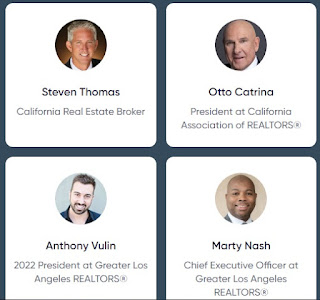

Really good webinar on 2022 State of Real Estate from Greater Los Angeles Realtors ( https://www.facebook.com/GreaterLARealtors @GLA_Realtors). The speakers were Otto Catrina from the California Association of Realtors ( https://www.facebook.com/CAREALTORS @CARealtors) and Steven Thomas of Reports on Housing ( http://www.facebook.com/reportsonhousing @housereports). If you're a member of GLAR, a video of the webinar will be here along with the slides. https://www.greaterlarealtors.com/members/new-updates If you're not a member my summary is below along with most of the slides.

The biggest issue of course was the Fed interest rate increase of .75%. This has really slowed the housing market which was the intent of the rate increase. The Fed and others expect a target Fed rate of 2.5 to 2.75% in 2023. This rate affects generally shorter term interest rates such as credit card rates, car loans and equity lines. It does affect long term home loan rates but not as directly or quite as much.

Europe also has inflation but they don't have the Fed controls that the US has. Steven Thomas is not calling a recession right now even though we had two quarters of decline in GDP. He will call a recession if the GDP declines for a longer period. The job market is still strong as is real estate. He uses six factors in determining a recession.

Steven Thomas coined the term the "pandession" which is a combination of the pandemic and recession. It's not a recession. The current market today is affected by the pandemic and lack of balanced supply and demand of homes. Last year was a supply catastrophe. It's still a seller's market but as rates rise, demand slows and supply starts to rise. People don't want to sell because they love their current mortgage rate. If they don't buy a new home after selling, they'd have to deal with high related rent.

Thomas stated this is not a bubble. There will be no housing crash. People have lots of equity. Home values are still doing well. Most homeowners today have good credit as opposed to 2007/2008 when they gave loans to everyone even people with bad credit. Our issue today is lack of supply though it's changing.

We have a headwind right now which is slowing things. It will continue to the end of the year but home values won't plunge. Luxury has really slowed. "Luxury market got a cold because of what has happened recently on Wall Street." We may have a recession next quarter but it won't affect housing that much. Not all recessions affect housing. All these comments go along with his slides, charts, research and numbers.

Below are the slides from first Otto Catalina of CAR then Steven Thomas of Housing Market in chronological order. I missed a few. The slides are larger after the first 20 when I expanded my view. Click to see images larger. If you're in real estate sales or appraising, Thomas' newsletter subscription looks pretty good and it's affordable. I may subscribe as he really has his finger on the pulse of the market. He runs a lot of numbers and makes some great charts and graphs besides giving his experienced common sense commentary. If you're in real estate in Los Angeles, makes sense to join GLAR. If you're in real estate in California, join CAR at least for the forms.

Mary Cummins of Cummins Real Estate is a certified residential licensed appraiser in Los Angeles, California. Mary Cummins is licensed by the California Bureau of Real Estate appraisers and has over 35 years of experience.

- Mary Cummins LinkedIn

- Mary Cummins Meet up

- Cummins Real Estate on Facebook

- Mary Cummins Real Estate blog

- Cummins Real Estate on Google maps

- Mary Cummins of Animal Advocates

- Mary Cummins biography resume short

- Mary Cummins Real Estate Services

- Animal Advocates fan page at Facebook.com

- Mary Cummins

- Mary Cummins Animal Advocates on Flickr photos

- Mary Cummins Animal Advocates on Twitter.com

- Mary Cummins on MySpace.com

- Mary Cummins on YouTube.com videos

- Mary Cummins of Animal Advocates on Classmates

- Mary Cummins on VK

.jpg)

.jpeg)