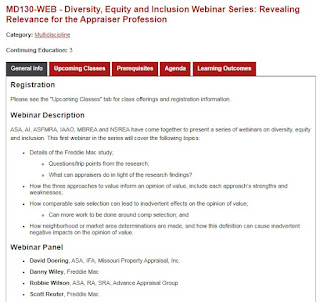

Leading Real Estate Appraisal Organizations Come Together to Present a New Series of Webinars on Diversity, Equity, and Inclusion

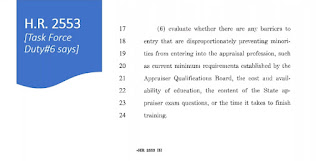

Dec 14, 2021 ASA, Appraisal Institute (AI), American Society of Farm Managers & Rural Appraisers (ASFRMA), International Association of Assessing Officers (IAAO), MBREA, and National Society of Real Estate Appraisers (NSREA) have come together to present a new series of webinars on diversity, equity, and inclusion.

The first webinar, entitled “Revealing Relevance for the Appraiser Profession” will air Monday, January 31, 2022 from 1:00-4:00 PM ET. Registration for the first free webinar is available at: http://bit.ly/30CLfNb

Presenting experts David Doering, ASA, IFA, Robbie Wilson, ASA, RA, SRA, Scott Reuter, and Danny Wiley, SRA, will discuss the details of the Freddie Mac study, including questions/points from the research and what appraisers can do in light of the research findings; as well as how the three approaches of value inform an opinion of value; how comparable sale selection can lead to inadvertent effects on the opinion of value; and how neighborhood or market area determinations are made, and how this definition can cause inadvertent negative impacts.

Webinar Speaker Panel

David Doering, ASA, IFA, Missouri Property Appraisal, Inc.

Robbie Wilson, ASA, RA, SRA, Advance Appraisal Group, Appraiser Instrutor.

This webinar will award 3.0 ASA continuing education hours. This webinar has not been approved by any state appraisal board for real property continuing education hours. A copy of the webinar video will be posted here when available.

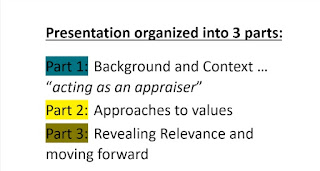

Below are my personal notes from the three hour webinar. There were three main parts then Q&A at the end. Johnnie White of ASA was the host of the webinar. Left to right, top to bottom, Robbie Wilson, Johnnie White, Danny Wiley, David Doering, Scott Reuter.

|

| Left to right, top to bottom, Robbie Wilson, Johnnie White, Danny Wiley, David Doering, Scott Reuter. |

1. Dave Doering and Scott Reuter were the first speakers talking about the Freddie Mac study. Scott Reuter wanted to clear up a few things. In the desktop appraisal there is a "floor plan" instead of a "sketch." The appraiser doesn't do the floor plan or sketch. It's provided by other sources. The desktop appraiser stays at their desk. Hybrid appraisals are basically a desktop appraisal with someone else providing some of the data for the property.

Scott Reuter, FreddieMac: Typically we are going to use closed sales transactions which are going to lag current trends. We're not here to beat you (the appraiser) up. (He was referring to the Freddie Mac paper about appraisal gaps.) We have made no conclusions stating there is bias in appraisals. We are just seeing different results from different areas.

While reviewing appraisals we noticed that currently there is about an 18% appreciation rate yet appraisers are only adjusting 5-6%. (My comment. We still can't go over the highest closed sales so even if we adjust for a full 18% appreciation, it won't change the final value. Maybe it will at least appease the borrowers)

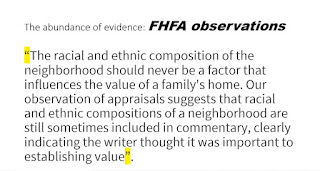

There was an issue of language in reports. The two problems are discriminatory language which you just can't use and subjective language. What does "desirable neighborhood" mean anyway? It's vague. All areas are desirable or they wouldn't exist. Instead you can say the median price in one area is higher than surrounding areas.

2. Robbie Wilson. Understanding the Three Approaches to Value. It was very difficult to understand what he was saying. I put in both ear buds, upped the volume, leaned forward and still had a problem. All the other speakers were very clear and understandable.

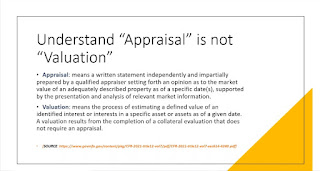

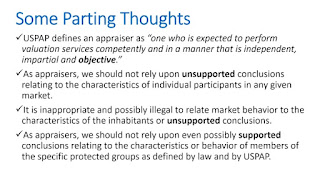

He explained value and the three approaches to value as if the viewers were not appraisers. He said appraisal technique has nothing to do with bias. Only people can be biased using the technology and methods just like the saying 'guns don't kill people. People do.' (Appraisers kill people? Not the best analogy. Now I realize why he posted a disclaimer at the beginning of his presentation saying everything is his own personal opinion only.)(Previously people were saying that the sales comparison approach/method was biased against black people because it relies on the sale of similar properties in similar areas. Andre Perry said this. Others said the resultant values were a product of redlining from years ago. Glad to see that Robbie doesn't agree with that idea.)

We need to do something about racism because of money. TAF said they would do something but they've done nothing. Redlining comes from these same government agencies. There is a mountain of evidence of systemic discrimination in housing. Everyone backs me up. Some are saying appraisers are not biased. Appraisers are biased. We need to kick them out. (He had 49 slides. Here are a few)

3. David Doering, Residential Appraiser. Appraisal Considerations in the Selection of Comparable Sales.

Our current regulations already preclude bias. It's an ethics violation. Definitions of objective and subjective bias. USPAP regulations preclude being subjective. They are now including protected characteristics besides just protected classes. Protected characteristics are for example gender expression.

There have been numerous isolated incidents of bias in the media. We don't know cause but it's a matter of public awareness.

Everyone knows the three major determinants of value are location, location, location. You can use comparables from a similar neighborhood if needed. A subdivision is not a neighborhood. You can use comps outside of the same subdivision (I missed a few minutes)

Q & A

To Robbie Wilson: Q: Can an AVM be biased? A: The program writer can be biased.

To Danny : Q: Will appraisers be involved in the UAD redesign? A: They already are.

To Danny: Q: What is the difference between the sketch and floor plan? A: Interior walls must be drawn in floor plan. Appraisers don't do the floor plan. It comes from someone else. The redesign of the UAD form will come out 2024. The last redesign was 2005.

To someone: Q: Are property data collector standards being developed? A: I'm sure they are. (He didn't understand question about hybrid data collectors so Danny answered) Danny: I think he's talking about hybrid data collectors. We have data standards and training requirements. They're not Uber drivers and delivery guys. We are testing our data standards.

To Robbie Wilson: Q: Any advice to anyone falsely accused of being biased? A: Facts will exonerate them.

Danny answering above question. Your workfile is your friend. 40% of the time (in investigations) appraiser didn't have a true copy of the final appraisal report. They didn't save the last copy, version.

To Robbie Wilson: Q: There are not that many female appraisers. How can we get more female appraisers in the profession? A: Recruiting.

I'll post the link to the video of the webinar here when it's available.

Mary Cummins of Cummins Real Estate is a certified residential licensed appraiser in Los Angeles, California. Mary Cummins is licensed by the California Bureau of Real Estate appraisers and has over 35 years of experience.

- Mary Cummins LinkedIn

- Mary Cummins Meet up

- Cummins Real Estate on Facebook

- Mary Cummins Real Estate blog

- Cummins Real Estate on Google maps

- Mary Cummins of Animal Advocates

- Mary Cummins biography resume short

- Mary Cummins Real Estate Services

- Animal Advocates fan page at Facebook.com

- Mary Cummins

- Mary Cummins Animal Advocates on Flickr photos

- Mary Cummins Animal Advocates on Twitter.com

- Mary Cummins on MySpace.com

- Mary Cummins on YouTube.com videos

- Mary Cummins of Animal Advocates on Classmates

- Mary Cummins on VK

No comments:

Post a Comment