Appraisal Institute Northwestern Branch Meeting - Visible Value, Invisible Risk on Industrial & Multifamily. September 18, 2025 at Tamayo's restaurant

Notes from the meeting: Juan Huizar sells income properties in Long Beach, California. Rates are up, loans are due and banks want cash to cover equity positions because asset values are down. Many owners are selling their property instead of refinancing because values are down. Today five plus units must cash flow to get a loan. Banks will still allow four or less to not cash flow. There's been about a 19% loss in value over the last five years in five plus units. Many of those properties were heavily improved and rents increased yet values are still down. Landlords can no longer evict tenants for major repairs. Rent control is limiting income. Some buildings with soft first stories will need seismic work. Many are taking the opportunity to turn those parking spots into ADUs. Tariffs on Chinese imports are causing US companies to use warehouses in Mexico to hold the Chinese imports then ship them to the US from Mexico. Tariffs are hurting manufacturing businesses and related property values.

Speakers: Juan Huizar, Gary Martinez

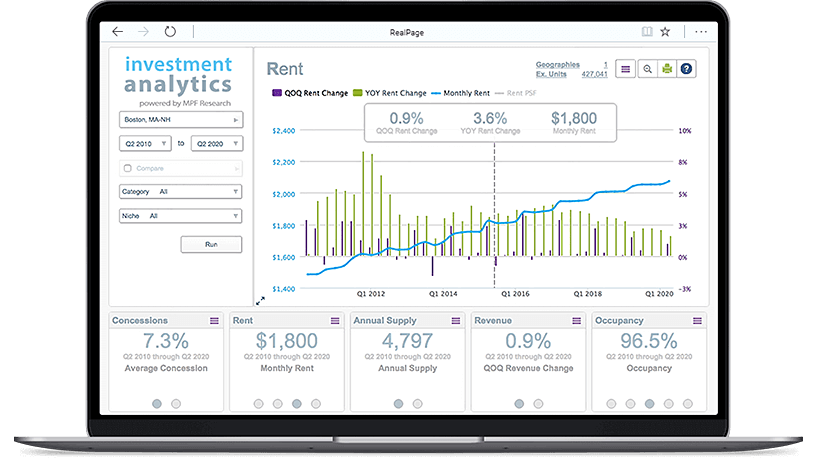

DESCRIPTION: This presentation explores how capital markets are rethinking the value of industrial properties, not just based on leases and rent rolls, but on hidden risks tied to tenant business models, tariffs, insurance costs, political pressure, and supply chain volatility. Through real-world examples and case studies, Gary Martinez, CCIM, SIOR, shares how today’s market is pricing the unseen, and why understanding these invisible risks is critical to understanding true value in 2025. A surprising 17% of all active multifamily properties are now selling for less than they did five years ago—even though many have undergone renovations, rents have increased, and overall asset performance has improved. In this data-driven presentation, we will unpack what’s driving this market correction and why it's creating a rare window of opportunity for investors and appraisers alike.

Juan Huizar, CCIM

BIO: From the rugged terrain of La Victorina in Zacatecas, Mexico, to the thriving business landscape of Long Beach, California, Juan Huizar's journey epitomizes the resilience and determination that define the American Dream. Raised amidst the challenges of a remote village without modern amenities, Huizar's family embarked on a courageous quest for better opportunities in the United States. Enduring the perils of desert crossings, they settled in the fertile Central Valley, where all 10 members toiled in the fields, picking garlic to make ends meet.

Today, Juan Huizar, a Certified Commercial Investment Member (CCIM), stands as a testament to the power of ambition and hard work. With an ingenious video strategy, Juan has elevated himself from relative obscurity to a nationally recognized figure in the real estate industry. His YouTube channel serves as a beacon of knowledge, attracting a remarkable 48% of his leads and drawing attention from esteemed platforms such as CNN, JP Morgan, and Western Real Estate. The CCIM designation underscores Juan’s mastery in financial analysis, market insights, negotiation tactics, and investment strategies.

As the founder and principal of Sage Real Estate, a premier commercial brokerage headquartered in Long Beach, Juan Huizar is at the forefront of innovation and excellence. His firm boasts the highest ratings in the city and ranks among the top 1.5% of boutique brokerages nationwide. Over the past eight years, Juan has personally brokered transactions totaling over $300 million, a testament to his unwavering commitment to client success and satisfaction.

Gary Martinez, SIOR, CCIM

BIO: Gary Martinez is a hardworking commercial real estate broker with 24 years of experience. He has successfully completed over 2,500 transactions, representing investors ranging from Fortune 100 companies to family-owned operations. His expertise includes investment analysis, maximizing cash flow, enhancing commercial property values, and identifying the right opportunities at the right time. While his primary focus is in Southern California, he has completed transactions nationwide.

Gary holds two of the most prestigious designations in commercial real estate—CCIM and SIOR. He is actively involved in the industry, serving as the current President of the SIOR Inland Empire & Orange County Chapter and a multi-time past President of SoCal CCIM. Additionally, he is a CCIM 102 Instructor, teaching Real Estate Market Analysis, and a board member for Cal State Fullerton’s Real Estate Association.

Beyond commercial real estate, Gary is deeply committed to community service. As the Chairman of the Board for The Whole Child, he played a key role in developing and launching The Whole Child’s Interim Housing Program in Santa Fe Springs. This transformative program provides a structured pathway for families to transition from homelessness to homeownership, reinforcing his dedication to creating lasting, positive change in the community.

A few slides.

Mary Cummins of Cummins Real Estate is a certified residential licensed appraiser in Los Angeles, California. Mary Cummins is licensed by the California Bureau of Real Estate appraisers and has over 35 years of experience.

- Mary Cummins LinkedIn

- Mary Cummins Meet up

- Cummins Real Estate on Facebook

- Mary Cummins Real Estate blog

- Cummins Real Estate on Google maps

- Mary Cummins of Animal Advocates

- Mary Cummins biography resume short

- Mary Cummins Real Estate Services

- Animal Advocates fan page at Facebook.com

- Mary Cummins

- Mary Cummins Animal Advocates on Flickr photos

- Mary Cummins Animal Advocates on Twitter.com

- Mary Cummins on MySpace.com

- Mary Cummins on YouTube.com videos

- Mary Cummins of Animal Advocates on Classmates

- Mary Cummins on VK

Mary Cummins, Mary K. Cummins, Mary Katherine Cummins, Mary, Cummins, #marycummins #animaladvocates #losangeles #california #wildlife #wildliferehabilitation #wildliferehabilitator #realestate #realestateappraiser #realestateappraisal #lawsuit real estate, appraiser, appraisal, instructor, teacher, Los Angeles, Santa Monica, Beverly Hills, Pasadena, Brentwood, Bel Air, California, licensed, permitted, certified, single family, condo, condominium, pud, hud, fannie mae, freddie mac, fha, uspap, certified, residential, certified resident, apartment building, multi-family, commercial, industrial, expert witness, civil, criminal, orea, dre, brea insurance, bonded, experienced, bilingual, spanish, english, form, 1004, 2055, 1073, land, raw, acreage, vacant, insurance, cost, income approach, market analysis, comparative, theory, appraisal theory, cost approach, sales, matched pairs, plot, plat, map, diagram, photo, photographs, photography, rear, front, street, subject, comparable, sold, listed, active, pending, expired, cancelled, listing, mls, multiple listing service, claw, themls, historical appraisal, facebook, linkedin

DISCLAIMER: https://mary--cummins.blogspot.com/p/disclaimer-privacy-policy-for-blogs-by.html