January 12, 2023 the Appraisal Institute AI posted a video titled "FHFA Uniform Appraisal Dataset Aggregate Statistics and How it Impacts You." Below is their text about the video. Below that are notes which I took and my personal comments about these issues.

"The Federal Housing Finance Agency (FHFA) recently published its new Uniform Appraisal Dataset (UAD) Aggregate Statistics Data File, consisting of 47.3 million UAD appraisal records collected from 2013 through the second quarter of 2022 on single-family properties.

FHFA also launched UAD Aggregate Statistics Dashboards on its website to provide user-friendly visualizations of the newly available data. The UAD Aggregate Statistics Data File and UAD Aggregate Statistics Dashboards give stakeholders and the public new access to a broad set of data points and trends found in appraisal reports.

In this webinar recording, hear from the FHFA Representative who worked on the UAD release, as well as appraiser practitioners about their initial observations and potential use cases of the UAD information for appraisers."

Link to video.

https://www.youtube.com/watch?v=kKGzW1652EI

1. First speaker was Dr. Rashida Johnson-Dorsey of FHFA. She spoke until the 22 minute mark about the FHFA data set statistics. She stated the new data set is from many anonymized real estate appraisals. She believes its most important use is to allegedly discern appraisal bias in valuations of white versus black home buyers. She feels the most important statistic is how many appraisals came in lower or higher than the contract price. She believes this shows bias against minorities specifically blacks.

My comment. Appraisers should not try to meet the contract price. We are mandated to appraise for market value based on most similar, recent sold comparables. If someone wants to offer $10 billion for a $50K shack, fine, but it won't appraise for $10 billion. Contract price does not equal value. The most important thing is market value and not contract price.

https://www.fhfa.gov/DataTools/Pages/UAD-Dashboards.aspx

2. Second speaker was Jillian White. She worked for Better Mortgage as an appraiser then was promoted right before they basically went under. She quit right before the end. Better was known for stating all other appraisers, companies are racist except them. It was part of their marketing. They said they were going to hire diverse appraisers but instead just went out of business. White mainly spoke about racism by white appraisers against blacks at various meetings and to the media while she was at Better. Generally Jillian White talks about racism and appraiser bias against black people. She generally brings up the stories about how she told black relatives to white wash their homes before sale or appraisals. All agents tell everyone to remove all personal photos, items... for many other reasons. She has repeatedly talked about how most appraisers are white old racist men who hate black people and appraise their homes for less than market value. She even said the appraiser trainee program is racist. I based this upon her recorded public statements in the media and public meetings which I've quoted. She supports Andre Perry's false statistics and paper. She was involved in "Our America: LowBalled" promoting the false narrative of the racist appraiser. I've copy/pasted her quotes, comments here in previous articles. While racism definitely exists not everything is racism. Research by AEI showed there was no effect of race of borrower on appraised values.

She actually talked about the "practical application of aggregate UAD statistical data" and

how lenders, AMCs and appraisers can use the data to find alleged racism and bias in appraisals and appraisers. She emphasized that the most important data is whether appraisers come in below or above contract price. Mind you the data set is HUGE and covers every factor involved in appraising. Contract price is one of many, many, many factors but it's the only one they care about. She stated there will be more "scrutiny" if appraisers come in below contract price. There will "be more noise if the value is below the contract price." Noise means complaints. You come in high, you're good to go.

White stated the PAVE report Action 2.3 stated regulators will look at lenders to identify appraisal bias. They will track whether you come in over or under contract price. They will check areas that are 80-100 % minority in census tracts. The lender must explain why they "came in low." "Came in low" per contract price and not market value. She stated over 23% of appraisals were under the contract price in minority areas. We don't have to explain if he come in high. (Wink, wink, hint, hint, come in high.)

My comment: This came up previously. There is another correlation between over/under contract price appraisals. It's not the race of the buyers or appraisers. It has to do with lower income people buying in lower priced areas.

White stated the AMCs will also be questioned. They will have to ask appraisers "why" they came in under the contract price in those areas. Appraisers will then be "forced to explain" why they came in lower than contract price more often than their peers.White stated AMCs will have to ask their appraisers "why are you out of whack in this territory?" i.e. why did you come in below the contract price in this minority area?

My comment: So much for the Dodd Frank Act when you have the government trying to force, push the appraiser to meet the contract price only in minority areas. So much for independent appraisers and appraisals. Appraisers are now being pushed to come in higher than market value in only minority areas. The purpose of the Dodd Frank Act was to stop lenders from trying to force appraisers to meet the contract price! They said it was a cause of the Great Recession. Now the government wants to violate the act and repeat the huge mistake! They're encouraging appraisers to commit bank fraud and commit federal crimes.

White stated that the statistics look at adverse site condition adjustments. She stated that's where appraisers make adjustments that make the value come in lower. She stated maybe in the past there would be a market reaction to a negative site but not today. Is it on a busy street? People don't care today. She feels some appraisers used this adjustment to devalue some properties of some people specifically minorities.

My comment: In the crazy 2021, 2022 market frenzy there could be dead rotting bodies in the homes and buyers would not have cared. They'd just push the dead corpses to the street and carry on. They were willing to buy shit homes in shit condition in shit locations just to own a home. They waived appraisals, inspections, repairs, paid way over list price...and now they regret it. Soon the banks will too.

I saw this. I still mentioned all the negatives I saw and included a market reaction if there was one. You know what? A bank is going to care about those factors if the loan goes south when the market goes down. The market has already made that change. When the market goes down buyers will not want to own a house wedged between a strip club, a recycling center and the 110/10 interchange. They either won't buy that home or they'll pay much less for it. Appraisers appraise at market value to protect the bank and government. Our purpose is not to help a buyer over pay for a property they may not be able to afford and will probably lose to foreclosure in a downturn. This is how people lost their homes after the Great Recession. And guess who was blamed? "Racist appraisers!"

White spoke from 22-45 minutes in the video.

3. Doug Potts, MAI Appraiser.

This guy promotes the false, misleading and totally debunked Andre Perry Brookings Institute "paper." I had a problem with this speaker and what he said. I watched the video after I heard about the crazy things he said from other appraisers. Here we go!

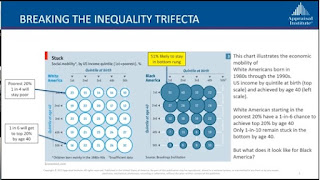

Doug Potts is involved in a grant project that looks at wealth creation and equality. He said blacks have been denied access to wealth in Detroit, Cleveland, Baltimore. If you are born black and poor, you are more likely to stay poor than if you are white. He mentioned redlining.

My comment: This again goes back to the income gap and socioeconomic issues. The real correlation is race is related to income which correlates with wealth, generational wealth and the value of a home you can afford to buy and own. Race is not the cause of the value of a home appraised by an appraiser. Here is an article I wrote about AEI's research about the correlation between race and socioeconomic issues including the income gap. https://mary--cummins.blogspot.com/2022/03/aei-reply-to-pave-report-andre-perrys.html

He mentioned redlining. I wrote an article about redlining here https://mary--cummins.blogspot.com/2021/05/redlining-in-home-loan-financing-mary.html We still use all the same factors to calculate loan risk EXCEPT race, nation of origin. The correlation is not race = home value. It's race = income = value of home one can afford to buy and own. Race, nation of origin never mattered in the redlining maps. If you removed them, the risk didn't change. They should have never been included and weren't included in all stats, maps or records.

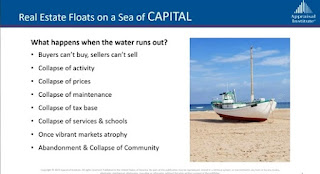

Doug Potts said if there is no capital for homes, home loans, areas will collapse.

My comment: It's called capitalism and real estate cycles. People don't want to live in one area so they move to a nicer more expensive one. The old area decreases in value as a result while the new one increases in value. Banks wants to loan money where they can make a profit and limit risk and loss.

Doug said the denial of capital caused whites to leave. No, it didn't! Some people moved to a different area which they found more desirable. THEN values decreased and banks loaned less money to the area based on the lower values of the homes. It's called real estate cycles which has happened forever all over the world. Why is Beverly Hills land worth more than land in Watts? It wasn't "denial of capital." Denial of capital is a result of the change in real estate cycle and property values. Here's an article I wrote on real estate cycles. https://mary--cummins.blogspot.com/2017/04/real-estate-cycles-mary-cummins-real.html

Doug thinks appraisers value homes lower in high minority areas because of the race of buyers. If he really believes this, he should surrender his appraiser license because he's not fit. I appraise in high minority areas with lower values in South Los Angeles. Most of the new buyers are uneducated, inexperienced first time buyers. They want their first home so bad they will offer over market value without knowing it. They will make offers on the worst homes in the area with small lots, poor condition, only one bathroom, recently renovated after major fire, home recently destroyed by tenants, located between freeway and industrial site... because it's all they can afford.

If the median home in the area is 1,000 sf with C3 condition on a 5,000 sf lot built 1920 and goes for $350,000, they offer $325,000 for a smaller home in worse condition on a smaller lot in an inferior location in the neighborhood. Looks like a good deal to them but it's probably worth much less. You're generally looking at minimum home purchase prices. Sometimes they want to buy a home because they were offered government loans with no money down. They have no skin in the game and think they're getting a free house which will double in value in a year. I've had people call me up asking me to find them a VA home, home they can buy with government funds. They tell me they have no job, income or money and believe they can buy the home. Some desperate scammy agents will sell these people homes they can't afford.

Homes in higher minority areas generally have issues. The lower the home value the more issues they have. The correlation again is race and income. Government needs to fix the income gap between white and black, brown. They also need to fix the gender income gap. Lower valued homes are generally located in inferior locations with close proximity to freeways, dump sites, oil fields, industrial property, run down areas... I drive these areas and see it. If the property has a lot of issues, is in fair condition, needs work, it won't meet requirements for a regular loan. It will end up under contract price. A flipper, developer, speculator would need to buy it for cash or with subprime mortgage, fix it up then sell it for a higher price on the regular market with a regular loan.

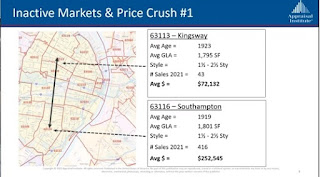

Doug thinks the lower value appraisals are "prices crushes." He thinks it's just unfair racism. He thinks if there is a 1,000 sf home in South LA on a 5,000 sf lot built in 1920, it should appraise for the same price as a 1,000 sf home in Beverly Hills on a 5,000 sf lot built in 1920. Doug should lose his license. The main value of a home is the LAND and not the STRUCTURE. You are paying for the dirt. LOCATION, LOCATION, LOCATION.

This reminds me of 20 Pacheco, Marin, CA. The owners of that home wanted appraisers to ONLY use comps in Mill Valley 1-2 miles away. Mill Valley homes are worth twice as much as Marin. If you actually look at the two cities, they are very very different and not comparable. There's a reason why Mill Valley is worth twice as much as Marin. Doug thinks appraisers should widen their comp search to intentionally include other HIGHER priced comps. He said higher only and not lower. He thinks it's especially important in lower valued areas which generally have fewer sales for this reason.This was the same issue in Marin. Zillow stupidly widened their AVM search and used Mill Valley comps. More trustworthy Corelogic AVM only used Marin comps and came in at market value.

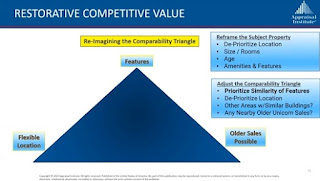

Doug Potts says his St Louis project "deprioritizes location." It can be used to "restore value." Doug says we can use the new data to cherry pick higher comps outside GSE selling defined rules. He said we can change the algorithm to change the numeric outcome. We can make 1+1=3 when it should be 1+1=2. He admits that it goes beyond assignment conditions. Hey, why not just add $1,000,000 to the appraisal of black owned homes. They can get huge loans, pay huge property taxes, huge monthly mortgage payment then lose their home in foreclosure because no one will buy it for $1,000,000.Doug spoke to 1:06 in the video.

Clearly Doug is out of his mind. What he is suggesting is called bank fraud. Bank fraud is punishable by at least 20 years in prison besides loss of license. No thanks. No one should do what he suggests. If his St Louis Project wants to give money, loans, houses to poor people, he can do that privately. Just don't expect the government, banks, public to pay to subsidize his personal project. No appraiser should lie about value to help a low income person over pay for a house. They end up with a bigger loan they can't afford to pay. No one would pay the higher appraisal value for the home. It's in the same less valuable location. An appraised value doesn't change the real market value. They'll be foreclosed upon and lose everything. You would be doing a disservice to these people. This happened right before the Great Recession. It also happened with student loans. They tell them they can make more money with a degree. Instead they only end up with tons of expensive debt and no new job or increase in pay. That is just plain cruel! They are hurting the people they claim they want to help. Fix the income gap and they can afford more expensive homes on their own.

In the past I've worked for nonprofits that help poor people buy homes. They never asked me to pump the value. They ask for market value. Sometimes they give 110% loans. They can do that as it's private money. Based on my experience giving people homes with no down payment is not the best way to help them. Help them make more money and buy their own home with a safe down payment and low mortgage payment.

It's a shame or a sham that the Appraisal Institute has jumped on the false narrative of the racist appraiser. They're doing it to protect themselves. They are mainly older, white, more affluent male appraisers. It costs $15,000 in fees, classes to become an MAI appraiser. What better way to deflect negative attention than to offer a webinar with mainly black speakers pointing the finger at others. If they really cared about diversity, they would make all their classes, educational material and literature free. Then all who take the classes could become MAI appraisers for free. They're a nonprofit but they won't do that because it's basically an old white affluent male elitist club that protects itself. They let a few women, minorities in, on the board for their image. They don't really care about promoting the industry or appraisers but themselves. They are actively attacking the industry and other appraisers with their positions in order to protect themselves.

Below are some comments on the YouTube video, see link above.

Carolyn Nuccio - 7PTC

"It's disgraceful that the Institute would be promoting using data that would result in misleading assignment results to resolve this finance issue, which at it's core is about "wealth creation"; and using appraisers to create that wealth. The FHFA should be focused on understanding market dynamics, and creating Federal Loan Guarantee programs that will lend above appraised value rather than trying to pressure appraisers into using data that will result in artificially inflated values. There's not enough data available about these statistics presented as to why the contract prices aren't appraising out. Jumping to the conclusion that appraisers are racially biased just because contract prices aren't being met is a huge jump. Perhaps the contracts need to be analyzed. Who are the sellers? Are they largely flipped properties owned by investors? Were the properties listed prior to contract? What's the List to Sale Price ratio in the market? This market derived data is all available on the URAR and should be included in the analysis. Perhaps some of the presenters could enhance their knowledge of how predatory lending works in disadvantaged neighborhoods. I would point to the Atlanta market back in 2004 - 2008 as an excellent example of how borrowers and homeowners were tricked into applying for, and qualifying for, over-valued homes and loans. Many of the appraisals did just as suggested in this presentation. The appraisers went outside of the competitive market for their comp selections in developing an opinion of value. As a result, when the borrower needed to sell their home, they were unable to sell it. Why? Because the original appraisal inflated the value and they couldn't find buyers to buy their home. The suggestions in this presentation are a sure fire way to create artificially inflated values; and a pretty good way for those involved in the transactions to be looking at jail time for mortgage fraud."

Pablo

"we have been taught location, location, location because that the the main and predominant factor when a buyer purchases the home. If there are two identical homes and one resides in an area that has more crime, lower rated school, you name it, they don't give a damn that it is the same house as they want. They won't consider it. There always needs to be lower income properties. What would happen to some of the economically struggling families that no longer can afford housing because of this ridiculous` method? This method would be discriminating against low income people because you are forcing the market up based on poor comp selection and MARKET MANIPULATION. If you did this with stocks, you would have the SEC knocking on your door."

Christopher Posey is a successful and experienced real estate appraiser in Chicago, Illinois. He watched the video and sent good questions to the moderator. His question was about appraiser liability related to this new value. Their reply is below along with his question. It's a closed real estate appraiser group so I can't share it publicly.

https://www.facebook.com/groups/appraiserforum/permalink/5779904935459009

Someone made a good comment stating these inflated appraisals would hurt poor people. If you artificially inflate the values then poor people can't afford to buy the homes. You aren't helping but hurting.

Below are some slides from the presentation.

DR RASHIDA JOHNSON-FORSEY

Mary Cummins of Cummins Real Estate is a certified residential licensed appraiser in Los Angeles, California. Mary Cummins is licensed by the California Bureau of Real Estate appraisers and has over 35 years of experience.

- Mary Cummins LinkedIn

- Mary Cummins Meet up

- Cummins Real Estate on Facebook

- Mary Cummins Real Estate blog

- Cummins Real Estate on Google maps

- Mary Cummins of Animal Advocates

- Mary Cummins biography resume short

- Mary Cummins Real Estate Services

- Animal Advocates fan page at Facebook.com

- Mary Cummins

- Mary Cummins Animal Advocates on Flickr photos

- Mary Cummins Animal Advocates on Twitter.com

- Mary Cummins on MySpace.com

- Mary Cummins on YouTube.com videos

- Mary Cummins of Animal Advocates on Classmates

- Mary Cummins on VK

No comments:

Post a Comment