|

| real estate appraisal, discrimination, black, bias, mary cummins, california, 20 pacheco, paul austin, tenisha tate austin, lawsuit, complaint, facts, real estate appraiser, marin city, sausalito |

Blog article has been updated. Original is at the bottom with recent updates on top. Original article was February 2021. Link to all legal documents below.

UPDATE: Case is now closed. Justice did not prevail. The facts were never stated or argued. We didn't see any appraisals. Side with deepest pockets won. Travesty of justice.

I read an article about nonprofits suing people just to get media attention and donations. It reminded me exactly of this case. The Judge said the group was "abusing court systems to fundraise" and claimed its goal was "to manipulate people into donating to their cause by incessantly publicizing sensational court cases with relentless calls for supporters to donate." That is exactly what the National Fair Housing Association does with these cases. They don't care that they harm people and malign an entire profession.

04/18/23 ORDER APPROVING STIPULATION FOR DISMISSAL WITH PREJUDICE AS TO DEFENDANTS JANETTE C. MILLER AND PEROTTI REAL ESTATE APPRAISALS, INC. Signed by Judge Maxine M. Chesney on 4/18/2023. (mmclc2, COURT STAFF) (Filed on 4/18/2023)

04/18/2023 Proposed settlement order just filed. Settlement appears to be confidential. Basic text.

04/17/2023 66 STIPULATION WITH PROPOSED ORDER for dismissal with prejudice as to defendants Janette C. Miller and Perotti Real Estate Appraisals Inc. filed by Paul Austin, Fair Housing Advocates of Northern California, Tenisha Tate-Austin. (Cristol-Deman, Liza) (Filed on 4/17/2023) (Entered: 04/17/2023)

"Plaintiffs and the remaining Defendants, Janette C. Miller and Perotti Real Estate Appraisals,

Inc., have reached a settlement in this matter. The parties hereby apply for and stipulate to issuance of

an order dismissing all claims with prejudice against these remaining two defendants, subject to the

terms of the settlement agreement. The parties request that the Court retain jurisdiction solely for the

purpose of enforcement of the settlement agreement.

Case 3:21-cv-09319-MMC Document 66 Filed 04/17/23 Page 1 of 4

STIPULATION FOR DISMISSAL WITH PREJUDICE; [PROPOSED] ORDER– CASE NO. 3:21-CV-09319 MMC

Claims against Defendant AMC Links, LLC have already been dismissed with prejudice

pursuant to a previous settlement agreement."

https://drive.google.com/file/d/1-Q2z8sKI21PPlRU7I6rJNsb23X82g7oA/view?usp=sharing

03/14/23 Still nothing new on the docket. There is no official notice of settlement confidential or otherwise. Nothing new since 12/02/22. The settlement with the AMC was confidential. Nothing about that settlement was released. The alleged settlement with Miller et al is allegedly confidential per the Plaintiff yet they shared info about Defendant admitting no wrong doing, being forced to take a "class" from the private housing group and being forced to watch the false TV show about similar fake cases of alleged discrimination. Doesn't sound confidential to me. Sounds more like Plaintiff only sharing what they want to share. What was Plaintiff forced to admit? Most likely that there were no damages and no racism.

03/10/23 I was just told in the TMZ interview that the Austins lied. They said the appraiser didn't use comps from their neighborhood but a different neighborhood.The first appraiser used comps in their same neighborhood which is what the Austins didn't want. In the lawsuit the Austins stated they lived in a "black" neighborhood with lower home values.They stated they wanted the appraiser to use comps from the "higher priced" "white neighborhood" only. The Austins did not want the appraiser to use comps in their same neighborhood. Then the Austins cited Andre Perry's fake paper as if it were fact.

Just saw the TMZ short video clip. It's not the full interview. I will only comment below on that short clip linked here.

Tenisha said "appraisers are on notice that if they continue to behave this way that there could be repercussions. Obviously people don't want to be sued."

This sounds like a threat to all appraisers in the US to me, white, black and brown. You will be sued if you appraise a home for market value and according to the law. If you don't give the borrow the value they want, they will sue the hell out of you with the help of deep pocketed private "fair housing" groups. This is undo pressure on appraisers. This is against the law. If any borrower said this or hinted this to an appraiser, the appraiser must notify the AMC, Lender and stop all work. If the appraiser hears this after they did the work, they must notify and the borrower will be denied any home loan.

This threat clearly already worked on the second appraiser who came in way too high. That appraiser knew the borrowers weren't happy and wanted, demanded a higher appraisal. They didn't want to get sued. The appraiser caved and used comps from Mill Valley which is miles away and worth twice as much as Marin City where the Austins' home is located. They knew the borrower would be happy with an overly high appraisal. Again, please, give me this appraiser's name and a copy of that report so I can report them to BREA. They need to go to prison for bank fraud. If I had the money, I'd offer a reward for a copy of that appraisal.

Harvey Levin: What did that appraiser gain by lowballing?

Tenisha: I don't think it's about them gaining anything either one way or the other because they're not the lender it's more about them perpetuating historical practices that have led to families of color cheated out of money for generations, so I think it's just the practice that they're conditioned to do.

Paul Tate: (paraphrased) Black, brown don't have opportunity to get wealth through homeownership. It's unconscious bias, I looked at this redlined black area or I see a black, brown family, my biases show up.

Harvey: You may have made a big difference by putting the word out you guys are gonna be held accountable if you do this. Must feel really good.

Tenisha: (big shit eating grin) (People) should arm themselves by knowing what their comps are in their neighborhood when asking for appraisal, also to, if appraisal doesn't come in where expected to ask for (sic) request for evaluation, ROV, and contact local fair housing association."

I fully support all homeowners finding out what SIMILAR homes of the same legal size in the SAME neighborhood area have sold for. I also support requesting a Reconsideration Of Value (ROV). What I don't support is what these people did and stated in their lawsuit. They specifically said they wanted the appraiser to ONLY use comps from OUTSIDE OF THEIR NEIGHBORHOOD. They wanted the appraiser to ONLY USE comps from a "WHITE" AREA MILES AWAY that sells for TWICE AS MUCH as their own neighborhood. They are the ones who noted black and white areas not the appraiser. We appraisers don't know the color or race of the areas. The appraiser never mentioned color, race... We know who the real racists are in this situation. The Austins said the most racist things in their lawsuit. I wish the appraiser was a billionaire so she could have sued them for defamation for what they said in the media. Sadly they attacked an elderly woman who was on the verge of retiring. Her daughter died of cancer during this stressful lawsuit. Her husband died a few months after her daughter.

I would love to see this couple apologize to the appraiser one day but that will never happen. These people are so in the wrong that it makes my blood boil. This settlement just shows the power of money for legal fees against an appraiser with a basic E&O insurance policy. These insurance companies are known to fold and settle 99.999999% of the time before any trial. The private fair housing organization knew this. They also knew the misguided media was on their side. They knew no one would actually read their racist lawsuit which is linked below. Defendant's reply to their suit goes into Plaintiff's shakedown lawsuit in great detail. At least all of that is on the record. Media is now just using these people to get traffic and sell ads from the fake racial outrage. People should be outraged by real racism and not this made up story.

And FTR this area was never redlined. It didn't even exist when the redline maps existed. Maps were 1930's to 1968. These homes were built 1965-1980. They never made a map of this area because it's a tiny city. Austins lied about redline maps affecting the value of their home. There were no maps of the entire county!

https://www.tmz.com/2023/03/10/black-couple-settles-lawsuit-home-appraisal-racial-bias-accountability/

Here is a tiny comparison of Mill Valley and Marin City where subject is located. The Austins wanted the appraiser to only use comps in the "white area" in Mill Valley where homes sell for twice as much. And I want my nonexistent home in South LA to be worth as much as one in Beverly Hills. Crime rate in Marin is twice Mill Valley. Home ownership rate is less than half of Mill Valley. Education levels in Marin City students is abysmal. Marin City income is only 29% of Mill Valley. Average home price is half in Marin. Violent crime is triple in Marin. Property crime is double. Where would one prefer to live?

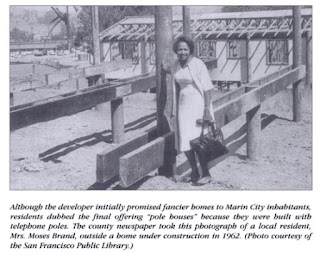

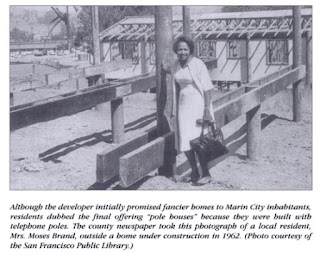

Marin City was built as a public housing project for poor people. This included all the homes and apartment buildings. The properties are very low quality built by the lowest bidders. Appraisers never look at these stats but I'm showing them here so you can see why Mill Valley is worth so much more than Marin. If the Austins want a Mill Valley price tag, they should buy a home in Mill Valley instead of trying to force appraisers to value their home like a Mill Valley home.

Homeownership rate Mill Valley 66% Marin 31%

Graduate degree 36 19

Didn't finish high school 1 10

High school only 7 17

Management jobs 75 37

Service jobs 5 24

Single 42 64

Married 58 36

School proficiency math 82 25

same for reading 85 15

**Median income $132K $39K

**Avg home price $1,826,600 $869,300

Violent crime 7% 26%

Property crime 24% 45%

White population 88% 44%

Black 1% 23%

Latino 4% 17%

Asian 5% 12

Appraisers never look at racial makeup of any neighborhood. I'm doing this for the sake of exposing Plaintiffs' argument about race as false. They stated Marin is a "black" area. They stated because the inhabitants are black, their property is worth less than whites. Marin is 44% white, 23% black, 17% Latino, 12% Asian. What about the non blacks in Marin? Their homes are worth the same amount as blacks and it's not because they're black because they're not. The homes in Marin City are worth less than Mill Valley because of the location, location, location. Homes in South LA are worth less than Beverly Hills. Racial makeup of those areas is probably the same as Marin.

The Austins bring up redlining. They said their area was redlined when there were risk maps. The maps came out in the late 1930's. Marin City where they live didn't even exist at that time. Most of it was built 1965 as a federal housing project for poor people. The maps were banned in 1968. This area had such a low population that they never made a map. The Austins said redlining of their home caused their home value to be low. It was unbuildable swamp land that was filled in. Their house is located in an area which is too steep to build. The hillside homes should not have been developed in the first place. They didn't begin building the lower part of the city until 1942. That area was built as housing for employees of the shipyard Marinship. Most private homes were built 1965-1980 after the redline maps were gone. Below is the redline map for the area. Look near Sausalito upper left. I don't think there was a redlining map for this area. I believe that means the Austins lied in their lawsuit. They said the area was devalued because of the redline maps. Here is a link to all the maps.There was no redlining map for Marin. There wasn't one for Mill Valley either because these cities are so small. https://www.arcgis.com/home/webmap/viewer.html?webmap=063cdb28dd3a449b92bc04f904256f62

The Austins said the settlement agreement is confidential. Then they said Defendant didn't admit any wrongdoing but agreed to watch a biased propaganda TV show and take a private class by the private fair housing organization. Then what's confidential? Just the dollar amount of settlement? Makes me think the dollar amount was zero since they revealed everything else. The insurance company clearly forced this on the appraiser.

This is for people new to this issue. Research has shown that whites make more money than blacks, Latinos. Married people make and keep more money than singles. People without young children make and have more money. Research has shown people who make more money have more money, more generational wealth and buy and own more expensive homes. People buy homes they can afford to buy and own. For this reason whites own more expensive homes than blacks, Latinos. It's not appraisers valuing white owned homes higher than black, Latino owned homes. We value homes based on recent similar sales in the same neighborhood. More whites live in more expensive areas. More blacks, Latinos live in less expensive areas. No one is valuing homes based on color or race. What the Austins stated are racist lies just to get attention and promote their personal agenda. They would have lost had the case gone to trial. The appraisers insurance company caved due to costs.

03/07/23 Case is allegedly settled. No actions have shown up on Pacer as of yet. Last entry was 12/02/22. Looks like the insurance company paying defendant's legal fees forced the appraiser to settle. They most likely threatened to stop paying legal fees. In the settlement Defendant states they “didn't engage in any unlawful discrimination.”Plaintiff states "Caroline Peattie, the executive director of Fair Housing, said the decision to settle was made because of the toll such a case takes on the people bringing it and the uncertainty of the outcome." No mention of the toll on the defendant who did nothing wrong. The other terms of the settlement would eat me up psychologically. Keep in mind the insurance company is probably footing the money for the payment, settlement. That's how it works. Imagine being forced to watch a very misleading TV show which promotes the false narrative of the racist white appraiser as part of this settlement. I covered most of the cases in that show. I'm just finishing up an article about that show. Just learned Miller has to take a class from the Plaintiff. "Miller, who the Austins have described as an older white woman, must also attend a training session on the history of segregation and real estate-related discrimination in Marin County, provided by Fair Housing Advocates of Northern California." This is cruel and unusual.

"The settlement announced Monday includes an undisclosed financial compensation from Miller and her firm, Miller and Perotti Real Estate Appraisers. The settlement also requires Miller to attend training on prevention of housing discrimination in the county and watch the documentary “Our America: Lowballed,” on housing discrimination cases. "

https://www.courthousenews.com/black-couple-settles-bias-suit-over-lowballed-home-appraisal/

I once had a car accident set up against me. Homeless lady with a super beat up car ran right into me and apologized at the scene. She gave me her info on a piece of paper but had no pen? She sued me. My insurance settled with her against my wishes. I did all this research to prove the lady was a scammer who did this many times. I had witnesses which said she just ran right into me while I was stopped at a light behind the crosswalk. Insurance told me they wouldn't defend the case anymore because it cost more to defend than the settlement. It's a basic money issue. I still refused to settle. My insurance company settled the case without me. That is probably what happened here. Appraiser didn't want the continued stress of the case. Her husband and daughter had died recently. She's older. Lady has been through enough.

My personal opinion is the Tates are clearly in the wrong. By now they must know it. I really wish Miller would have sued them for defamation for what they falsely said in the media about her. The Housing Alliance of Northern California basically beat Miller into submission for their own political agenda. The main issues of the appraisal and discrimination were never argued in the court. Miller's appraisal was market value at that time. The other higher appraisal was way over market value.That appraiser should lose their license and go to jail for bank fraud. If anyone knows who did that appraisal or has a copy of it, please, send it to me. I won't divulge who sent it to me ever.

All this talk of whitewashing homes makes one think maybe people should do the opposite if they want an appraisal value twice as high as market value. It looks like threatening and filing lawsuits, falsely yelling racial discrimination will get you some money and press. The Austins were so cruel that they even demanded this elderly woman be forced to watch a propaganda TV show which starred them and their lies to the media. Nothing they said was ever proven in a court of law. Everyone who knows the facts of the case knows the truth.

01/24/2023 The Tates sent in comment for today's ASC meeting on appraisal bias. Here it is.

https://files.consumerfinance.gov/f/documents/cfpb_appraisal-hearing_paul-austin-and-tenisha-tate-austin-testimony_2023-01-24.pdf

"The appraiser did not look at properties that were more similar in the nearby areas that have higher populations of white residents. This suggests that the appraiser was hyper focused on comparing our home to a certain type of home that was not favorable to our valuation."

Owner stated they wanted appraiser to use comps from the white area because they had higher values. This is what it's all about. They wanted a higher value than what their home was worth. Had the second appraiser not used the incorrect comps in Mill Valley, the first appraiser would not have been sued. I really want to find the second appraiser and their report so I can report them to BREA. They should lose their license.

The Tates went on to affirm that the appraiser didn't use cops outside of the neighborhood. The Tates don't just blame that one appraiser but all appraisers and the entire system for their alleged "devaluation."

The Tates keep referring to their "brooker," "Brooker" when meaning loan agent. Clearly they don't understand real estate or appraisals. They said they didn't file a complaint because of statute of limitations. Their statement is riddled with many mistakes. The husband who wrote it is supposed to have a degree and be involved in teaching children. His wife also has a degree. How did he ever graduate with all these errors? The Tates admit they use the house as means to get cash.They have $90,000 in student loan debt. They basically bought it from the estate for no money down.

12/02/2022 Minute Entry for proceedings held before Magistrate Judge Sallie Kim: Settlement Conference held on 12/2/2022. Case did not settle. No further settlement proceedings scheduled at this time.

Total Time in Court: 5 hours, 15 minutes.Not reported.

Attorneys for Plaintiffs: Liza Cristol-Deman and Julia Howard-Gibbon.

Client Representatives: Paul Austin, Tenisha Tate Austin, and Caroline Peattie.

Attorneys for Defendants Janette C. Miller/Miller and Perotti Real Estate Appraisals, Inc.: Peter Catalanotti.

Client Representative: Janette Miller.

11/01/22 New comp showed up in Sausalito close to the ocean for $1.3M. 81 Buckelew St, Sausalito, CA 94965-1101. Location is superior to subject. Ocean, mountain view, little bigger on bigger lot that's not as sloped. Clearly Pacheco was not worth $1.4M at the last appraisal Feb 2020 if this sold for $1.3M 11/22 almost two years later. https://www.realtor.com/realestateandhomes-detail/81-Buckelew-St_Sausalito_CA_94965_M25854-23340

10/24/2022 ORDER APPROVING STIPULATION FOR DISMISSAL WITH PREJUDICE AS TO DEFENDANT AMC LINKS LLC ONLY. Signed by Judge Maxine M. Chesney on 10/24/2022. (mmclc2, COURT STAFF) (Filed on 10/24/2022)

10/21/2022 I would love to know what the settlement was. I'm sure their insurance company is the one who agreed to it. The AMC ordered a second appraisal after the Austins didn't like the first one. That doesn't look good. The AMC should have walked away after the first appraisal. AMCs can learn from this lesson. AMC paid more for a second appraisal only to open themselves up for liability. Stupid, dumb and maybe even unethical. They didn't do it for profit. They lost money ordering the second appraisal. They did it to make the lender happy so they could continue to get work. Even with Dodd Frank Act AMCs and appraisers can still be pressured. The AMC probably tried to get Miller to up her value but she stood her ground because it was market value. To go higher would be wrong. Based on my research the second appraisal was wayyyyyyy over market value at that time. That is the appraiser who should be sued but people don't sue appraisers who come in high. Well, not until the market drops or they can't pay their mortgage. I'd love to see that appraisal but I doubt we'll ever see it. I'm sure that appraiser is in hiding.

STIPULATION WITH PROPOSED ORDER for dismissal of defendant AMC Links LLC only filed by Paul Austin, Fair Housing Advocates of Northern California, Tenisha Tate-Austin. (Cristol-Deman, Liza) (Filed on 10/21/2022)

09/15/2022 Case settled to AMC Links only. Miller did not settle. As Miller just filed their amended reply, they have no desire to settle this frivolous case. Would love to see AMC Links' settlement but we may only hear about it from the Plaintiff. Legally the AMC carries the liability as they have to approve the appraiser's appraisal. The AMC did order the second appraisal which the Plaitniffs liked because it was higher than the first and most likely higher than market value. The written agreement has not been executed, signed or filed so it's not final yet. The AMC really didn't muster much of a defense in their filings though they did basically deny all of Plaitntiffs' claims. AMC and Miller have different lawyers.

Case Name: Austin et al v. Miller et al Case Number: 3:21-cv-09319-MMC

Document Number: 62(No document attached)

Minute Entry for proceedings held by Zoom before Magistrate Judge Sallie Kim: Settlement Conference held on 9/14/2022.

Case settled as to Defendant AMC Links only. The parties will execute a written agreement.

Further Settlement Conference with remaining parties set in person for 12/2/2022 08:00 AM in San Francisco Courtroom C, 15th Floor.

Total Time in Court: 8 hours, 15 minutes.

Not reported.

Attorneys for Plaintiff: Liza Cristol-Deman and Julia Howard-Gibbon.

Client Representatives: Paul Austin, Tenisha Tate Austin, and Caroline Peattie.

Attorneys for Defendants Janette C. Miller/Miller and Perotti Real Estate Appraisals, Inc.: Peter Catalanotti and Madonna Herman.

Client Representative: Janette Miller.

Attorney for AMC Links: Alex Graft.

Client Representative: Rod Olsen, Steve Bauer, Claudia Gaglione, and Bert Ringwood.

(This is a text-only entry generated by the court. There is no document associated with this entry.) (mkl, COURT STAFF) (Date Filed: 9/14/2022)

08/25/2022 Media articles about the court win for the appraiser.

"Judge Dismissed Marin County Couple's Lawsuit Claiming Racially Biased Home Appraisal."

https://www.northbaybusinessjournal.com/article/article/judge-dismisses-marin-county-couples-lawsuit-claiming-racially-biased-home

"Appraiser Miller Wins Claim in Racial Discrimination Lawsuit."

https://appraisersblogs.com/appraiser-miller-wins-claim-in-racial-discrimination-lawsuit

08/23/2022 One battle has been won on an important claim. "ORDER GRANTING MILLER DEFENDANTS' MOTION TO DISMISS FIRST AMENDED COMPLAINT; DISMISSING PLAINTIFFS' SEVENTH CLAIM FOR RELIEF AS ASSERTED AGAINST MILLER DEFENDANTS; VACATING HEARING. Plaintiffs' Seventh Claim for Relief, as asserted against the Miller Defendants, is dismissed without further leave to amend. Signed by Judge Maxine M. Chesney on August 22, 2022. (mmclc2, COURT STAFF) (Filed on 8/22/2022)

Below is the text of the order. They lost for all the reasons Defendant and I stated. This proves the Plaintiffs are liars. They lied to the Court. They lied to the media. This case is about people taking advantage of the current charged racial environment since the murder of George Floyd to try to shake people down for money. They don't care that the Defendant is being threatened, harassed, attacked every single day. Her business and reputation have been permanently destroyed by liars out for a buck and media attention.

"Before the Court is defendants Miller and Perotti Real Estate Appraisals, Inc.

(“MPREA”) and Janette C. Miller’s (“Miller”) (collectively, “Miller Defendants”) Motion,1

filed June 27, 2022, to dismiss, pursuant to Rule 12(b)(6) of the Federal Rules of Civil

Procedure, the Seventh Claim for Relief asserted against them in plaintiffs Tenisha TateAustin, Paul Austin (collectively, the “Austins”), and Fair Housing Advocates of Northern

California’s (“FHANC”) First Amended Complaint (“FAC”). Plaintiffs have filed opposition,

to which the Miller Defendants have replied. Having read and considered the papers filed

in support of and in opposition to the motion, the Court deems the matter appropriate for

decision on the parties’ respective written submissions, VACATES the hearing scheduled

for August 26, 2022, and rules as follows.

In their Seventh Claim for Relief,2 plaintiffs allege the Miller Defendants negligently

misrepresented “that they were providing an unbiased appraisal of [the Austins’ house],”

1 On May 19, 2022, defendant AMC Links LLC filed an answer to the FAC.

2 The Seventh Claim for Relief is brought only by the Austins.

Case 3:21-cv-09319-MMC Document 60 Filed 08/22/22 Page 1 of 3

and that the Austins “reasonably relied” on such representations “in attempting to secure

a mortgage loan with favorable terms.” (See FAC ¶¶ 104-106.)

To state a claim for negligent misrepresentation, a plaintiff must allege “(1) the

misrepresentation of a past or existing fact, (2) without reasonable ground for believing it

to be true, (3) with intent to induce another’s reliance on the fact misrepresented,

(4) justifiable reliance on the misrepresentation, and (5) resulting damage.” See Apollo

Cap. Fund, LLC v. Roth Cap. Partners, LLC, 158 Cal. App. 4th 226, 243 (2007). Here, as

set forth below, plaintiffs have failed to allege the requisite reliance on the Miller

Defendants’ alleged misrepresentations.

Although plaintiffs assert the Austins “reasonably relied on defendants’

representations” (see FAC ¶ 106), nothing in the FAC states, or even suggests, the

Austins believed the representations in the Miller Defendants’ appraisal report were true.

Rather, plaintiffs allege the Austins were “shocked” by the report, did not use it, and,

instead, contacted their broker to request a “second appraisal from a different appraiser”

(see FAC ¶ 68), as they needed an appraisal in order to “refinance [their] mortgage” (see

FAC ¶ 20). Contrary to plaintiffs’ contention, however, the need for an appraisal is not

“sufficient . . . to fulfill the element of reliance.” (See Opp. at 3:21-4:1); see also Kwikset

Corp. v. Superior Court, 51 Cal. 4th 310, 326 n.10 (2011) (noting “reliance” means

“reliance on a statement for its truth and accuracy,” and “not merely on the fact it was

made”); Buckland v. Threshold Enters., Ltd., 155 Cal. App. 4th 798, 808 (2007) (holding

“reliance occurs only when [a] plaintiff reposes confidence in the truth of the relevant

representation, and acts upon this confidence; finding, where plaintiff “suspected”

defendants’ misrepresentations were “false or misleading,” plaintiff “lacked the requisite

confidence” and could not “establish actual reliance”); Morizur v. Seaworld Parks & Ent.,

Inc., Case No. 15-cv-02172-JSW, 2020 WL 6044043, at *15 (N.D. Cal. Oct. 13, 2020)

(holding, where “plaintiff d[oes] not actually believe the representation at issue, there can

be no actual reliance on it”).

Likewise unavailing is plaintiffs’ allegation that, had the Austins known the Miller

Defendants would make misrepresentations in the report, the Austins “would not have

used the Miller Defendants to appraise their house.” (See FAC ¶ 68.) As the Miller

Defendants point out, it is “illogical to argue” that, in allowing the Miller Defendants to

conduct the appraisal, the Austins relied on misrepresentations made in a report

prepared after the appraisal was conducted. (See Mot. at 6:2-4.)3

CONCLUSION

Accordingly, the instant motion to dismiss is hereby GRANTED, and plaintiffs’

Seventh Claim for Relief, as asserted against the Miller Defendants, is hereby

DISMISSED without further leave to amend. "

Here is the order.

https://drive.google.com/file/d/1fGk78xwzyKkpq0qGF8csvsfxChZD0c4w/view?usp=sharing

08/18/2022 "Racial Targeting Under the Heading of Diversity, Equity & Inclusion." This article is about people losing their homes in the Great Recession. Some were appraised higher because it was a real estate bubble right before the crash. Some who were targeted were POC, poorer, less educated. Wealthier educated white people also lost their homes in the same predatory scams. The Dodd Frank Act was passed because of the predatory lending. Today people must be able to afford the payments.

Some are saying some banks, appraisers are appraising too high today because POC are being targeted in predatory lending at the peak of the market again. I have no idea if that is true. I know that scammers don't care about color or race. They will rip off anyone and everyone.

Will the Austins be able to continue to make their home payments? Their mortgage payments have gone up considerably because they have taken more and more money out of the home which they basically bought for no money down. Based on market value they could have very little equity in the home today. They should stop upgrading the home because it's probably an over improvement for the area. https://appraisersblogs.com/racial-targeting-masked-as-a-virtue-under-the-heading-diversity-equity-n-inclusion

08/16/2022 Settlement Conference schedule. This is normal court activity. It doesn't mean they're settling. I really hope Miller's insurance doesn't settle on her behalf because of legal fees. I hate seeing these shakedown lawsuits by Plaintiffs who lie especially about such racially and politically charged issues. I don't believe this is open to the public. There will be a public notice if they settle or not.

CLERKS NOTICE SETTING ZOOM HEARING. The Settlement Conference set for 9/14/2022 09:30 AM before Magistrate Judge Sallie Kim will now be held by videoconference via a Zoom meeting.

Meeting Access: Counsel and their clients may access the meeting information at https://www.cand.uscourts.gov/sk. Do NOT join the Zoom webinar for Public Hearings. Go to the section labeled: Non-Public Hearings [Settlement Conferences] to obtain the information for the non-public Zoom meeting. (Zoom Meeting ID: 161 399 7742 Passcode: 530648) Parties will be placed in a waiting room and admitted once the settlement conference begins.

080922 The Court allowed Plaintiff to file an Amended Complaint for Failure to State a Claim Upon which Relief can be Granted. Plaintiff previously lost that claim in Defendant's first Motion to Dismiss. Plaintiff filed that complaint. Defendant now answers that complaint to that claim.

REPLY (re [50] MOTION to Dismiss FIRST AMENDED COMPLAINT FOR FAILURE TO STATE A CLAIM UPON WHICH RELIEF CAN BE GRANTED (FRCP 12(B)(6)) ) DEFENDANTS JANETTE C. MILLER AND MILLER AND PEROTTI REAL ESTATE APPRAISALS, INC.S REPLY BRIEF IN SUPPORT OF MOTION TO DISMISS FIRST AMENDED COMPLAINT FOR FAILURE TO STATE A CLAIM UPON WHICH RELIEF CAN BE GRANTED (FRCP 12(B)(6)) filed byJanette C. Miller, Miller and Perotti Real Estate Appraisals, Inc.. (Catalanotti, Peter) (Filed on 8/8/2022)

https://drive.google.com/file/d/182bNy0DHI8GusGHok-JVmLdxYoqpE2xa/view?usp=sharing

My comments after reading it is summarized in the table of contents for their argument below. It's also the same argument I made it commenting on Plaintiff's Amended Complaint. Plaintiffs didn't rely on Miller's appraisal. They did the opposite.They ordered a new appraisal. They relied on the second appraisal and not Miller's. Plaintiff's main claim is they don't agree with Miller's appraisal which means they didn't rely on it.

While the Austins are telling the media and world that Miller appraised their home for $500,000 less than what they felt it was worth, they didn't lose any money. FTR Miller's appraisal was accurate. The second appraisal was wrong. The Austins still basically told the media they lost $500,000 when they didn't. In order to have a reason to file a lawsuit to help the Housing Alliance's political cause and promote the false racist appraiser narrative they sued for the difference in interest rates for a short period of time. If they had to pay for the lawsuit, I doubt they would have filed it because they have no chance of getting any true money damages. It appears the Housing Alliance just wanted to shake down the lender, AMC, appraiser who are all insured with a false discrimination claim because the political climate is ripe since the murder of George Floyd. This is how the Housing Alliance gets donations and grants. If only people didn't promote the disproved false racist appraiser narrative during the 2020 election, in Andre Perry's debunked paper, in the media and by HUD's Marcia Fudge's PAVE Task Force. Lies have consequences.

In light of the mortgage market meltdown will the AMC still exist and have any assets by the end of this case? Miller has insurance and her home has been in a trust for years. There's no money the Plaintiffs can get from the Defendants. They would have to prove Miller did this intentionally. If they prove that, insurance company is off the hook and Plaintiffs get nothing.

Legal Argument

a. Plaintiffs’ arguments regarding insurance are improper and should be stricken

b. Plaintiffs fail to allege that they reasonably relied upon the Miller Appraisal

i. Plaintiffs allege no new facts to show reliance

ii. The cases cited by Plaintiffs to support reliance do not support Plaintiffs’ position

iii. Plaintiffs’ argument that they had no choice but to rely on the Miller appraisal has no merit

iv. Plaintiffs’ argument that they relied upon Miller’s standard certifications in the appraisal has no merit

c. Plaintiffs failed to allege specific facts for each element of negligent misrepresentation

i. Bily does not support Plaintiffs’ arguments

ii. The reliance language in the Miller appraisal does not support Plaintiffs’ arguments

iii. Soderberg does not support Plaintiffs’ arguments

iv. This Court should follow Tindell and Willemsen

v. The Court should not consider the unpublished CA COA decisions cited by Plaintiffs

vi. The published cases cited by Plaintiffs are easily distinguishable and do not support Plaintiffs’ argument

d. Miller owed Plaintiffs no duty

e. Plaintiffs fail to allege specific facts to show that they suffered compensable damages

UPDATE: Plaintiffs' reply to Defendant's Motion to Dismiss Plaintiffs' First Amended Complaint. This is important because it is the about the appraiser's liability to third parties who are not the client or intended user of the report. This is the negligent representation claim. The Austins claim they relied on Miller's appraisal and were damaged as a result. This is the one claim the Judge allowed the Plaintiff to restate in an amended complaint because it was denied in the original Motion to Dismiss. They assume Miller's appraisal was faulty. It wasn't but at this point the Judge is only interested in the argument "if it were faulty." From the reply,

"In January 2020, when the Austins first sought to refinance their house, their

mortgage broker offered them an interest rate of 3.875%. (FAC ¶ 46)

• If the Austins had known that Miller’s representations in her appraisal were not true,

they would not have agreed to use her as an appraiser. (FAC ¶ 68)

(My comment. The borrower can't choose the appraiser per the 2010 Dodd Frank Act. There was no way the borrower would know the value before Miller did the appraisal. There was no way they could not allow an appraiser for no reason. They had no reason when she showed up at their home)

• The Austins relied on Miller’s appraisal, which included false representations, and as

a consequence were unable to finance at the interest rate of 3.875%. (FAC ¶ 68)

• By the time that a second appraisal was completed by a different appraiser, the

interest rate available to the Austins was 3.99%. (FAC ¶ 68)

• Miller’s biased appraisal based on false representations directly resulted in a delay in

financing and the higher interest rate. (FAC ¶¶ 77; 106)

These allegations, considered together with the original allegations in the complaint and in

the light most favorable to plaintiffs, state a valid claim for negligent misrepresentation by a real

estate appraiser. The Miller Defendants’ motion to dismiss this claim from the first amended

complaint (ECF 50, or “Motion”) should be denied."

Miller's argument,

"Miller first claims that Plaintiffs fail to allege specific facts to show that they reasonably

relied upon Miller’s Appraisal to their detriment. (Motion at 6-8.) Second, Miller argues that she

owed no duty to Plaintiffs, and therefore cannot be held liable for negligent misrepresentation.

(Motion at 8-9.) Finally, Miller asserts that Plaintiffs fail to allege specific facts to show that they

suffered the type of damage recoverable in a claim for negligent misrepresentation. (Motion at 9-

10.) Each of these claims should be rejected."

Miller's appraisal report allegedly states paragraph 23,

"The borrower, another lender at the request of the borrower, the mortgagee or its successors

and assigns, mortgage insurers, government sponsored enterprises, and other secondary

market participants may rely on this appraisal report as part of any mortgage finance

transaction that involves any one or more of these parties."

They cite Michelson v. Camp, 72 Cal.App.4th 955 (1999). I followed that case because I used to work for Michelson. Dr. Gary K Michelson lost that case. Here is the main issue in regard to the appraiser,

"[1] Preliminarily, we discuss which of appellants' claims against respondent survive the Supreme Court's decision in Bily v. Arthur Young & Co. (1992) 3 Cal. 4th 370 [11 Cal. Rptr. 2d 51, 834 P.2d 745, 48 A.L.R.5th 835]. There the court held that an accounting firm, hired by a company to perform an audit of its financial statement, was not liable to anyone except the party contracting for its services for negligence in performing the audit. (3 Cal.4th at p. 406.) The court further held that persons who are "specifically intended beneficiaries of the audit report who are known to the auditor and for whose benefit it renders the audit report" may recover on a theory of negligent misrepresentation. (Id. at pp. 407-415.) Liability could likewise be imposed for intentional fraud as long as the representations were made with the intent to defraud plaintiff or the public or any other particular class of persons to which plaintiff belongs. (Id. at p. 415.)

Appellants alleged in their complaint that although respondent was not in their employ, the 1992 recertification was prepared for their benefit in connection with the Edelman loan transaction. Thus, their misrepresentation claims survive, but there is no basis for the pure negligence claim. (Bily v. Arthur Young & Co., supra, 3 Cal. 4th 370; Soderberg v. McKinney (1996) 44 Cal. App. 4th 1760, 1765-1772 [52 Cal. Rptr. 2d 635].)"

The court went on to state,

"To rely on an old appraisal when a recent one had been prepared expressly to resolve the issue of value at the time of foreclosure is manifestly unreasonable."

In the Austin v Miller case there was also a second appraisal. The Austins didn't use Miller's appraisal in their refinance. They didn't give up on their refinance. They didn't accept whatever loan they could get based on Miler's appraisal. Instead they chose to order a new appraisal. Clearly the Austins did not rely upon the first Miller appraisal and requested a second appraisal which they relied upon. Court stated,

"prevent[s] the use of intentional self-contradiction as a means of obtaining unfair advantage in a forum provided for suitors seeking justice.'

Here is that case https://law.justia.com/cases/california/court-of-appeal/4th/72/955.html

The full Plaintiff reply is below.

https://drive.google.com/file/d/1y6ROpCs3V48O5ERO3fNZRzNzLBhfPHE_/view?usp=sharing

07/16/2022 Set/Reset Deadlines as to [50] MOTION to Dismiss FIRST AMENDED COMPLAINT FOR FAILURE TO STATE A CLAIM UPON WHICH RELIEF CAN BE GRANTED (FRCP 12(B)(6)). Responses due by 7/25/2022. Replies due by 8/8/2022. Motion Hearing set for 8/26/2022 09:00 AM in San Francisco, Courtroom 07, 19th Floor before Judge Maxine M. Chesney. (mll, COURT STAFF) (Filed on 7/14/2022)

07/07/2022 ORDER GRANTING JOINT APPLICATION AND STIPULATION TO RESET BRIEFING SCHEDULE RE MILLER DEFENDANTS' MOTION TO DISMISS FIRST AMENDED COMPLAINT. The deadline for plaintiffs to file their opposition is extended to July 18, 2022. The deadline for defendants to file their reply is extended to August 1, 2022. The hearing on defendants' motion to dismiss is continued to August 19, 2022, at 9:00 a.m. Signed by Judge Maxine M. Chesney on July 6, 2022. (mmclc2, COURT STAFF) (Filed on 7/6/2022)

07/06/2022 STIPULATION WITH PROPOSED ORDER re [50] MOTION to Dismiss FIRST AMENDED COMPLAINT FOR FAILURE TO STATE A CLAIM UPON WHICH RELIEF CAN BE GRANTED (FRCP 12(B)(6)) to reset briefing schedule filed by Paul Austin, Fair Housing Advocates of Northern California, Tenisha Tate-Austin. (Attachments: # (1) Declaration of Liza Cristol-Deman in support of joint application and stipulation to reset briefing schedule re Miller Defendants' Motion to Dismiss First amended Complaint [ECF 50])(Cristol-Deman, Liza) (Filed on 7/6/2022)

06/28/2022 MOTION to Dismiss FIRST AMENDED COMPLAINT FOR FAILURE TO STATE A CLAIM UPON WHICH RELIEF CAN BE GRANTED (FRCP 12(B)(6)) filed by Janette C. Miller, Miller and Perotti Real Estate Appraisals, Inc.. Motion Hearing set for 8/5/2022 09:00 AM in San Francisco, Courtroom 07, 19th Floor before Judge Maxine M. Chesney. Responses due by 7/11/2022. Replies due by 7/18/2022. (Catalanotti, Peter) (Filed on 6/27/2022)

https://drive.google.com/file/d/1nSoWd-XumtfFH4U3H3tOvgDZ3NYMCaM8/view?usp=sharing

06/20/2022 STIPULATION re [43] Amended Complaint, STIPULATON TO EXTEND TIME FOR DEFENDANTS JANETTE C. MILLER AND MILLER AND PEROTTI REAL ESTATE APPRAISALS, INC. TO RESPOND TO PLAINTIFFS FIRST AMENDED COMPLAINT filed by Janette C. Miller, Miller and Perotti Real Estate Appraisals, Inc.. (Catalanotti, Peter) (Filed on 6/20/2022)

05/20/2022 STIPULATION re [43] Amended Complaint, Stipulaton To Extend Time For Defendants Janette C. Miller And Miller And Perotti Real Estate Appraisals, Inc. To Respond To Plaintiffs First Amended Complaint filed by Janette C. Miller, Miller and Perotti Real Estate Appraisals, Inc.. (Catalanotti, Peter) (Filed on 5/19/2022)

DEFENDANT, AMC LINKS LLC.S ANSWER TO PLAINTIFFS FIRST AMENDED COMPLAINT; REQUEST FOR JURY TRIAL ANSWER to Amended Complaint byAMC Links LLC. (Attachments: # (1) Certificate/Proof of Service)(Graft, Alexander) (Filed on 5/19/2022)

05/17/2022 Standard court business. Minute Entry for proceedings held by Zoom before Magistrate Judge Sallie Kim: Scheduling Conference held on 5/17/2022. Settlement Conference (in person) set for 9/14/2022 at 9:30 AM. The Court will issue a settlement conference order.

05/07/2022 Amended Complaint filed. Previously Defendant stated they may file another Motion to Dismiss. We shall see.

https://drive.google.com/file/d/1ihXBMKaz_rnf9i4eYuoKNB3YaBueVYSV/view?usp=sharing

The Complaint cites the defective Freddie Mac data which was debunked by AEI.

Complaint now states the home originally appraised at $575,500 2016 and was 4 bed, 2 bath with 1,248 GLA when they purchased it. They state they added 270 GLA, a den and half bath, to lower level. They obtained a permit to add 450 sf of ADU. It doesn't state if they added the ADU or not at that time. The size is different than public records which is 2,173 sf. One of the numbers is clearly wrong. It appears to be one floor and about 27' x 49' or about 1,300 sf.

Again they state the appraiser should have used comps in Mill Valley and Sausalito. That is absolutely incorrect. Now they argue Miller allegedly deviated from USPAP and recognized methods. They added that the AMC failed to review the work of Miller. They state they never would have allowed Miller to do their appraisal. As the property owner can't choose or not choose an appraiser this is moot. They requested a new appraiser and appraisal from the AMC which they received and got their loan. They state rates rose from 3.87 to 3.99% before they ultimately received their $756,000 05/2020 refinance. They are suing for .0012% on their mortgage payment. That would be the difference in 3552 and 3604 or 52/mo for 18 months or $936 total. That's clearly not why they're suing. They are hoping to use the current political environment to shake a settlement out of the insurance company. This case is so ridiculous.

The complaint contains this chart from real estate agency Compass. The disclaimers on this chart which many have used on the internet means it doesn't carry any weight for a particular house.

Scheduling order from Judge.

Minute Entry for proceedings held before Judge Maxine M. Chesney:

Initial Case Management Conference held by Zoom webinar on 5/6/2022.

CASE REFERRED to Magistrate Judge Sallie Kim for Settlement Conference.

Amended Pleadings due by 7/15/2022. Close of Fact Discovery due by 5/1/2023. Designation of Experts due by 2/27/2023. Rebuttal Reports due by 4/7/2023. Close of Expert Discovery due by 6/13/2023.

Further Status Conference set for 6/16/2023 at 10:30 AM in San Francisco, Courtroom 07, 19th Floor before Judge Maxine M. Chesney. Joint Status Conference Statement due by 6/9/2023.

Dispositive Motion due by 7/7/2023.

Final Pretrial Conference set for 10/17/2023 at 10:00 AM in San Francisco, Courtroom 07, 19th Floor.

Jury Selection/Jury Trial (5-7 days) set for 10/30/2023 at 09:00 AM in San Francisco, Courtroom 07, 19th Floor before Judge Maxine M. Chesney.

04/30/2022 Case status and management statement joint.

https://drive.google.com/file/d/1Xog07T5twtZqCY_189W7-Kn-Xb61CxYO/view?usp=sharing

"AMC Links Defendants and the Miller Defendants anticipate filing motions for summary judgment. Plaintiffs are uncertain as to whether there will be any dispositive motions filed in the future. Depending on the content of Plaintiffs amended complaint, discussed below, AMC Links Defendants and the Miller Defendants may file motions to dismiss."

"Plaintiffs intend to file a first amended complaint on or before May 6, 2022"

DISCOVERY: "Discovery Scope and Schedule. Plaintiffs will be serving requests for production,

interrogatories, and request for admissions. The initial round of discovery will seek information and

documents relevant to the discrimination claims brought under the Fair Housing Act, §§ 1981-1982,

the California Fair Employment and Housing Act, and Unruh Act, and the defenses asserted in

response to those claims.

Plaintiffs intend to take the depositions of Janette Miller and a 30(b)(6) witness from AMC

Links, as well as possible third-party witnesses and key witnesses identified by Defendants. The target

dates for these depositions are the fall of 2022, after Plaintiffs receive responses to written discovery.

In addition, Plaintiffs will designate expert witnesses and conduct related discovery.

AMC Defendants intend to serve initial written discovery including interrogatories and

requests for production and take Plaintiffs’ depositions. AMC Links Defendants will take third

party witness depositions including the Plaintiffs’ mortgage broker, the friend who purportedly

greeted the second appraiser, and other witnesses disclosed in the Plaintiffs’ discovery responses.

AMC Links Defendants expect to designate and depose appropriate expert witnesses.

The Miller Defendants intend to serve written discovery including requests for production,

interrogatories, and request for admissions to the parties. The Miller Defendants intend to serve

subpoenas on third parties including (but not limited to) the individuals and entities involved in the

each of the prior refinances alleged by the individual plaintiffs in the Complaint along with the

appraiser who appraised the individual plaintiffs’ property subsequent to Defendant Miller. The

Miller Defendants will depose Plaintiffs and all witnesses. Finally, appropriate expert witnesses

will be designated.

The parties agree to work cooperatively to schedule depositions on mutually convenient

dates. Under current public health recommendations, and if those recommendations remain in place,

the parties also agree to conduct depositions remotely pursuant to Rule 30(b)(4)."

"Plaintiffs have agreed to provide a settlement demand in advance." of discovery.

Trial estimated October 2023.

My comment: I really hope this makes it to the summary judgment stage. Everyone needs to see the public evidence. Appraisers, AMCs, mortgage experts know this is a frivolous case but the public doesn't know that yet. The second appraisal I'm sure will include comps in Mill Valley which are worth twice as much as Marin City. I will bet that appraiser gave them most of the weight. The accurate robot AVMs already show that the second appraisal was way off and Miller's appraisal was in line with the true market value for that time.

I bet that the second appraiser has a lot less experience than Miller who has been an appraiser since at least 1992 or 30 years. Appraisers were first licensed in California in 1994 with first tests around 1992/1993. I've been licensed since 1993 but have been an appraiser for much longer since 1983. Per her website she's been appraising since the early 1980's. She was born in San Francisco and has lived in San Rafael since at least the 1980's. She's lived in same county as the subject for 40+ years. She's clearly an expert in the area. If you click menu, she has a lot of articles in there about appraisals, the appraisal process, types of appraisals... She talks about the sales comparison approach. She's an expert legal witness for legal cases. She does appraisal reviews. These skills will come in handy.

Sadly this woman is 77 years old and was probably getting ready to retire and take it easy enjoying her grandchildren and garden. This frivolous lawsuit and the stress I'm sure it's caused is probably devastating. On top of this Janette's daughter and biz partner just died in 2021 and her husband died months later. Janette has suffered even more tragedies. One of these tragedies caused her to start the Citizens Against Homicide to help families who have lost loved ones to homicide. The fact that she's being sued in a frivolous, meritless and defamatory lawsuit such as this is beyond frustrating and upsetting. Falsely calling someone a racist is disgusting besides racist. Maybe the Austins are biased against Italians. Thankfully Janette is a very sharp and tenacious fighter for what's right.

"Sales Comparison

Instead, appraisers rely on the sales comparison approach to value these types of items. Appraisers get to know the neighborhoods in which they work. They understand the value of certain features to the residents of that area. They know the traffic patterns, the school zones, the busy throughways; and they use this information to determine which attributes of a property will make a difference in the value. Then, the appraiser researches recent sales in the vicinity and finds properties which are ''comparable'' to the subject being appraised. The sales prices of these properties are used as a basis to begin the sales comparison approach."

https://www.millerandperotti.com/

It's possible the appraiser's and AMC's insurance companies may want to settle just to avoid the cost of a trial. Settling doesn't equate to winning on the evidence, law or arguments. It would be a shame if the insurance company gives in to the false media pressure from all the false and misleading articles about this case. If there is a settlement, I hope the Defendants don't have a gag order so they can state the truth of the case after settlement.

Just Googled Janette Miller and this case. The Justice Dept went so far as to post their statement in their website. Political.

https://www.justice.gov/crt/case-document/file/1472031/download

Newsweek sort of did an article. What they wrote is not accurate.

https://www.newsweek.com/black-couple-sue-appraiser-accused-lowballing-them-1657294

Current Assessment & Tax. The property taxes increased from purchase price to current market value per the assessor's office. County Tax Assessor assessed it at $892,000 which is close to the appraised value.

Assessment Year 2021 2020 2019

Assessed Value - Total $892,812 $883,660 $572,220

Assessed Value - Land $375,266 $371,420 $364,140

Assessed Value - Improved $517,546 $512,240 $208,080

04/13/2022 Miller Motion to Dismiss granted in part and denied in part.

1. With respect to plaintiffs’ First Claim for Relief (FHA), the motion is (a) GRANTED to the extent said claim is based on § 3604, and (b) DENIED to the extent said claim is based on §§ 3605 and 3617.

2. With respect to plaintiffs’ Second (FEHA), Third (§ 1981), Fourth (§ 1982), and Fifth (Unruh Act) Claims for Relief, the motion is hereby DENIED. In light of this finding, the Court does not address herein the Miller Defendant’s additional argument that they did not owe the Austins a duty of care.

3. With respect to plaintiffs’ Sixth (UCL) and Seventh (Negligent Misrepresentation) Claims for Relief, the motion is hereby GRANTED.

4. If plaintiffs wish to amend their complaint to cure the above-noted deficiencies, they shall file their First Amended Complaint no later than May 6, 2022.

https://drive.google.com/file/d/1NFMf2XuswV93bDlJxFudpclBfUBpxkGq/view?usp=sharing

This is a Motion to Dismiss per Rule 12(b)(6). The facts of the case have not been seen or proven. The Court merely looks at the statements made by Plaintiff as if they were true. As a real estate appraiser who has looked at the home and values, I believe the Appraiser appraised the subject property for fair market value at the time. I haven't seen any evidence of bias or even of a low appraisal value. We have not yet seen any of the appraisals. The Court has basically ruled that if everything Plaintiff has stated is the truth, they may have a legal basis for a lawsuit and claim.

The next step in the case is discovery. I would bet after discovery there will be a Motion for Summary Judgment filed by the Defendant. That will include the evidence which will show there was no bias. If Defendant doesn't win the Motion for Summary Judgment, the case will go to trial if there is no settlement. I assume Defendant's E&O insurance is paying for their legal fees. It will be up to the insurance if they want to settle or not. I firmly believe there is no evidence of bias based on the value. I haven't seen the appraisals. Plaintiff included words and phrases from Defendant's appraisal. Nothing I've seen would indicate bias. I would love to see the high appraisal. That appraiser should be reported and lose their license. They clearly used comps from a different neighborhood. It was either negligence or bias.

03/27/2022 I checked out Miller's reviews. They're very good except for the false reviews after the articles about this case. Those should be removed as those people were never clients. I then saw two negative reviews where the alleged clients state Miller came in lower than they liked. They were from white people. Can't claim bias now. Plaintiff's would have to prove she came in low with black people only.

As a real estate appraiser there are some clients who think their home is worth more than it is or less than it is. The people who think it's worth less are happy to see a high value never complain. The people who think it's worth more complain. Sometimes they just don't understand the process. They may see a neighbor's home sell for $100,000 more but they don't realize it's twice the size with a full view and has been totally remodeled. This is why I explain these things in layman's terms in the report. You know the owner and their brother will be reading it. Other people just think yelling, threatening and complaining will get the appraiser to increase the value so they can get a bigger, cheaper loan. A good and honest appraiser will never budge from true market value based on true sold comps. Thankfully there are now laws which state a homeowner will be denied a loan if they try to influence the appraiser and the value.

03/26/2022 Very well researched article about the PAVE Task Force report which mentions this case and Andre Perry's false and misleading paper which is mentioned in Plaintiff's complaint. Both PAVE and Perry conflate race with socio-economic status. When you adjust for SES, the race differences disappear. Home value is not a race issue but a socio-economic issue. It has to do with income. Income has to do with marital status, having children under 18 years... This article cites research which shows that race does not affect values in appraisals. https://www.aei.org/research-products/report/comments-on-the-pave-report

Marin City: Median income $29,209. (25.1%) had a female householder with no husband present. (72.8%) lived in rental housing.

Mill Valley. Median income $90,794. (7.6%) had a female householder with no husband present. (28.5%) lived in rental housing units.

03/24/2022 Hearing tomorrow March 25th is cancelled.Judge is taking it on briefs and will release her order later.

"Before the Court is defendants Miller and Perotti Real Estate Appraisals, Inc. and Janette C. Miller’s (collectively, “Miller Defendants”) "Motion to Dismiss for Failure to State a Claim Upon Which Relief Can Be Granted," filed January 10, 2022, and renoticed January 14, 2022. Plaintiffs have filed opposition, to which the Miller Defendants have replied. Having read and considered the papers filed in support of and in opposition to the motion, the Court deems the matter appropriate for determination on the parties’ respective written submissions, and hereby VACATES the hearing scheduled for March 25, 2022."

03/02/2022 Defendant's attorney is good and experienced. They blow apart every argument and statement in Plaintiff's Reply. They even stated that the Plaintiff and their attorney lied and misrepresented the law and cases cited. Defendant stated and showed that Plaintiffs' arguments make no sense at all. They are not facts and aren't based on any legal authority or case law. Plaintiff failed to show that Defendant discriminated against Plaintiff in any way based on any law. Items in quotes came from the reply linked below.

"However, Plaintiffs admit that “Miller signed that she would “select[] and use[] comparable sales that are locationally, physically, and functionally most similar to the subject property,” in Certification number 7. (Opp., 6:15- 17)(emphasis added). Miller is being sued for using comparable properties that were comparable in location to the Subject Property, as she certified she would."

The property and transaction are not under FHA because they are/were not owned by the government and did not use FHA financing. There was no sale or rental. There was no threat that Plaintiff could be deprived of housing.

"Plaintiffs’ fail to provide evidence of discriminatory intent or impact."

"However, none of the five “indicia” of discrimination that Plaintiffs allege in the Complaint state that Miller treated Plaintiffs differently than any other person because of their race. "

"While Courts are flexible in what circumstantial evidence could support a claim of discriminatory impact, a stricter evidentiary standard applies to real estate appraisers. In 1988, Congress amended the FHA to provide a specific exemption for appraisers:

Nothing in [the FHA] prohibits a person engaged in the business of furnishing appraisals of real property to take into consideration factors other than race, color, religion, national origin, sex, handicap, or familial status. (§ 3605(c))

Interpreting this amendment, the Supreme Court, provided the following example:

If a real-estate appraiser took into account a neighborhood's schools, one could not say the appraiser acted because of race. And by embedding 42 U.S.C. § 3605(c)'s exemption in the statutory text, Congress ensured that disparate-impact liability would not be allowed either. Texas Dep't of Hous. & Cmty. Affs. v. Inclusive Communities Project, Inc. (2015) 576 U.S. 519, 539.

Here, with zero support or any experience in the appraisal industry, Plaintiffs allege that

“Miller should have selected comps outside of Marin City … but failed to do so because the racial demographics of surrounding areas were different – i.e., whiter -- than Marin City’s.” (Compl., ¶60). These allegations are not supported by any facts. More importantly, this is why Congress amended the FHA. This is exactly the situation that the Supreme Court warned against: allowing disparate impact lawsuits under the FHA against appraisers who take into account the neighborhood of the property they are appraising. Per the Supreme Court, these claims should “not be allowed.”

Putting an even finer point on it, the Supreme Court found:

In a similar vein, a disparate-impact claim that relies on a statistical disparity must fail if the plaintiff cannot point to a defendant's policy or policies causing that disparity. A robust causality requirement ensures that “[r]acial imbalance ... does not, without more, establish a prima facie case of disparate impact” and thus protects defendants from being held liable for racial disparities they did not create. Id. at 542. (citations omitted)

Here, Plaintiffs five indicia are based heavily on statistics. However, Plaintiffs fail to point to a policy by Miller that caused a disparity. Per the Supreme Court, the 1988 amendment to the FHA was designed to protect appraisers from racial disparities they did not create. In other words, Miller’s use of comparable properties within Marin City.

The best guidance to infer discriminatory intent actually stems from the cases that Plaintiffs cite in the Opposition. In Hanson v. Veterans Admin. (5th Cir. 1986) 800 F.2d 1381 for example, parties to a real estate transaction filed a suit against the VA alleging racial discrimination in its appraisal practice. The appraiser in Hanson used the “market approach” method to determine the reasonable value of the property being purchased – selection of three comparable properties with similarities to the property being sold as a starting point then adjustment of the sales price depending on the differences of the comps and the appraised property. Hanson, at 1383. The Hanson Court held that the use of such a method and practice is insufficient to establish discriminatory intent. Id., at 1383. Plaintiffs also introduced statistical evidence in an attempt to show that the low appraisal in racially mixed neighborhoods resulted in a negative impact on the property value in that community. Plaintiffs’ expert found that approximately 80% of the appraised homes in Plaintiffs’ community were undervalued when they should have appreciated in value because the community was “no longer experiencing the effects of racial transition.” The VA’s expert testified that Plaintiffs’ expert failed to considered “non-racial variables” such as crime rates and quality, thereby, resulting in skewed data. Id., at 1389. The Court ultimately found Plaintiff’s data to be insufficient to establish discriminatory effect or impact on the community. Id., at 1389.

Moreover, in Latimore v. Citibank Federal Sav. Bank, 151 F.3d 712, 715-16 (7th Cir. 1998), the Court concluded that “the fact that [the defendant's] appraisal was lower than someone else's does not create an inference of discrimination.” Rather, it merely showed that the appraiser “uses conservative appraisal methods.” Id. Justice Posner dissenting in Swanson v. Citibank, N.A., 614 F.3d 400, 408 (7th Cir. 2010), argued that a more likely explanation for defendant’s low appraisal of the plaintiff’s home was a mistake rather than racial discrimination.

Plaintiffs claim that the Complaint “includes an abundance of direct and circumstantial evidence of discrimination besides the value differences.” (Opp., 16:6-7). “Direct evidence”typically consists of clearly sexist, racist, or similarly discriminatory statements or actions without need for inference or presumption. Antonio v. Sec. Servs. of Am., LLC, 701 F. Supp. 2d 749, 782(D. Md. 2010) (referencing a person’s race or the use of common racial epithets is considered direct evidence). Here, the Complaint fails to allege any instance where Miller made explicit remarks regarding the Plaintiffs’ race during the Property inspection or within the appraisal report itself. Thus, Plaintiffs allege no direct evidence.

Plaintiffs argue that Miller’s statement in her appraisal that Marin City has a “distinct marketability,” “is considered unacceptable within the industry because it may demonstrate intent to discriminate.” (Opp. 14:1-5). Plaintiffs cite to Fannie Mae Guidelines and provide a link at fn. 4. This could have been a strong argument but for the fact that the Fannie Mae Guidelines do not list “distinct marketability” as an unacceptable appraisal practice. Neither does the Flores case cited by Plaintiffs. Since the Guidelines and the case cited by Plaintiffs do not state that the use of “distinct marketability” is unacceptable, we will have to wonder how Plaintiffs’ counsel came to this conclusion.

vi. Plaintiffs fail to state a claim under §§ 3604 (c) and 3617.

Plaintiffs argue that Miller “interfered with” with Plaintiffs exercise of fair housing rights in violation of § 3617 by considering Plaintiffs’ race and the racial demographic of Marin City in determining the value of the Property. As discussed above, Plaintiffs fail to state sufficient facts to show that Miller considered race. Moreover, Plaintiffs fail to establish how Miller’s single appraisal was fairly traceable to the reduction in value of their Property and the properties in Marin City, on the whole. Therefore, Plaintiffs fail to state a claim under § 3617.

h. Plaintiffs’ Seventh Claim for Negligent Misrepresentation fails to state a claim upon which relief can be granted.

Plaintiffs argue, with literally zero support, that “all of the cases cited by defendants are based on an outdated version of the Uniform Residential Appraisal Report (URAR). (Opp., 24:1- 2). Plaintiffs then go on to completely fabricate that the URAR was revised to include language that the borrower may rely on the appraisal. As the undersigned was the attorney in the Tindell case, from start to finish, Miller can represent that Plaintiffs’ argument is completely false and that the same reliance language existed in the Tindell appraisal.

Plaintiffs cite to Soderberg v. McKinney (1996) 44 Cal.App.4th 1760, 1772, for support. However, the Court in Willemsen v. Mitrosilis (2014) 230 Cal. App. 4th 622, 631–32 distinguished Soderberg:

In Soderberg, the appraiser issued an appraisal to a mortgage broker with the knowledge and intent that the mortgage broker would distribute it to a class of potential investors who would rely thereon in making their decision to invest or not invest. In the matter before us, however, there is no indication that the ... Defendants issued their appraisal report with the knowledge or intent that Willemsen would rely upon it in deciding whether to buy or not to buy the property .... Rather, they knew and intended that the bank would use the appraisal report in determining whether the property had sufficient value to serve as its collateral.

The Court in Tindell affirmed the dismissal of a negligent misrepresentation claim similar to the one alleged in the Complaint. As Miller argued in her Motion, the appraisal is prepared for the lender, not the borrower. Plaintiffs did not rely on the appraisal in making any decisions. For these reasons, the Court should grant Miller’s Motion as to this cause of action."

Plaintiffs did not show any evidence that Plaintiffs were harmed in any way. Plaintiffs did not show any evidence of discrimination by Defendant.

Defendant's Reply to Plaintiff's Reply to Defendant's Motion to Dismiss for Failure to State a Claim.

https://drive.google.com/file/d/1GGy2jmqJmNGFIUC7KuNIoFMxB8bBEeMw/view?usp=sharing

Plaintiff's Notice of Letter.

https://drive.google.com/file/d/1GF-NSJ0F1LmQ_FMiWckpqDKvgIEu6gWW/view?usp=sharing

Letter.

https://drive.google.com/file/d/1JYLs8di7Q99NGvqKp6AUH4ZhLNf_WE3E/view?usp=sharing

02/18/2022 29 CLERK'S NOTICE CONVERTING MOTION HEARING SCHEDULED ON MARCH 25, 2022 AT 9:00 AM TO A ZOOM WEBINAR.

As to 19 MOTION to Dismiss For Failure To State A Claim Upon Which Relief Can Be Granted (FRCP 12(B)(6)).,. Motion Hearing set for 3/25/2022 at 09:00 AM in San Francisco, - Videoconference Only before Judge Maxine M. Chesney. This proceeding will be held via a Zoom webinar.

Webinar Access: All counsel, members of the public, and media may access the webinar information at https://www.cand.uscourts.gov/mmc

General Order 58. Persons granted access to court proceedings held by telephone or videoconference are reminded that photograph ing, recording, and rebroadcasting of court proceedings, including screenshots or other visual copying of a hearing, is absolutely prohibited.

Zoom Guidance and Setup: https:/ /www.cand.uscourts.gov/zoom/.

Motion Hearing set for 3/25/2022 at 09:00 AM in San Francisco, - Videoconference Only before Judge Maxine M. Chesney. (This is a text-only entry generated by the court. There is no document associated with this entry.),(tl, COURT STAFF) (Filed on 2/18/2022) (Entered: 02/18/2022)

02/21/2022 30 STATEMENT OF RECENT DECISION pursuant to Civil Local Rule 7-3.d filed byPaul Austin, Fair Housing Advocates of Northern California, Tenisha Tate-Austin. (Attachments: # 1 Exhibit 1 - Inter-agency letter)(Related document(s) 27 ) (Cristol-Deman, Liza) (Filed on 2/21/2022) (Entered: 02/21/2022)

02/21/2022 31 REPLY (re 19 MOTION to Dismiss For Failure To State A Claim Upon Which Relief Can Be Granted (FRCP 12(B)(6)) ) Defendants Janette C. Miller And Miller And Perotti Real Estate Appraisals, Inc. Reply In Support Of Its Motion To Dismiss For Failure To State A Claim Upon Which Relief Can Be Granted (Frcp 12(B)(6)) filed byJanette C. Miller, Miller and Perotti Real Estate Appraisals, Inc.. (Catalanotti, Peter) (Filed on 2/21/2022) (Entered: 02/21/2022)

UPDATE: 02/23/2022 Isaac Peck of WorkingRE OREP just wrote a very good article on this case. OREP (Organization of Real Estate Professionals) is the main liability insurance company, agent for appraisers' E&O Insurance. WorkingRE is the main magazine. It goes into detail but the summary is "Allegation #1: Prioritizing Comps from the Same Neighborhood = Racial Bias. Allegation #2: Sales Comparison Approach is Racist."

Obviously the allegations by Plaintiffs make absolutely no logical sense. Matched paired analysis is the main method everyone in the world has always used to valuate for everything from gold to wheat to land. People in government, real estate experts have already recently stated that there is no way the government, lenders, banks or investors would ever not use the sales comparison approach to value. It's the most reliable estimate of value. It's based on sellers and buyers.

https://www.workingre.com/first-discrimination-lawsuit-what-it-means-for-appraisers/

A brief portion of the article. See link for full article.

"The valuation industry has been abuzz with talk of appraisal discrimination ever since one of the first discrimination lawsuits was filed against an appraiser in December 2021. Plaintiffs Tenisha Tate-Austin and Paul Austin, as well as the Fair Housing Advocates of Northern California filed a lawsuit against Jannette Miller, a white appraiser, and AMC Links LLC, an appraisal management company. (See First Discrimination Lawsuit: What It Means for Appraisers for details.)

Then, on January 10, 2022, Janette Miller and her attorneys filed a 29 page, full-throated assault on the many allegations made by the Austins, ultimately asking for a hearing on March 4, 2022 asking the court to dismiss the Austin's entire case because they have "failed to state a claim upon which relief can be granted." (The hearing has now been extended to March 25th).

No Proof of Racism

In response to the many accusations that Miller engaged in racial discrimination, the Miller brief argues that the Austin's have no proof of that claim.

For example, the Austin's lawsuit asserts that Miller's opinion is "fundamentally flawed" because of the small number of sales per year in Marin City (the subject's neighborhood), and further argues that Miller's methodology results in a huge margin of error, is inherently flawed, and is statistically unsound.

Miller's response: "Plaintiffs simply conclude that the small number of years and use of a sample size equates to racial discrimination. The allegations fail to show an intent to discriminate."

Furthermore, the Austins point out that Miller describes Marin City as having "distinct marketability which differs from the surrounding areas." The Austins go on to argue this is actually "coded" language based on race because of the "racial demographics and history of Marin City."

Miller's response is essentially that the Austin's can't prove that the words "distinct marketability" are evidence of racial discrimination. "It is self evident that every geographical area would have some sort of distinct marketability. If the Plaintiffs' argument is accepted, any appraiser who used the term 'distinct marketability' to describe a home in Marin City would be liable for racial discrimination," reads the brief.

The Austins, in their suit, repeatedly take issue with Miller's appraisal methodology, from her use of "dated market trends" to the comparable sales that she selected for analysis.

However, Miller's defense continues with the same theme, pointing out that the use of dated marketing trend information does not mean that Miller discriminated against the Austins. Additionally, in answering the accusation that Miller's choice of comparables is somehow discriminatory, the brief argues: "There is nothing inherently racist about choosing comparable properties that are located in the same city as the Subject Property. Without any direct (or indirect) evidence of actual racial discrimination Miller's choice of comparable properties cannot support Plaintiff's claim of discrimination."

In each instance where the Austins alleged Miller discriminated against the Austins, the response from Miller's legal team is essentially that they have failed to provide any proof of that accusation. "None of the 'indicia' alleged by Plaintiffs shows that Miller was motivated to discriminate against the Austins on the basis of race. Each of the 'indicia' alleged by Plaintiffs could equally be explained by non-discriminatory factors. Plaintiffs do not allege that Miller treated any other borrowers differently than the Austins. Even if they did, that would not not necessarily indicate a discriminatory motive," reads the brief.

In other words, even if the plaintiffs can win that Miller appraised the Austins' house negligently, erroneously, or incompetently, there is no evidence that Miller discriminated against the Austins."

An issue brought up in the above article. Plaintiff's alleged 35% of residents in Marin are black. The rest are not. That means allegedly, theoretically the appraiser was also "racist," "biased" against the non-black people who own property there. Legally a racism, bias lawsuit must prove that the appraiser was only racist, biased against the Plaintiff. They must show they treated other people differently than Plaintiff. That argument fails as the suit states all property owners in Marin were affected, damaged. That would mean black, white and other people besides Plaintiff. This was clearly a political lawsuit filed to raise issues to support reparations, Andre Perry's false and misleading paper and issues raised in the 2020 election after the death of George Floyd.

02/16/2022 Plaintiffs filed a Reply to Defendant's Motion to Dismiss. The DOJ filed a Statement of Interest in the case. Below is the DOJ Statement of Interest to intervene in the case. It'd be great if an appraisal organization would also file a Statement and intervene in this case. If I had the time and money, I would do it.

https://drive.google.com/file/d/1ANKqe4WDUhGM1YyHhQ1sFlRGwGTJYwEC/view?usp=sharing

Below is a one paragraph summary of the DOJ's position.