|

| Mary Cummins, resume, curriculum vitae, job history, real estate appraiser, Los Angeles, California, work history, biography, real estate appraisal, real estate, appraiser, appraisal, marycumminscurriculumvitae |

Curriculum Vitae

Abstract

Cummins is a bilingual Latino real

estate appraiser born and raised in Los Angeles, California with over 38 years

of experience. Cummins has appraised over 20,000 residential, multi-family,

income, land, industrial, mixed-use properties and construction projects for

lenders, AMCs, lawyers, relocation companies, banks and individuals. Cummins

has passed the Department of Justice and SterlingBackcheck background checks

multiple times. There has never been any complaint, claim or lawsuit against

any license. A la mode Total software. Combined LA/Westside MLS member. E&O

insurance $1,000,000 no claims.

Education

•

Beverly Hills High School 1982 - Dean's list,

Swim Team, Water Polo

•

University of Southern California 1984 - Dean's

list, Swim Team, Scholarship

Licenses, Certifications

•

Real Estate Sales License 1984

•

Real Estate Brokers License 1986

•

California Notary Public 1989

•

Real Estate Appraisal License CertifiedResidential 1993 (First Mandatory 1994)

•

HUD/FHA Approved Real Estate Appraiser

Work Experience

•

1984 Merrill Lynch Real Estate - Sales,

Comparative Market Analysis

•

1984 to present - Cummins Real Estate Services -

Real Estate Appraisal, Sales

•

1985 Apartment Owners Association - Commercial

Brokerage Division

•

1986 Forensis Group - Expert Witness

•

1990 Westside Properties - Real Estate

Appraisal, Sales. 100% office

Selected Legal Cases

•

1989 Schine vs Schine - Appraisal of Ambassador

Hotel as land for development project with Donald Trump. Deposed.

•

Various cases for Forensis Group 1986-2006

•

2009 Union Pacific vs Jimmy Nasralla. Criminal.

Court appearance.

•

2010 Don Carstens vs JP Morgan. Civil. Deposed.

Court appearance.

•

2013 Narrative Appraisal for LA Metro Eminent

Domain

Courts

•

United States Bankruptcy Court California

•

Los Angeles County Superior Court Civil

•

Los Angeles County Superior Court Criminal

•

Riverside County Superior Court Civil

Selected Clients

•

Crestview Financial

•

Don Carstens, Attorney at Law

•

Home Savings Bank

•

Wells Fargo

•

Chase Financial, Bank

•

Forensis Group, Expert Witness

•

Western Relocation Services

Selected Professional

Education 1,350+ hours

•

1984 Lumbleau School of Real Estate - Real

estate sales

•

1984 to present - Various real estate schools:

Expert Witness Testimony, Appraising Apartments, Oddball Appraisals, USPAP, FHA

Appraising, Appraising Manufactured Homes, Environmental Issues for Appraisers,

Fair Housing, LEED Real Estate, Foundations in Sustainability: Greening the

Real Estate and Appraisal Industries, Review Appraisals, REO and Foreclosures,

The Cost Approach.

•

1985 Merrill Lynch - Real estate sales, CMA

•

1986 Lumbleau School of Real Estate - Real

estate broker – 8 College Courses

•

1986 Apartment Owners Association - Income

property evaluation and sales

•

2014 2 - 4 Family Finesse 06167C167

•

2014 The

Sales Comparison Approach 14CP167303029

•

2014 Understanding

Residential Construction 14CP167303033

•

2014 The Nuts and Bolts of Green Building for Appraisers

10167C114

•

2014 Even

Odder: More Oddball Appraisals 08167C181

•

2014 Appraising FHA Today - Virtual classroom 06167C169

•

2014 Laws

and Regulations for California Appraisers 12167C163

•

2014 2014-2015 7 hour National USPAP Update Course 13CP167303017

•

2014 Appraising

Manufactured Homes 11167C134

•

2014 Land

and Site Valuation 08167C187

•

2014 Mortgage Fraud- Protect Yourself 08167C179

•

2016 2016-2017 7 Hour National USPAP Update Course 15CP167303053

•

2018 2018-2019 7- Hour Equivalent USPAP Update Course 1810000011

•

2018 FHA

Site Inspection for Appraisers 1610000007

•

2018 California Laws and Regulations for Appraisers 1710000010

•

2018 Mold

A Growing Concern 1310000004

•

2018 Appraising

Energy Efficient Residential Properties 1710000008

•

2018 Environmental

Hazards Impact on Value 1210000001

•

2018 Construction

Details From Concept to Completion 1710000009

•

2018 A

Brief Historic Stroll Through America's Architectural Styles 1310000003

•

2020 2020-2021 7-Hour Equivalent USPAP Update Course 2010000012

Selected Seminars,

Webinars

•

2020 California Preservation Foundation webinar:

Learning from Large-Scale Adaptive Reuse Projects

•

2021 HUD: Advancing Equity in the Home Valuation

Process

•

2021 Freddie Mac, Appraisal Institute: Property

Valuation, Appraisal Bias, & Black Homeownership

•

2021 ClearCapital: Does Your Appraisal Data

Include Racial Bias?

•

2021 HUD: National Fair Housing Training

Academy, Collateral Damage: The Consequences of Racial Bias in the Residential

Appraisal Process

•

2021 Richard Hagar, SRA: Six-Part Appraiser

Webinar series

How to Determine Land

Values, Even Where There Are No Sales

Comparables: What to Use

and What to Do When You Can't Find Any

Why the Cost Approach is

Valuable (and Helps You Earn Higher Fees)

Easy Ways to Determine

Condition Adjustments

How a Regression Analysis

Can Help Determine Adjustments

Fighting Pressure and

Intimidation

• 2021 Consumer Finance Protection Bureau: Home Appraisal Bias

Event

• 2021 Fannie Mae: Racial Bias in Appraisals

• 2021 Appraisal Subcommittee Roundtable: Building a More

Equitable Appraisal System

• 2021 George Dell; Peter Christensen, Attorney: How to Avoid

Being Accused of Bias in Real Estate Appraisal

• 2022 Los Angeles Business Journal: Commercial Real Estate

Symposium

• Appraisal Institute: Diversity, Equity and Inclusion Webinar

Series: Revealing Relevance for the Appraiser Profession

• Robert Keller: Bullet Proof Workfile Class

Selected Media

•

1985 LA Times “People in Westside Real Estate”

Cummins joins Merrill Lynch

•

1990 LA Times “People in Westside Real Estate”

Cummins joins Westside Properties

•

2002 LA Times “Suggestions for the bidder whose

offers are rejected”

•

2006 Daily News “County relaxes restrictions on

llamas, animal rehab”

•

2007 LA Times “Historical Homes, not for everyone”

•

2009 LA Weekly “Jimmy Nasralla finds a lawyer”

•

2009 LA Weekly “Is LA City Attorney Trutanich

screwing over the little guy?”

•

2009 LA Weekly “Jimmy on the edge of town”

Awards

•

2014 Los Angeles Business Journal, Latino

Business Award

•

2014 Los Angeles Business Journal, Women Making

a Difference Award

•

2020 GlobeSt. Women of Influence Award

Social Media

•

1992 Mary Cummins Real Estate website – Includes

Real Estate Dictionary

•

2000 Cummins Real Estate blog – Articles on Real

Estate, Appraisal, Affordable Housing, Homeless, Housing Crisis, Celebrity

Homes

•

2010 Cummins Real Estate Services Facebook page

Task Forces, Committees

•

2006 Los Angeles City Proposition F Committee –

Oversaw construction of new animal shelters and fire stations with

$500,000,000+ fund

Publications, Articles

•

Main Reasons Home Loans are Denied

•

How Condominium Home Owners Associations (HOA)

are Organized and Operate

•

How Real Estate Appraisers Measure and Calculate

Size of a Home

•

Race and Racism in Real Estate Appraisal

•

Difficulties Finding a Real Estate Appraiser

Mentor in California

•

The History of Redlining in Home Lending

•

How to Submit a Reconsideration of Value, Appeal

•

Understanding the 1004P Hybrid Real Estate

Appraisal

•

One Cause of the Housing Crisis

•

Causes of the Increase in Homelessness in Los

Angeles

•

Ideas to Help Solve the Housing Crisis

•

Real Estate Cycles, Revitalization and

“Gentrification”

•

Notre Dame Cathedral fire shows how building structure affects

susceptibility to fires

•

Eminent Domain in California and Texas

•

Donald Trump and the Ambassador Hotel Development

Project

•

Using Google Maps to Calculate a Driving Route for Real

Estate Appraisers

•

Using Google Maps to Get Rough Estimates of Building Size

•

EB-5 Visa Renewal Program and Real Estate

•

California Bill AB139 - Real Estate Transfers and Trusts

•

Office to Housing Conversion is Not That Easy

•

Appraisal Gap: What is it? What are the Causes?

•

Different Types of Home Valuations

•

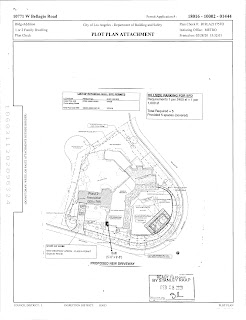

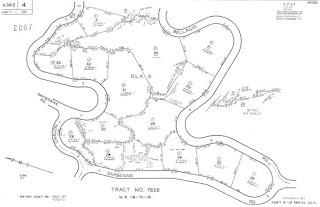

Measuring, Describing Land Using Metes and Bounds, PLSS,

Lot and Block and Parcel Numbers

Past, Present Organizations, Memberships

•

USC Alumni Real Estate Network, AREN

•

National Association of Real Estate Appraisers, NAREA

•

Beverly Hills Board of Realtors, BHBR, now Beverly Hills/Greater

Los Angeles Association of Realtors, GLAR

•

Los Angeles Board of Realtors, LABR, now Beverly Hills/Greater

Los Angeles Association of Realtors, GLAR

•

California Association of Realtors, CAR

•

Combined L.A./Westside MLS, CLAW

Other Experience

•

Bilingual – English, Spanish

•

PC, Mac, iPad, iPhone

•

UAD, .pdf, .doc, .xml, .env, html, FTP, Power

Point, FHA forms

•

Approved by numerous Appraisal Management

Companies

•

MLS, Homeputer, a la mode, Total, AppraisalMAT,

LoopNet, Carets

•

Real estate photography, panoramas, scans, floor

plans

•

E&O insurance $1,000,000/$1,000,000

•

Never had a real estate complaint, claim or

lawsuit

•

Perfect appraiser license record

•

Passed full SterlingBackcheck background check

multiple times

•

Passed multiple DOJ background checks for

professional licenses, gun permit

•

Perfect driving record, type 100+ wpm

Mary Cummins Resume, Curriculum Vitae as pdf

http://www.marycummins.com/marycumminscurriculumvitae.pdf

Mary Cummins of Cummins Real Estate is a certified residential licensed appraiser in Los Angeles, California. Mary Cummins is licensed by the California Bureau of Real Estate appraisers and has over 35 years of experience.

Mary Cummins, Mary K. Cummins, Mary Katherine Cummins, Mary, Cummins, #marycummins #animaladvocates #losangeles #california #wildlife #wildliferehabilitation #wildliferehabilitator #realestate #realestateappraiser #realestateappraisal #lawsuit real estate, appraiser, appraisal, instructor, teacher, Los Angeles, Santa Monica, Beverly Hills, Pasadena, Brentwood, Bel Air, California, licensed, permitted, certified, single family, condo, condominium, pud, hud, fannie mae, freddie mac, fha, uspap, certified, residential, certified resident, apartment building, multi-family, commercial, industrial, expert witness, civil, criminal, orea, dre, brea insurance, bonded, experienced, bilingual, spanish, english, form, 1004, 2055, 1073, land, raw, acreage, vacant, insurance, cost, income approach, market analysis, comparative, theory, appraisal theory, cost approach, sales, matched pairs, plot, plat, map, diagram, photo, photographs, photography, rear, front, street, subject, comparable, sold, listed, active, pending, expired, cancelled, listing, mls, multiple listing service, claw, themls, historical appraisal, facebook, linkedin DISCLAIMER: https://mary--cummins.blogspot.com/p/disclaimer-privacy-policy-for-blogs-by.html