RealPage was sued by the Department of Justice for alleged "price fixing" of apartment rents. DOJ stated RealPage was "attempting to illegally decrease pricing competition between landlords and deprive renters the benefits of that competition." I find it hard to believe that a rental database is "price fixing." What about Zillow, MLS, stock market, Kelly Blue Book...? They all show list and sales prices which people use to set prices for similar goods. An an appraiser I do sales and rental analysis all the time with MLS, CoreLogic, Realty, Google... data. Is that price fixing? People hire me to find out what the market rate sales price or rent is for their home or apartment. Am I a "price fixer?"

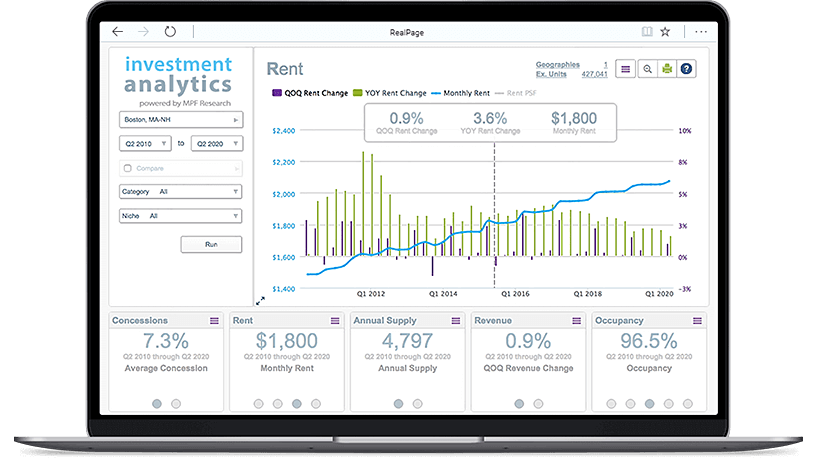

RealPage offers a host of software and services to help property managers. One of those services is a software called YieldStar. YieldStar uses rental data from software users and more to suggest list rent prices for apartment building owners. Apartment owners have been using rental data to set prices since the beginning of time. Sometimes the rental prices are public and sometimes you have to do some research to find out the list and sales rent. Back in the day we had to get on the phone and call people. Some do the research and sell the reports. In this case property owners were submitting their own rents anonymously into the database. They don't want to do it publicly because then tenants could see their bottom rent, max rent concessions and only offer to pay rock bottom rent. Car dealerships do the same. Do we even know if they were inputting real rental rates? Doubt it was verified. RealPage said managers only used the data half of the time. Only 10% of some markets use their software. You would need 70% of apartment managers using the data and recommendations to affect the market. Here at most you had 5% considering market rate rent based on the data. They were given market rent data and not an inflated agreed upon value by all apartment building owners. That's the big difference here.

The real issue is rents have risen and it's an election year. Rents correlate directly with home prices which have risen at the same exact rate. The underlying cause is people aren't making enough money to pay the rent because wages are stagnant and there are not enough housing units. They need to help people make more money and build more units. Because it's an election year one party has to instead blame the government's problem on private individuals and businesses. "Vote for me and I'll lower your rent by suing a data company!" Getting rid of RealPage won't lower the rent. They never want to fix the real problem because it's too big and complex.

The last election cycle Joe Biden said blacks and Latinos were being lowballed by "old white racist male" appraisers devaluing their homes. We appraisers were the scapegoat for blacks, Latinos not having as much money as whites and owning less valuable homes. Biden said if elected he'd make sweeping changes with appraisers to increase property values. He didn't change anything but increase government meetings and paperwork. Again the real problem is income. In this situation whites make more than blacks, Latinos. If you make more money you have more money and can afford to buy a more expensive home in a more expensive area. Appraisers report values. We don't set them. Guess what? Whites also own more expensive cars than blacks, Latinos. Are real estate appraisers to blame for that also?

I will try to find the lawsuits and read them closely to see if there was any real "price fixing." The timing right before the election with Kamala Harris talking about high rents and "price gougers" makes me think this is just an election year issue. I'm just glad it's not another made up problem with appraisers. We've been through enough with the false lowball narrative smeared all over the media and internet.

https://www.yahoo.com/news/justice-department-suing-realpage-over-163534773.html

This article goes more into the specifics of the lawsuit. It still doesn't make sense. What about Kelly Blue Book algorithm for car values? They suggest market rate values for cars. It's based on car sales and listings. This is feeling like election year politics. It reminds me of the DOJ, HUD getting involved in a private alleged real estate bias lawsuit in Marin, California. DOJ filed a Statement of Interest in a fake racial discrimination case in appraisal values. It was 100% political so the government can say "see, we're doing something. Vote for us!"

Below are CoreLogic and Zillow rent reports on a property. Will they and MLS be sued next? I assume the value is being pulled from MLS and Zillow rental database. Apartments.com also shows rental prices for various areas. There are so many rental databases offering suggested rents. Maybe RealPage should have made the rental database non anonymous. It could just be based on general area and not specific building addresses.

Mary Cummins of Cummins Real Estate is a certified residential licensed appraiser in Los Angeles, California. Mary Cummins is licensed by the California Bureau of Real Estate appraisers and has over 35 years of experience.

- Mary Cummins LinkedIn

- Mary Cummins Meet up

- Cummins Real Estate on Facebook

- Mary Cummins Real Estate blog

- Cummins Real Estate on Google maps

- Mary Cummins of Animal Advocates

- Mary Cummins biography resume short

- Mary Cummins Real Estate Services

- Animal Advocates fan page at Facebook.com

- Mary Cummins

- Mary Cummins Animal Advocates on Flickr photos

- Mary Cummins Animal Advocates on Twitter.com

- Mary Cummins on MySpace.com

- Mary Cummins on YouTube.com videos

- Mary Cummins of Animal Advocates on Classmates

- Mary Cummins on VK

Mary Cummins, Mary K. Cummins, Mary Katherine Cummins, Mary, Cummins, #marycummins #animaladvocates #losangeles #california #wildlife #wildliferehabilitation #wildliferehabilitator #realestate #realestateappraiser #realestateappraisal #lawsuit real estate, appraiser, appraisal, instructor, teacher, Los Angeles, Santa Monica, Beverly Hills, Pasadena, Brentwood, Bel Air, California, licensed, permitted, certified, single family, condo, condominium, pud, hud, fannie mae, freddie mac, fha, uspap, certified, residential, certified resident, apartment building, multi-family, commercial, industrial, expert witness, civil, criminal, orea, dre, brea insurance, bonded, experienced, bilingual, spanish, english, form, 1004, 2055, 1073, land, raw, acreage, vacant, insurance, cost, income approach, market analysis, comparative, theory, appraisal theory, cost approach, sales, matched pairs, plot, plat, map, diagram, photo, photographs, photography, rear, front, street, subject, comparable, sold, listed, active, pending, expired, cancelled, listing, mls, multiple listing service, claw, themls, historical appraisal, facebook, linkedin

DISCLAIMER: https://mary--cummins.blogspot.com/p/disclaimer-privacy-policy-for-blogs-by.html

No comments:

Post a Comment