https://www.youtube.com/watch?v=HaFfhOo1Edk&t=1830s

"Today’s (February 2, 2022) Buzzcast interview is with Jody Bishop, the new President of The Appraisal Institute. We sat down with Jody and Joan Trice, Founder of Allterra Group, LLC to discuss what the outlook for the Appraisal Institute is for 2022 and what appraisers can expect from their initiatives."

You can go to the video, click the three dots bottom right then view the transcript. Joan Trice JT asked the questions and Jody Bishop JB replied. Below are my notes.

JB: The AI Board couldn't get together until May for a few reasons I won't mention. We used a consultant to handle the meeting to be neutral. We have five top priorities: modernizing education and production, new technology and social media, develop plan to recruit and retain professionals, implement PAREA and develop diversity equity and inclusion action plan. It's time to work to meet our goals. We need a cultural shift to refuse other ideas so we can finish the top 2, 3 or 5 goals. Then we'll be successful.

JT: What about the diversity program?

JB: We already have some effort with the appraisal diversity initiative ADI. Someone gave $3M to the program for the next three years. The National Urban League held symposium to recruit women and POC. We gave grants for initial licensed education, textbook. We started a women's initiative committee a while back. Hope to have a plan by Q3.

JT: Will AI be matching candidates with supervisors?

They will take an AI class. We're working on PAREA. AI was given/gave? $500K to write a program on producing PAREA. We will have students do a robust case study. It will take them through an appraisal of a house. We will have mentors going through the program. They should be highly trained after process. (They will do only one home appraisal? Maybe they need to at least do one home, one condo, one 2-4 units?)

Commercial by AI. Become a member today! :-D Their membership has gone from 25,000 to 17,000 today. They've lost almost 30% of their members while their salaries, expenses and travel expenses have increased.

JT: What is your personal agenda, strategic plan?

JB: I have to give board information they need to make decisions. I have to make sure they don't get distracted with other items. We're working through a cultural shift. Other goals are better communication and messaging.

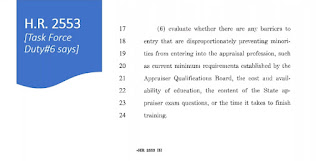

JT: There is the clear report, appraisal subcommittee report, review of USPAP, Fannie Mae just launched their study on racial bias, PAVE report coming any minute. Any thoughts where PAVE will come down?

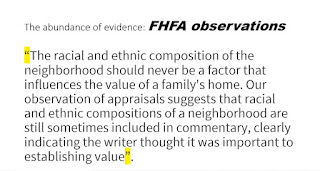

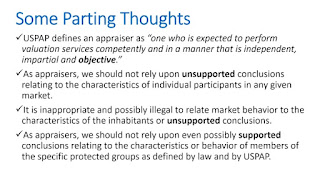

JB. We met with PAVE folks. We arranged for drive-by appraisal ride-along. They watched appraiser measure property. It was helpful for them. We're trying to educate these folks about what appraisers really do. They're discovering there's more to it than just the appraiser running amok out there. All these reports of appraisals but we don't have enough information to see what is really going on. We have a team that has studied various reports, Andre Perry's, Freddie Mac, AIE report. We're looking at Fannie Mae report. We looked at appraisal gap in Freddie Mac report. (He summarized their report per FM). FM looked at refinances.They compared appraisals to avm values. It really wasn't undervaluation going on. Maybe there was renovation work in white areas? They're going to look more.

We're trying to educate about history of diversity, redlining, restrictive covenants... It's helpful to learn what happened in the past to understand the concerns today.

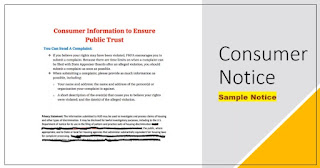

PAVE will come out in a week or so. Clear study, ASC, looking at Appraisal Foundation as well. The most glaring thing is wanting to allow appraiser to be liable to the borrower. It makes me nervous too.

Commercial. LiDar measurement. Remote evaluations. incenteram.com

JT: Should the borrower be intended user of report?

JB: It's concerning. You can be sued no matter what disclaimer is in the report (who is the intended user). It gives borrower power to go after appraiser. If we start adding onerous new regulations, liability, it could dissuade new appraisers.

JT: You can't serve two masters. We don't give them cover to tell the truth. If the appraiser says property in bad condition, lender would put pressure on appraiser not to be honest. The borrower would be angry if appraiser is honest. If it's a hoarder house and appraiser states that, borrower would be insulted.

JB: We should not have flag words (such as hoarder). That's why codes Q, C are better. C4 is not hoarder. Your camera can take 1000 pics. Photos can save you the heartache.

JT: I'm a fan of transparency but would be better for borrower to get a summary of report but not the report with the UAD codes which they don't understand.

JB: Hybrids. The appraiser would not be influenced by anyone at the house. Appraisers don't see the borrower at purchase appraisal but may at refinance appraisal inspection. With hybrid there is no connection between appraiser and borrower. The gold standard for appraisal is full inspection, drive the neighborhood, see the comps themselves. That is the argument against AVMs. There is a push to AVM but want to enhance it somehow. The best thing to happen to appraisers is the Zillow news that AVMs are not accurate. The Zillow (failure) was great timing for the PAVE report, Joe Biden team weighing in.

Mary Cummins of Cummins Real Estate is a certified residential licensed appraiser in Los Angeles, California. Mary Cummins is licensed by the California Bureau of Real Estate appraisers and has over 35 years of experience.

- Mary Cummins LinkedIn

- Mary Cummins Meet up

- Cummins Real Estate on Facebook

- Mary Cummins Real Estate blog

- Cummins Real Estate on Google maps

- Mary Cummins of Animal Advocates

- Mary Cummins biography resume short

- Mary Cummins Real Estate Services

- Animal Advocates fan page at Facebook.com

- Mary Cummins

- Mary Cummins Animal Advocates on Flickr photos

- Mary Cummins Animal Advocates on Twitter.com

- Mary Cummins on MySpace.com

- Mary Cummins on YouTube.com videos

- Mary Cummins of Animal Advocates on Classmates

- Mary Cummins on VK