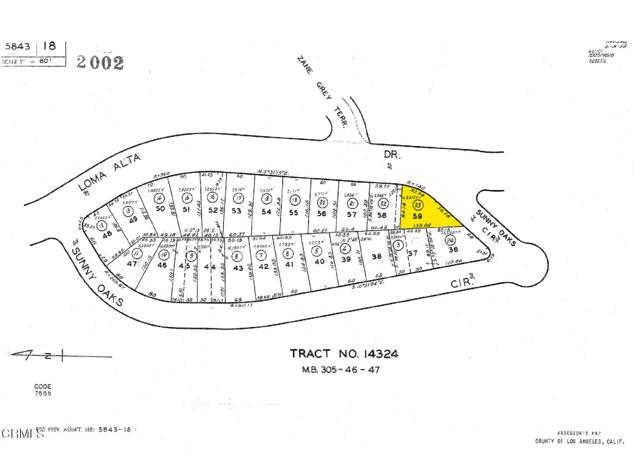

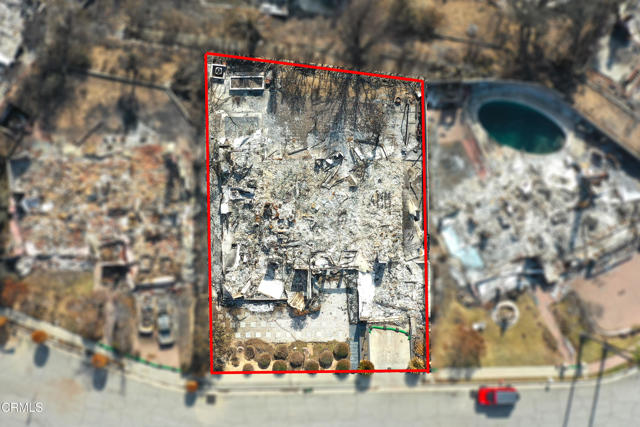

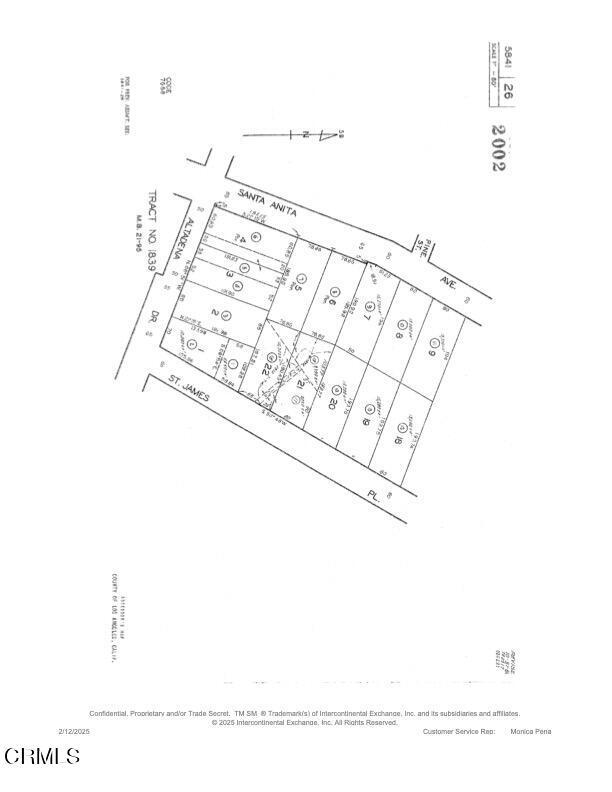

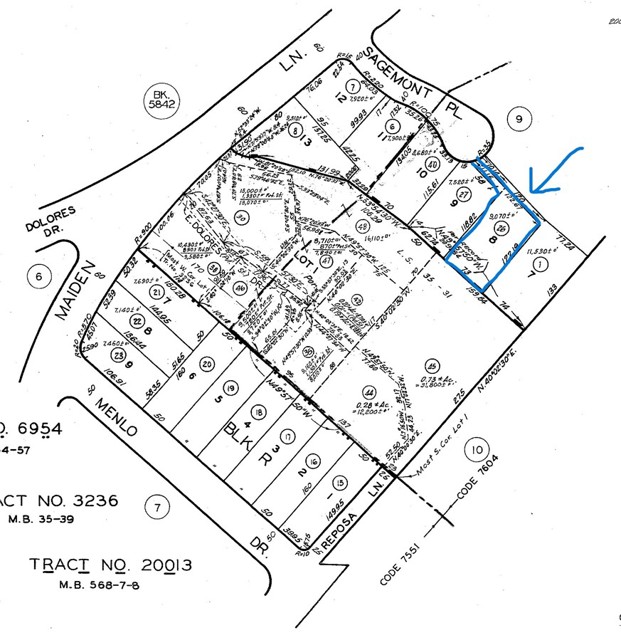

Altadena now has 63 land listings for sale and ten sold since the fires from 5,300 sf to 24,000 sf price range $199,000 to $950,000. There are now ten sales at $199,000 to $790,000. Most sales $520,000 to $790,000. Almost all sales are over list price selling at 100-118% over list price. Below is summary of seven sales.

Property Type Count: 7

Avg LSZ: 9,155

Avg LP/LSZ: $65.36

Avg DOM: 6

Avg Orig Price: $610,286

Avg Price: $574,571

Avg Sale Price: $613,011

Avg SP/LSZ: $70.83

#altadena #landsales #eatonfire #losangeles #california #marycummins #realestateappraiser #realestateappraisal

Open Houses | Photo | MLS # | AR | S | Address | City | Lot Sz | Acreage | Zoning | LP | SP | DOM | Doc(s) | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

85 | ALTADENA | 10,264 | 0 | LAR175 | ||||||||||

85 | ALTADENA | 24,898 | 1 | LCR120 | $220,000 | |||||||||

85 | ALTADENA | 10,264 | 0 | LAR175 | ||||||||||

85 | ALTADENA | 5,463 | 0 | LCR175 | ||||||||||

85 | ALTADENA | 9,052 | 0 | LCR175 | ||||||||||

85 | ALTADENA | 6,502 | 0 | LCR175 | $520,000 | |||||||||

85 | ALTADENA | 7,516 | 0 | LCR175 | ||||||||||

85 | ALTADENA | 5,346 | 0 | LCR175 | ||||||||||

85 | Altadena | 7,365 | 0.1691 | LCR175 | ||||||||||

85 | ALTADENA | 7,751 | 0 | LCR175 | $525,000 | |||||||||

85 | ALTADENA | 8,745 | 0 | LCR175 | ||||||||||

85 | ALTADENA | 5,737 | 0 | LCR 175 | $570,000 | |||||||||

85 | ALTADENA | 7,597 | 0 | LCR175 | ||||||||||

85 | ALTADENA | 6,377 | 0 | LCR175 | ||||||||||

85 | ALTADENA | 6,703 | 0 | Residential | ||||||||||

85 | ALTADENA | 7,525 | 0 | LCR1YY | ||||||||||

85 | Altadena | 7,581 | 0.174 | LCR175 | ||||||||||

85 | ALTADENA | 6,484 | 0 | LCR175 | ||||||||||

85 | ALTADENA | 5,972 | 0 | LCR175 | ||||||||||

85 | ALTADENA | 7,752 | 0 | LCR1YY | ||||||||||

85 | Altadena | 7,564 | 0.1736 | LCR175 | ||||||||||

85 | Altadena | 6,805 | 0.1562 | LCR175 | ||||||||||

85 | ALTADENA | 8,537 | 0 | LCR175 | ||||||||||

85 | ALTADENA | 7,147 | 0 | R-1-7500 | ||||||||||

85 | ALTADENA | 10,529 | 0 | LCR175 | ||||||||||

85 | ALTADENA | 6,558 | 0 | LCR175 | ||||||||||

85 | ALTADENA | 10,572 | 0 | LCR175 | ||||||||||

85 | ALTADENA | 8,225 | 0 | LCR175 | ||||||||||

85 | ALTADENA | 8,911 | 0 | LCR175 | ||||||||||

85 | ALTADENA | 6,839 | 0 | LCR175 | ||||||||||

85 | Altadena | 7,477 | 0.1716 | LCR175 | ||||||||||

85 | ALTADENA | 8,750 | 0 | LCR175 | ||||||||||

85 | ALTADENA | 8,916 | 0 | R-1-7500 | ||||||||||

85 | Altadena | 9,088 | 0.2086 | LCR175 | ||||||||||

85 | ALTADENA | 10,591 | 0 | LCR175 | $603,000 | |||||||||

85 | ALTADENA | 5,911 | 0 | LCR175 | ||||||||||

85 | ALTADENA | 15,379 | 0 | LCR175 | ||||||||||

85 | ALTADENA | 7,481 | 0 | R-1-7500 | ||||||||||

85 | ALTADENA | 8,987 | 0 | LCR175 | $680,000 | |||||||||

85 | Altadena | 9,727 | 0.2233 | LCR175 | ||||||||||

85 | ALTADENA | 15,612 | 0 | LCR17500* | ||||||||||

85 | ALTADENA | 9,472 | 0 | LCR175 | $603,077 | |||||||||

85 | ALTADENA | 10,058 | 0 | LCR175 | ||||||||||

85 | ALTADENA | 9,116 | 0 | LCR175 | ||||||||||

85 | ALTADENA | 9,695 | 0 | LCR175 | ||||||||||

85 | ALTADENA | 12,829 | 0 | LCR2YY | ||||||||||

85 | ALTADENA | 13,878 | 0 | LCR175 | ||||||||||

85 | ALTADENA | 7,465 | 0 | LCR175 | ||||||||||

85 | Altadena | 8,145 | 0.187 | LCR175 | ||||||||||

85 | Altadena | 9,712 | 0.22294 | LCR175 | ||||||||||

85 | ALTADENA | 15,660 | 0 | LCR119 | ||||||||||

85 | ALTADENA | 10,702 | 0.2457 | $750,000 | ||||||||||

85 | Altadena | 15,047 | 0.3454 | LCR110000-R115 | $790,000 | |||||||||

85 | ALTADENA | 12,939 | 0 | LCR120 | ||||||||||

85 | ALTADENA | 15,213 | 0 | LCR175 | ||||||||||

85 | Altadena | 7,500 | 0.1681 | LCR175 | ||||||||||

85 | ALTADENA | 10,037 | 0 | LCR110 | ||||||||||

85 | ALTADENA | 11,086 | 0 | LCR175 | ||||||||||

85 | ALTADENA | 16,441 | 0 | R-1-7500 | $780,000 | |||||||||

85 | ALTADENA | 9,961 | 0 | LCR110 | ||||||||||

85 | ALTADENA | 22,510 | 1 | LCR120 | ||||||||||

85 | ALTADENA | 19,685 | 0 | LCR17500 | ||||||||||

85 | ALTADENA | 27,972 | 1 | LCR175 | ||||||||||

85 | ALTADENA | 11,033 | 0 | LCR175 |

Mary Cummins of Cummins Real Estate is a certified residential licensed appraiser in Los Angeles, California. Mary Cummins is licensed by the California Bureau of Real Estate appraisers and has over 35 years of experience.

- Mary Cummins LinkedIn

- Mary Cummins Meet up

- Cummins Real Estate on Facebook

- Mary Cummins Real Estate blog

- Cummins Real Estate on Google maps

- Mary Cummins of Animal Advocates

- Mary Cummins biography resume short

- Mary Cummins Real Estate Services

- Animal Advocates fan page at Facebook.com

- Mary Cummins

- Mary Cummins Animal Advocates on Flickr photos

- Mary Cummins Animal Advocates on Twitter.com

- Mary Cummins on MySpace.com

- Mary Cummins on YouTube.com videos

- Mary Cummins of Animal Advocates on Classmates

- Mary Cummins on VK

Mary Cummins, Mary K. Cummins, Mary Katherine Cummins, Mary, Cummins, #marycummins #animaladvocates #losangeles #california #wildlife #wildliferehabilitation #wildliferehabilitator #realestate #realestateappraiser #realestateappraisal #lawsuit real estate, appraiser, appraisal, instructor, teacher, Los Angeles, Santa Monica, Beverly Hills, Pasadena, Brentwood, Bel Air, California, licensed, permitted, certified, single family, condo, condominium, pud, hud, fannie mae, freddie mac, fha, uspap, certified, residential, certified resident, apartment building, multi-family, commercial, industrial, expert witness, civil, criminal, orea, dre, brea insurance, bonded, experienced, bilingual, spanish, english, form, 1004, 2055, 1073, land, raw, acreage, vacant, insurance, cost, income approach, market analysis, comparative, theory, appraisal theory, cost approach, sales, matched pairs, plot, plat, map, diagram, photo, photographs, photography, rear, front, street, subject, comparable, sold, listed, active, pending, expired, cancelled, listing, mls, multiple listing service, claw, themls, historical appraisal, facebook, linkedin

DISCLAIMER: https://mary--cummins.blogspot.com/p/disclaimer-privacy-policy-for-blogs-by.html