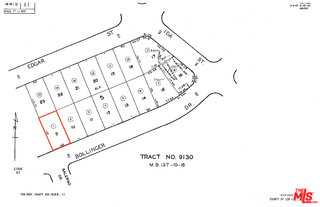

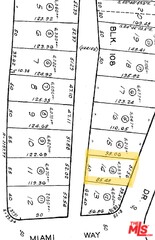

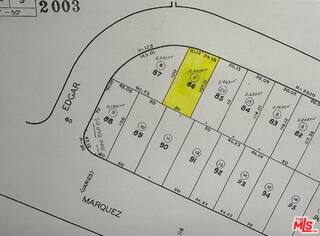

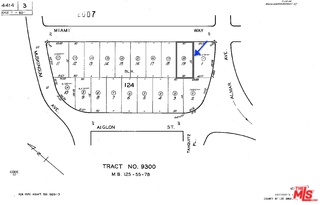

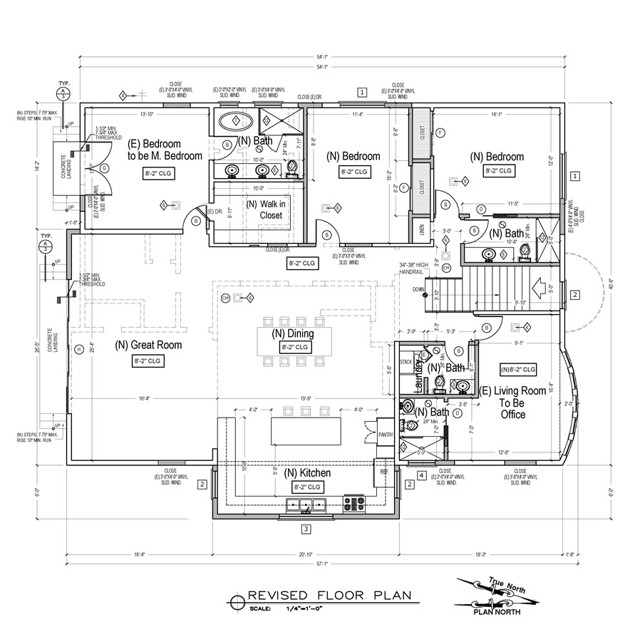

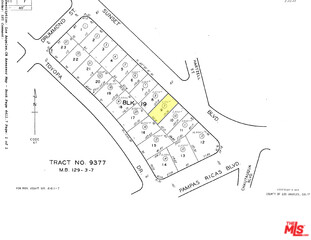

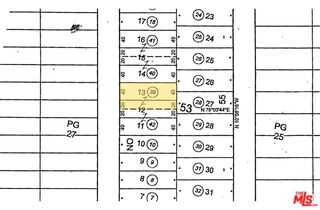

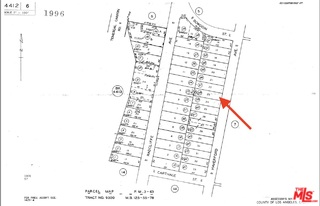

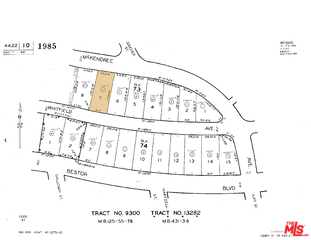

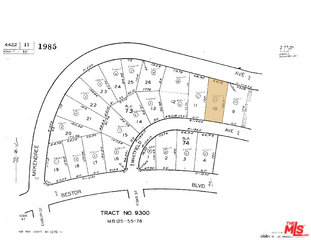

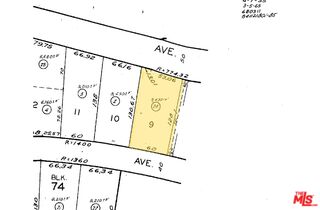

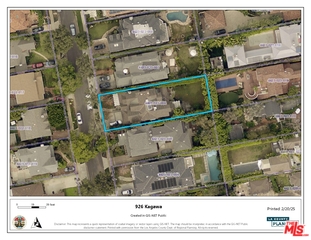

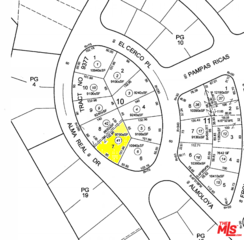

New California bill AB 273 aka the Altered Images Law takes effect January 1, 2026. One must disclose if there is an altered image in real estate advertisements or promotions. One must also show the unaltered original. This makes a lot of sense and could prevent lawsuits. Still, buyer beware of altered images. Sometimes are just cleaned up with some items removed. Some alter them to appear staged, empty or cleaned and painted. Other times they've removed high tension power lines, water towers from the background or added pools.

California Business and Professions Code, Section 10140.8, becomes effective relating to a real estate broker or salesperson who includes a digitally altered image in an advertisement or other promotional material for the sale of real property:

(a)(1) A real estate broker or salesperson, or person acting on their behalf, who includes a digitally altered image in an advertisement or other promotional material for the sale of real property shall include in the advertisement or promotional material a statement disclosing that the image has been altered and a link to a publicly accessible internet website, URL, or QR code that includes, and clearly identifies, the original, unaltered image. The statement shall be reasonably conspicuous and located on or adjacent to the image and shall include language indicating that the unaltered images can be accessed on the linked internet website, URL, or QR code.

(2) If an advertisement or promotional material described in paragraph (1) is posted on an internet website over which the real estate broker or salesperson, or person acting on their behalf, has control, they shall include the unaltered version of the images from which the digitally altered images were created in the posting. A person subject to this paragraph may comply with this requirement by including a link to a publicly accessible internet website that includes, and clearly identifies, the original, unaltered image. If the real estate broker or salesperson, or person acting on their behalf, complies with this requirement by including a link to the unaltered images, the statement required by paragraph (1) shall include language indicating the unaltered images can be accessed on the linked internet website, URL, or QR code.

(b)(1) For purposes of this section, “digitally altered image” means an image, created by or at the direction of the real estate broker or salesperson, or person acting on their behalf, that has been altered through the use of photo editing software or artificial intelligence to add, remove, or change elements in the image, including, but not limited to,

fixtures, furniture, appliances, flooring, walls, paint color, hardscape, landscape, facade, floor plans, and elements outside of, or visible from, the property, including, but not limited to, streetlights, utility poles, views through windows, and neighboring properties.

(2) “Digitally altered image” does not include an image where only lighting, sharpening, white balance, color correction, angle, straightening, cropping, exposure, or other common photo editing adjustments are made that do not change the representation of the real property.

See more at the link. https://info.vestaplus.net/altered-images

Mary Cummins of Cummins Real Estate is a certified residential licensed appraiser in Los Angeles, California. Mary Cummins is licensed by the California Bureau of Real Estate appraisers and has over 35 years of experience.

- Mary Cummins LinkedIn

- Mary Cummins Meet up

- Cummins Real Estate on Facebook

- Mary Cummins Real Estate blog

- Cummins Real Estate on Google maps

- Mary Cummins of Animal Advocates

- Mary Cummins biography resume short

- Mary Cummins Real Estate Services

- Animal Advocates fan page at Facebook.com

- Mary Cummins

- Mary Cummins Animal Advocates on Flickr photos

- Mary Cummins Animal Advocates on Twitter.com

- Mary Cummins on MySpace.com

- Mary Cummins on YouTube.com videos

- Mary Cummins of Animal Advocates on Classmates

- Mary Cummins on VK

Mary Cummins, Mary K. Cummins, Mary Katherine Cummins, Mary, Cummins, #marycummins #animaladvocates #losangeles #california #wildlife #wildliferehabilitation #wildliferehabilitator #realestate #realestateappraiser #realestateappraisal #lawsuit real estate, appraiser, appraisal, instructor, teacher, Los Angeles, Santa Monica, Beverly Hills, Pasadena, Brentwood, Bel Air, California, licensed, permitted, certified, single family, condo, condominium, pud, hud, fannie mae, freddie mac, fha, uspap, certified, residential, certified resident, apartment building, multi-family, commercial, industrial, expert witness, civil, criminal, orea, dre, brea insurance, bonded, experienced, bilingual, spanish, english, form, 1004, 2055, 1073, land, raw, acreage, vacant, insurance, cost, income approach, market analysis, comparative, theory, appraisal theory, cost approach, sales, matched pairs, plot, plat, map, diagram, photo, photographs, photography, rear, front, street, subject, comparable, sold, listed, active, pending, expired, cancelled, listing, mls, multiple listing service, claw, themls, historical appraisal, facebook, linkedin

DISCLAIMER: https://mary--cummins.blogspot.com/p/disclaimer-privacy-policy-for-blogs-by.html