|

| Mary Cummins, Real Estate Appraiser, California, BREA, OREA, license, licensee, certified, residential, general, trainee, Los Angeles, number, increase, decrease, year |

UPDATE: New article about total number appraisers in US. They show 7486 appraisers in California.

https://appraisalbuzz.com/analysis-of-2025-asc-appraisal-license-data/

02252025 Chase Pursley just posted an article with ASC appraiser statistics on LinkedIn. He stated per ASC the number of licensed appraisers in California is 6,686 as of today. Per BREA there were 8,796 licensed appraisers in 2023. Would be interesting to know why the numbers are different. ASC should have all licensed appraisers. What does the BREA list include that ASC doesn't? Figured it out. BREA lists people who live outside of California who have California licenses. Some have more than one type though both types may not be active. An older residential license may be included along with say certified general if they upgraded. That's why BREA shows more licenses which may not mean unique licensees.

https://www.linkedin.com/feed/update/urn:li:activity:7300289295423074304/

06252024 AppraisalBuzz stated there are 70,000 appraisers in the US. We have a population of apx 340,000,000. They stated 1/3 are eligible for social security which is about 62-65 years old.

05272024 I was fooling around in the BREA site and searched all appraisers. It said "14056 record(s) returned." These are all appraisers on record. Some could be expired, cancelled, dead ... and not active. I don't know when or why BREA would remove an appraiser from the list.

https://www2.brea.ca.gov/breasearch/faces/party/search.xhtml

I was in the site looking for AMCs. The total number of AMCs I assume including expired, cancelled in 2019 was 148. I printed out the list. Today it was 327 five years later. It could be more expireds or more AMCs now working in multiple states. It doesn't necessarily mean there are more currently licensed AMCs in California. Plus, some AMCs were taking over by others and are now DBA as the other AMC name.

02152024 As of November 6, 2023 there are 8,796 appraisers in California down from a 20,000 peak in 2007.

More stats:

59% are aged 50-69

65% are male

https://www.brea.ca.gov/pdf/23-493_BREA_Fall_Winter_Newsletter_web.pdf

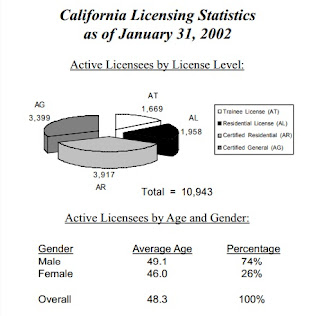

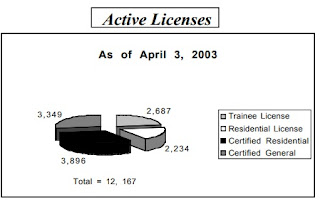

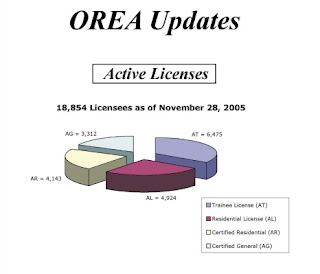

Numbers for last 22 years or so are below:

2002 10943

2003 12167

2005 18854

2007 20100

2009 15625

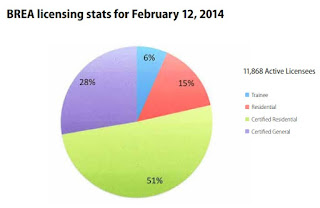

2014 11868

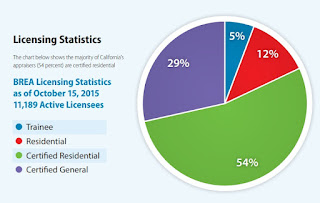

2015 11189

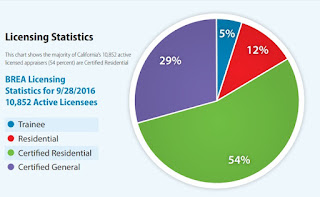

2016 10852

2017 10742

2018 10562

2019 10056

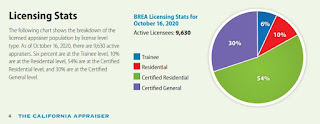

2020 9630

2021 9461

2022 9374

2023 9012

2024 8796

08/01/23 As of June 15, 2023 there are 9,012 appraises in California down from 20,000 peak in 2007. https://www.brea.ca.gov/pdf/BREA_Spring_Summer_Newsletter2023.pdf

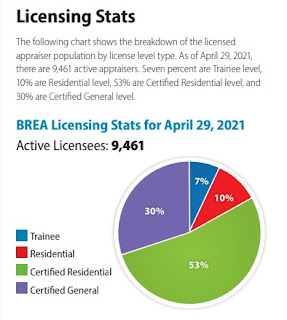

12/31/22 From the fall/winter newsletter. "As of October 1, 2022, there are 9,374 active appraisers. Eight percent are trainee level, 10% are residential level, 53% are certified residential level, and 29% are certified general level." Basically only 82% can appraise for federally backed bank loans. Number is down again.

05/06/2022 Number of licensed appraisers as of March 16, 2022 is 9,613. "Eight percent are trainee level, 10% are residential level, 53% are certified residential level, and 29% are certified general level." This is based on the newsletter below which I received 05/06/2022.

What's concerning is the number of certified residential is 4,988. You must have a Certified Residential appraiser for loan purposes if the loans are backed, insured by the federal government. You can also be a certified general but CR is the minimum needed. Number of trainees doesn't matter that much because business is way down now because of increasing interest rates. I doubt most get their final licenses because there won't be any work. You also need a minimum of two to three years of experience to get work. I wrote about this in a previous article about the problems with the trainee model.

https://brea.ca.gov/pdf/Newsletter%202022%20spring-summer.pdf

ORIGINAL: Above is a chart of the active licensed real estate appraisers in California per the California Bureau of Real Estate Appraisers. The numbers are also in a table below. This includes Trainee, Residential, Certified Residential and Certified General. The numbers aren't taken from the exact same time every year because that is how they reported it via their website. Most were November of each year. The numbers came from the Spring or Winter Newsletter reports. The specific dates and numbers are listed below.

In Spring 2009 the head of BREA (then called OREA) Bob Clark stated "With the unprecedented appreciation in real estate values, OREA experienced a dramatic increase in licensing activity, going from approximately 18,800 licensees in 2005 to over 20,100 licensees by the beginning of 2007. With the decline in the real estate market, the pendulum has swung in the opposite direction, with a current license population of approximately 17,300."

There were 17,300 in the Spring (maybe March 2009) and 15,625 by November 30, 2009. Today we have less than 50% of the number appraisers we had in 2007 right before the peak then crash. We have about 10,000 fewer Appraisers. This doesn't mean we don't have enough appraisers.

The peak before the Great Recession was about 2007. Homes had appreciated greatly and rates were low so everyone was buying, selling and refinancing. This caused a huge demand for real estate appraisers, agents and mortgage brokers. There is always a large influx during these times. It is expected to lose licensees as the market slows because there is less business. Appraiser licenses renew every two years today. It makes sense that licensees would not renew their license when it expires after the slowdown. For this reason there could be up to a two year lag between the slow down and loss of licensees. Some got their license to appraise as a side gig. Licensees doesn't mean they are working appraisers or full time working appraisers.

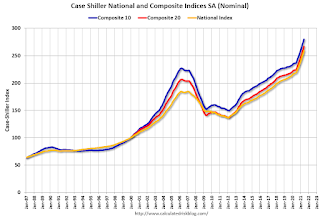

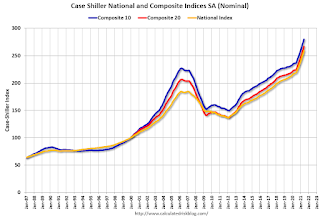

Below is a chart of the U.S. National Home Price Index. You can see the 2007 peak and subsequent Great Recession. You can also see our current crazy market.

|

| US National Home Price Index, BREA, Mary Cummins, Real Estate Appraiser |

One would expect an increase in the number of appraisers when the market heats up like it has done within the last few years. Oddly enough there is no increase in the number of licensed real estate appraisers. I believe one of the reasons there hasn't been an increase is because of the current Trainee Appraiser Program. Today a new real estate appraiser must work at as Trainee for a licensed, experienced Appraiser for a certain number of hours. That is difficult to almost impossible because licensed Appraisers generally don't want to mentor trainees. Nothing to gain, everything to lose. I wrote an article that outlines the problems HERE with possible solutions.

The market is expected to continue to appreciate though not at the crazy rate of 2020 and 2021. Some lenders, mortgage brokers such as Better.com have already eliminated some lending agents. One of the reasons it will slow is because the Fed has stated they will increase interest rates in 2022 maybe even more than once. Another reason is lack of inventory and many being priced out of the market. While some Appraisers were busy and had lag times within last six to 12 months things have already slowed and not just because of the holiday time of year. We may not need more appraisers.

The Government stated they are working to understand the Appraiser issue. By the time the issue is resolved there won't be a need for as many because of the market. Things have already slowed and will slow further. Maybe we just don't need as many appraisers as we did in the past. Today some lenders use appraisal waivers and AVMs. This could end up being a non issue.

Some lenders, AMCs, others are stating there aren't enough appraisers. This isn't true. There may not be enough appraisers today willing to do desktop appraisals for $65-$130. Most appraisers don't want to do desktops because of the liability issue. The law and form states we must agree that we have enough verified data to complete the assignment. If you don't do the inspection, drive the comps, you don't have enough data. What if there's a major defect in the property, area, comp photos are photoshopped... Then the appraiser is on the hook for any loss. It won't matter that you relied on the inspection by John Doe and comp photos on MLS. You're still liable. Why accept the same liability for 1/5 to 1/3 the payment?

Below is a cartoon about the issue. It's an older cartoon but it rings true today.

|

| appraiser shortage, not enough appraisers,cartoon, lie, false, mary cummins, real estate appraiser |

AMCs, Lenders, others want to make it super easy for new appraisers so they can recruit newbies to underpay. Some AMCs, Lenders are offering trainee hours in house. That looks like influence to me. Some want certain people to be able to easily get appraisal licenses for other reasons. There is an agenda.

While I feel the trainee system needs adjusting, we shouldn't get rid of it. We also shouldn't get rid of all education and experience requirements as some have been stating like Maxine Waters. That opens up the government, financial institutions and banks to huge levels of fraud. That would never pass Congress, thank god.

Chart number of licensed real estate appraisers in California by year. Licensing was first mandatory in 1994 because of legislation. I've been appraising since 1984 as a real estate agent though no license was needed at the time.

|

Year

|

# Licensed Appraisers

|

|

2002

|

10943

|

|

2003

|

12167

|

|

2004

|

|

|

2005

|

18854

|

|

2006

|

|

|

2007

|

20100

|

|

2008

|

|

|

2009

|

15625

|

|

2010

|

|

|

2011

|

|

|

2012

|

|

|

2013

|

|

|

2014

|

11868

|

|

2015

|

11189

|

|

2016

|

10852

|

|

2017

|

10742

|

|

2018

|

10562

|

|

2019

|

10056

|

|

2020

|

9630

|

|

2021

|

9461

|

2022 9413

Below is where I got the data so you can see the actual dates. The 2007 data came from the quote above. As of December 1, 2021, there are now 9,388.

Mary Cummins of Cummins Real Estate is a certified residential licensed appraiser in Los Angeles, California. Mary Cummins is licensed by the California Bureau of Real Estate appraisers and has over 35 years of experience.

Mary Cummins, Mary K. Cummins, Mary Katherine Cummins, Mary, Cummins, #marycummins #animaladvocates #losangeles #california #wildlife #wildliferehabilitation #wildliferehabilitator #realestate #realestateappraiser #realestateappraisal #lawsuit real estate, appraiser, appraisal, instructor, teacher, Los Angeles, Santa Monica, Beverly Hills, Pasadena, Brentwood, Bel Air, California, licensed, permitted, certified, single family, condo, condominium, pud, hud, fannie mae, freddie mac, fha, uspap, certified, residential, certified resident, apartment building, multi-family, commercial, industrial, expert witness, civil, criminal, orea, dre, brea insurance, bonded, experienced, bilingual, spanish, english, form, 1004, 2055, 1073, land, raw, acreage, vacant, insurance, cost, income approach, market analysis, comparative, theory, appraisal theory, cost approach, sales, matched pairs, plot, plat, map, diagram, photo, photographs, photography, rear, front, street, subject, comparable, sold, listed, active, pending, expired, cancelled, listing, mls, multiple listing service, claw, themls, historical appraisal, facebook, linkedin