|

| National Fair Housing Alliance NFHA Promotes False Racist Narrative about Real Estate Appraisers for MONEY, mary cummins, real estate appraiser, real estate appraisal, aei, hud, nfha, national fair housing alliance, race, discrimination, bias, settlements, |

UPDATE: Appraisal Institute just posted about this issue here.

"Recently, a HUD-funded billboard campaign stated, “Home appraisals should be based on property, not people.”

We wholeheartedly agree. Bias in appraisals is not only unethical—it’s illegal. However, this campaign unfairly targets a profession built on independence, impartiality, and consumer protection. In a powerful response, Sandra K. Adomatis, SRA, President of the Appraisal Institute, clarifies the critical role of appraisers, addresses misconceptions, and highlights the need for meaningful policy change to support housing equity.

Read Sandra’s full letter and learn why appraisers are key advocates for fair and objective valuations 👉 https://bit.ly/490vHl6 "

11/16/2024 I was in the market and picked up Essence magazine because Serena is on the cover and I love her. It's a black women's lifestyle magazine. Inside was another targeted racist ad against appraisers. I then decided to look at the white women's lifestyle magazines. No racist ads in there. This was targeted to black women.

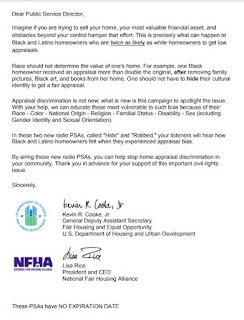

10/16/2024 Just found the PSA and script for the new NFHA ads. This is disgraceful! HUD, NFHA is basically defaming all real estate appraisers calling them racist. This has to be unconstitutional for the government to spend money making, promoting these "ads" to spread racist falsehoods against nonblacks, nonLatinos. It's unconstitutional for the government to give preference or money to specific races. It must be unconstitutional to harm specific races. Research based on their own data proves this is false. AEI's research showed there is no racism in appraisal values.

Radio spot script

"Robbed" (:60)

WOMAN V/O: My husband and I were ready to sell our home of 25 years,

so we got it appraised. We thought we knew what to expect, but when our

home appraisal came back, we felt…robbed. Compared to a similar home

right around the corner, our appraisal was $80,000 less. That’s a big

difference. It was the same type of home, in the same neighborhood, in

the same condition and age.

NARRATOR V/O: A recent study found that Latino and Black

homeowners are about twice as likely as white homeowners to get low

appraisals. For example, one Black homeowner received an appraisal

more than double the original, after removing family photos, Black art, and

books from her home.

If you believe your home has been unfairly appraised because of race or

national origin, that could violate the Fair Housing Act. Contact HUD at

HUD.gov/fairhousing – that’s HUD.gov/ fairhousing. Everyone has a right

to fair housing.

A public service message from HUD in partnership with the National Fair

Housing Alliance."

Radio spot 2 "Hide" (:60)

HUSBAND V/O: After getting my promotion, the time had come to sell our

home. So we got an appraisal.

WIFE V/O: But it was much lower than we expected. Before we had it

appraised again, a friend suggested we make some changes.

HUSBAND V/O: I put my framed vintage Negro League Baseball shirt,

our African art, and family photos into storage. And that second appraisal

came back much higher!

WIFE V/O: It’s a shame we had to hide who we are to get a fair home

appraisal.

NARRATOR V/O: A recent study found that Black and Latino

homeowners are about twice as likely as white homeowners to get low

appraisals. For example, one Black homeowner received an appraisal

more than double the original, after removing family photos, Black art, and

books from her home.

If you believe your home has been unfairly appraised because of race or

national origin, that could violate the Fair Housing Act. Contact HUD at

HUD.gov/fairhousing – that’s HUD.gov/fairhousing. Everyone has a right

to fair housing.

A public service message from HUD in partnership with the National Fair

Housing Alliance"

https://causewaypsa.com/EPK/65056_HUD_Radio_EN/HUD_EPK.pdf

HUD, NFHA is basically defaming all real estate appraisers calling them racist. This has to be unconstitutional for the government to spend money on these "ads" to spread racist falsehoods. Reseach based on their own data proves this is false. AEI's research showed there is no racism in appraisal values.

ORIGINAL: The private nonprofit group National Fair Housing Alliance NFHA promotes the false narrative about alleged racist, biased real estate appraisers, lenders, AMCs to get donations, grants and millions in legal settlements per year. They falsely promote fake debunked papers about race and home values. Currently they're running advertisements falsely stating that real estate appraisers lowball blacks and Latinos. Private NFHA brings in $30,000,000 a year in donations and has $23,000,000 in assets in 2021. They're probably bringing in double that today in 2024 because of a recent 2022 $53,000,000 settlement from Fannie Mae and 2022 $4,000,000 settlement from Redfin. EIN 521676364 Phone (202) 898 1661

Here is their main profile in Guidestar. https://www.guidestar.org/profile/52-1676364

Here is their most recent IRS form 990 for 2021.

https://pdf.guidestar.org/PDF_Images/2022/521/676/2022-521676364-202322239349301757-9.pdf

2023 audit shows $28M assets.

https://projects.propublica.org/nonprofits/display_audit/2023-09-GSAFAC-0000045422

They became a nonprofit in 1990. Lisa Rice is the CEO. They're headquarters are in Washington, D.C. but they're not part of the government. HUD refers people to NFHA to do their work filing complaints but they aren't a contractor. HUD runs ad campaigns about fair housing with NFHA. HUD did award over $30,000,000 in Fair Housing grants in 2024 alone to NFHA type programs. In 2021 they got a huge increase in litigation settlements i.e. $17,000,000 with legal costs of about $500,000. I wonder if they get pro bono lawyers to help them for free so they make more profit. In 2022 they got $53,000,000 from Fannie Mae racial discrimination settlement. They are clearly motivated to shake down appraisers, lenders and AMCs for money. It's been a huge financial boon to sue people to get them to cough up a settlement to end litigation, harassment, defamation and bad press caused by NFHA and their national press releases, conferences and misleading articles and videos. NFHA gets donations and press just from the press releases about their frivolous meritless lawsuits. They include a donation link in the press releases.

Nonprofit doesn't mean there are no profits or they aren't motivated by money. The main employees and sometimes board members generally get generous salaries, bonuses and perks. They are motivated by the money, power and prestige. The nonprofit sometimes donates to other groups which are generally friends of the main employees. They sometimes hire friends of the CEO, husbands, wives, children. Many nonprofits are actually just for profit businesses in disguise who don't pay taxes. A prime example is Shedd aquarium vs Sea World. They're both aquarium business with sea animals doing tricks which bring in about a billion per year. Shedd is a nonprofit and Sea World is a business doing the exact same thing. Here's an article I wrote about that.

Lisa Rice CEO makes almost $300,000 a year. Catherine Cloud the COO makes almost the same. They spend $3,000,000 in wages. They spend $500,000 on conferences and $250,000 just at the Hyatt Hotel. They receive grants from the government after paying $500,000 to lobby the government.

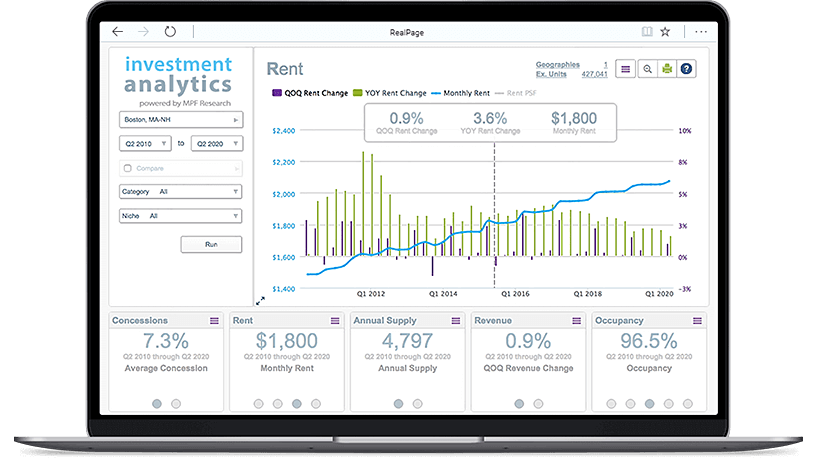

Have you seen these ads which NFHA, HUD run in major magazines, websites and on TV? They are very deceptive. American Enterprise Institute AEI proved that appraisers don't lowball anyone let alone blacks and Latinos. First time buyers in lower income areas buying lower priced homes are more likely to be black and Latino because of the income gap. The real estate purchases are more likely to have concessions for repairs and closing costs in these areas. This is why some appraisal values are sometimes 3% lower than contract value. The contracts include the concessions for repairs and closing costs which pads the sales price by about 3%. Appraisers have to adjust for concessions which lowers appraisal value by the concession amount for repairs and such.

I just realized that NFHA has done advertisement campaigns in the past with HUD. I just saw a full ad with HUD disclaimer on the bottom of one ad.

I couldn't read the fine print in the ad I originally posted above. HUD is working with NFHA on these misleading ads. The block of text after "Everyone has a right to fair housing" could say "A public service message from the U.S. Department of Housing and Urban Development in partnership with

the National Fair Housing Alliance. The federal Fair Housing Act prohibits discrimination because of race, color, religion, national origin, sex, familial status or disability. For more information, visit www.hud.gov/fairhousing." It still makes it seem that private NFHA is part of the government when it's not.

Here is their income from settlements, shakedowns.

NFHA stated that appraisers lowball blacks and Latinos in the US. This is false. AEI proved with the government's own data that appraisers aren't lowballing anyone, see links below. The data NFHA used for this false statement was based on robot appraisals. No appraisers were involved. AEI debunked Andre Perry's false and misleading paper. It was not peer reviewed research. This is again correlation and not causation. Blacks, Latinos make less money than white people. If you make less money, you have less money and you will buy/own a lower priced home in a lower priced area. It's the income gap. Same thing happens to lower income whites, Asians ... everyone. Blacks, Latinos own lower priced cars for the same reason. Will they also blame that on real estate appraisers? If they really care about the issue, they should fix the income gap which has nothing to do with housing.

NFHA and HUD are lying to the public about appraisal bias. FTR anyone can use the HUD logo. HUD clearly states this in their website. I could use the HUD logo in my website and falsely state all non Latino appraisers lowball Latinos so Latinos should only use me, a Latina, for their appraisal. I could probably make money lying like that but I'd never do that because it's dishonest and racist. NFHA makes money being dishonest. They know they are promoting a false racist narrative for their own agenda which is money.

I just noticed that NFHA has different ads for different publications based on most likely race of viewer based on subscriber statistics. Some are Latinos, blacks, Asians and whites. Is this racist? Should they be sued for racism, targeted racism, colorism like they are suing lenders? They're doing the same exact thing they are accusing others for money. The ad in Sports Illustrated showed white people. The one in a mainly a black magazine showed black people. Who is the racist here?

Just found one of the ads blown up so I can see the text. It is from NFHA and HUD. Click to view larger to read the text.

Great article by Jeremy Bagott on this same issue. He shows the bigger picture which is the use of the false narrative of the racist biased appraiser to get rid of appraisers to make lenders, AMCs more money. Lenders have lobbied the government to use AVMs, appraisal waivers, value acceptance, hybrid appraisals, desktop appraisals to get rid of appraisers in favor of free robots. These robots are more biased than any appraiser because they don't know or consider all factors in appraisal. Robots don't know condition, view, lot type, actual size, actual bed/bath count, permitted size, upgrades, amenities, specific location...which are main factors in valuation. https://mailchi.mp/c5f09f56ce7f/regulatory-capture-hud-and-a-crony-nonprofit-9382139

References

How Common is Appraiser Bias?

https://www.aei.org/wp-content/uploads/2022/06/How-Common-is-Appraiser-Racial-Bias-An-Update-May-2022-FINAL-corrected-1.pdf?x91208

Exploring Alternative Explanations for Appraisal Under-Valuation

https://www.aei.org/research-products/report/exploring-alternative-explanations-for-appraisal-under-valuation/

The Impact of Race and Socio-Economic Status on the Value of Homes by Neighborhood A Critique of the Brookings Institution’s “The Devaluation of Assets in Black Neighborhoods”

https://www.aei.org/wp-content/uploads/2021/08/Impact-of-Race-and-Socio-Economic-Status-on-the-Value-of-Homes-by-Neighborhood-Presentation-8.5.21-FINAL-v4.pdf?x85095

Racial Bias in Appraisals: New Research

https://www.aei.org/wp-content/uploads/2023/11/Racial-Bias-in-Appraisals-New-Research-FINAL_revised.pdf?x91208

Mary Cummins of Cummins Real Estate is a certified residential licensed appraiser in Los Angeles, California. Mary Cummins is licensed by the California Bureau of Real Estate appraisers and has over 35 years of experience.

Mary Cummins, Mary K. Cummins, Mary Katherine Cummins, Mary, Cummins, #marycummins #animaladvocates #losangeles #california #wildlife #wildliferehabilitation #wildliferehabilitator #realestate #realestateappraiser #realestateappraisal #lawsuit real estate, appraiser, appraisal, instructor, teacher, Los Angeles, Santa Monica, Beverly Hills, Pasadena, Brentwood, Bel Air, California, licensed, permitted, certified, single family, condo, condominium, pud, hud, fannie mae, freddie mac, fha, uspap, certified, residential, certified resident, apartment building, multi-family, commercial, industrial, expert witness, civil, criminal, orea, dre, brea insurance, bonded, experienced, bilingual, spanish, english, form, 1004, 2055, 1073, land, raw, acreage, vacant, insurance, cost, income approach, market analysis, comparative, theory, appraisal theory, cost approach, sales, matched pairs, plot, plat, map, diagram, photo, photographs, photography, rear, front, street, subject, comparable, sold, listed, active, pending, expired, cancelled, listing, mls, multiple listing service, claw, themls, historical appraisal, facebook, linkedin

DISCLAIMER: https://mary--cummins.blogspot.com/p/disclaimer-privacy-policy-for-blogs-by.html