buyers. If someone wants to pay $200,000 for a $100,000 home in South Los Angeles, they can do that with a huge down payment but they won't because it doesn't make sense. The property won't be worth $200,000 except for property tax purposes. They can only sell it for $100,000. They lost $100,000.

I also doubt that appraisers are not getting enough training in fair housing and discrimination. We take many classes to get our license and more classes every two years to keep our licenses. I don't know any appraiser who does not realize it's not legal to discriminate. If they want to add "shall" and "must" to USPAP, fine by me. I'm also fine with education changes as long as there aren't more hours and are just more hours on fair housing.

E. Barriers to Entry into the Appraisal Profession

I agree with some of these issues and suggestions though not all. They suggest reviewing any possible barriers to entry. Let's just make sure the bar is not so low that anyone can become an appraiser. You need to be a math, numbers person who can physically measure a building, climb a ladder, get into a crawl space, visually see construction material, hear a fan... They need some hands-on training. You wouldn't want a medical surgeon to just pass a written test then start cracking people open with a bone saw.

They suggest reducing license types to certified and general only getting rid of trainee.They suggest getting rid of college education requirement and possibly reducing the number of education hours needed. They suggest having an application based class so they can learn how to do an appraisal and getting rid of experience hours. If they do that, lenders will just make sure they only request appraisals from appraisers with so many years of experience. Those new people won't get work. They suggest reviewing the tests to make sure they are fair. I passed the appraisal exam for certified residential first time within an hour after a major car accident (uninsured motorist totaled my car) where I broke both wrists and got a concussion. I didn't go to the hospital until later because I was not going to lose my $750 test fee. I agree that some questions were worded poorly but just choose the best answer. The test was easier than high school exams. I would hope at least a GED or High School diploma would be needed. Don't set people up for failure. Make sure they can do the job or they won't get work.

They suggest AI and others try to recruit more women and people of color. I'm a Latino female. I contacted AI about supposed scholarships they offer. They said I have to pay to join AI just to apply for the scholarship! They dangle a scholarship to get money from new memberships. No thanks.

One worry here is that the big rush of appraisals is over. We don't need new appraisers right now. I fear people will pay to become appraisers and lenders will not use newbie appraisers. That would be cruel to do to people.

F. Compliance and Enforcement p. 71

They talk about using data to determine if there is discrimination in appraisals. They talk about releasing report results. They won't release negative results of HUD complaints because complainant of course won't agree. You will only hear about cases where there was discrimination or someone agreed to a non-guilty statement just to end the case due to legal costs. They need to release ALL of the HUD complaints and investigation results.This is why the false narrative has continued. HUD did state most cases are dismissed but that's it. HUD also said most discrimination complaints based on disability and not color or race.

They talked about maybe using another method of determine value. Lenders won't agree to cost or income approach as they don't reflect market value. Lender needs to know what they can sell the property before if the borrower doesn't make the payments. They talk about getting rid of the free form text parts of the appraisal. Okay! Less work for appraisers though they may no longer comply with USPAP without text explanations.

Pg 77, Reconsideration of Value

There should be standards in the ROV process. I believe there already are but I'm fine with it being more defined. Maybe there should be a fee paid by the lender. Sometimes an appraiser can be given seven new comps to consider. If you have to drive and see them all then put them all in the grid and then explain why they can or cannot be used, that's a complete new appraisal if not more work.

Conclusion

Overall I disagree with the message and tone of the report. The report is discriminatory, biased and defamatory against appraisers as a whole and as an industry. There is no independent research which shows appraisal bias and discrimination. They mention anecdotal media cases about alleged bias and discrimination as if they were facts. HUD won't release the final investigation reports of two cases which I believe have been dismissed because the complainants don't want them released. They refer to Andre Perry's paper as if it were peer review published research when it's just the false basis of his misleading book which he's selling. I'm okay with the basic recommendations which are to take a closer look at some issues. I agree with some of the suggestions to make becoming an appraiser easier.

Below is the Table of Contents with page numbers.

Table of Contents

Acknowledgments 3

Executive Summary 5

Part I: Background 13

A. The Problem of Bias in the Appraisal Industry 13

• The Appraisal System Historically Undervalued Homes in Communities of

Color

13

• Appraisal Policies Perpetuated an Unfounded Association Between Race and

Risk

15

• Discrimination in Appraisals Continues on an Individual and Systemic Basis 17

• Appraisal Discrimination Is One of the Key Drivers of Today’s Wealth Gap 24

• Appraisals Can Also Raise the Unique Challenge of Overvaluation 25

• The Appraiser Workforce Suffers from a Lack of Diversity 26

B. Civil Rights Laws and Regulations Applicable to the Appraisal

Industry

27

• The Fair Housing Act and the HUD Regulation 27

• The Equal Credit Opportunity Act and the CFPB’s Regulation B 28

• The Civil Rights Act of 1866 29

• State Laws and Prohibited Bases 29

• Theories of Proof 30

• Increase in Appraisal Discrimination Enforcement 33

Part II: Analysis and Recommendations 34

C. Questions about the Governance of the Appraisal Industry 34

• Overview of the Appraisal Regulatory Structure 34

• The Appraisal Foundation’s Legal Authority is Not Clear 35

• The Appointments and Elections Processes Would Benefit from Inclusion of

Viewpoints that Represent Consumers, Including Consumers of Color

40

• The Rules of Procedures and Exposure Draft Process Would Benefit from

Greater Transparency and Inclusion of Viewpoints that Represent Consumers,

Including Consumers of Color

44

2

D. Gaps in Fair Housing Requirements and Training 48

• Lack of a Clear Prohibition of Discriminatory Conduct 48

• Lack of Guidance on the Use of Discretion 52

• Lack of Clear Fair Housing Training Requirements 56

• Lack of Effective Fair Housing Training 58

E. Barriers to Entry into the Appraisal Profession 64

• Multiple Levels of Licensing and Certification 64

• College Degree Requirements 66

• Appraisal Education Hours 66

• Experience Hours 66

• Standardized Tests 68

• Concern: Pipeline of Trainees and the Future of the Profession 69

F. Compliance and Enforcement 71

• Need for Data 71

• Development of Robust Compliance Management Systems 72

• Duty of Care: Appraiser Accountability 75

• Reconsideration of Value Process 77

G. Conclusion 80

H. Glossary of Acronyms 81

I. Appendix I – Authors’ Summary Biographies 82

Mary Cummins of Cummins Real Estate is a certified residential licensed appraiser in Los Angeles, California. Mary Cummins is licensed by the California Bureau of Real Estate appraisers and has over 35 years of experience.

- Mary Cummins LinkedIn

- Mary Cummins Meet up

- Cummins Real Estate on Facebook

- Mary Cummins Real Estate blog

- Cummins Real Estate on Google maps

- Mary Cummins of Animal Advocates

- Mary Cummins biography resume short

- Mary Cummins Real Estate Services

- Animal Advocates fan page at Facebook.com

- Mary Cummins

- Mary Cummins Animal Advocates on Flickr photos

- Mary Cummins Animal Advocates on Twitter.com

- Mary Cummins on MySpace.com

- Mary Cummins on YouTube.com videos

- Mary Cummins of Animal Advocates on Classmates

- Mary Cummins on VK