|

| federal valuation agency,fair act of 2022,real estate appraiser,real estate,bill,financial services,maxine waters,firrea,HUD,mary cummins,US house committee,appraisal,discrimination, |

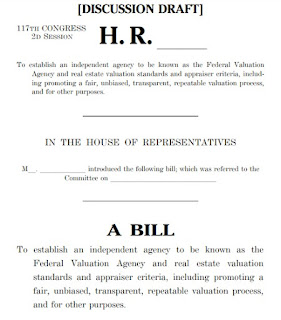

Maxine Waters is proposing a new Bill to establish a new Federal agency to oversee appraisers and the appraisal industry. Maxine Waters wants to amend the The Financial Institutions Reform, Recovery, and Enforcement Act of 1989 to basically get rid of ASB, AQB, ASC and TAF as we know them replacing them with the new "Federal Valuation Agency." The basic summary is as follows:

"To establish an independent agency to be known as the Federal Valuation Agency and real estate valuation standards and appraiser criteria, including promoting a fair, unbiased, transparent, repeatable valuation process, and for other purposes."

"This Act may be cited as the ‘‘Fair Appraisal and Inequity Reform Act of 2022’’ or the ‘‘FAIR Act of 2022’’.

"The Financial Institutions Reform, Recovery, and Enforcement Act of 1989 is amended—(1) in section 1110(1) (12 U.S.C. 3339(1)), by striking ‘‘Appraisal Standards Board of the Appraisal Foundation’’ and inserting ‘‘Federal Valuation Agency, by rule’’; and (2) in section 1116 (12 U.S.C. 3345)—(A) in subsection (b), by striking ‘‘ or endorsed by the Appraiser Qualification Board of the Appraisal Foundation’’ and inserting ‘‘, by rule, by the Federal Valuation Agency’’;

Memorandum about meeting "Devalued, Denied, and Disrespected: How Home Appraisal Bias and Discrimination Are Hurting Homeowners and Communities of Color" US House Committee on Financial Services.

https://docs.house.gov/meetings/BA/BA00/20220329/114561/HHRG-117-BA00-20220329-SD002-U2.pdf

My comments on the falsities in this document in order. This was clearly written by someone with a personal agenda who intentionally did not use independent research or any legitimate research for that matter.

First some real facts. Whites make and have more money than blacks, Latinos. For this reason whites buy and own more expensive homes than blacks, Latinos. People buy what they can afford. For this reason homes owned by whites are worth more than homes owned by blacks, Latinos. This is the actual cause of the wealth gap. It has nothing to do with appraisers and appraisals. If the government wants to close the wealth gap between whites, blacks and Latinos, they need to close the income gap.

These two statements in the report are true. Currently, the "White homeownership rate is 74.1%, compared to 44.2% for Black families and 48.4% for Latinx families." "White families held 10 times more wealth than Black families and 7 times more than Latinx families in 2016." Waters intentionally doesn't include the cause of these gaps which is the difference in income. White families make almost double at $76,000 and black families only $45,000. When you are only making $45,000 a year there is no disposable income to save to buy a house. You are living hand to mouth. "The disparity is another reason why it's more difficult for Black families to save and build wealth than it is for White households." https://www.cnn.com/2021/06/01/politics/black-white-racial-wealth-gap/index.html If you can't save money to buy a house, you won't own one. You won't benefit from home appreciation if you don't own a house. If a poorer person does buy a house, it'll be a less expensive home appreciating at the lower rate and amount.

Appraisers do not appraise homes of certain types of people less than other people's homes. Appraising is a math formula. That's how the Automated Valuation Methods (AVMs) function. Appraisers use the same exact formula except we have better data because we actually inspect the subject property, neighborhood and see the sold comparables. AVMs don't see any of the properties. They don't even know if they exist.

Appraisers don't know the color, race, ethnicity ... of the neighborhood, owners/buyers of sold comparables and most of the time even the owner or buyer of the subject property. We don't have color, race, ethnicity ... info in our databases. We wouldn't use it if we did as it doesn't matter when it comes to home value. Buyers, sellers set market value. Appraisers just report it.

1. Background

A. Waters mischaracterized a paper written by Andre Perry, i.e. "The Devaluation of Assets in Black Neighborhoods: The Case of Residential Property." This paper is not published or peer reviewed "research." It is a personal paper written by Perry to promote his book by the same title. Perry intentionally chose two very different groups to compare. He compared small extremely different samples of areas with 0-1% black people and over 50% black people. Perry then used Zillow zestimate AVM values. We all know how inaccurate Zillow is based on their recent failures. No appraisers or appraisals were involved in the data. Perry committed major statistical areas in his analysis. He never controlled for location. Everyone knows the three main factors in real estate valuation are LOCATION, LOCATION, LOCATION. Many other grave statistical errors were committed. Perry has never posted his data because he doesn't want anyone to review it. The only thing the paper may show is the fact that whites make and have more money than blacks. This goes back to income equality. "Perry conflates race with socio-economic status. When adjusted for SES, the gaps disappear. (Ref. https://www.aei.org/research-products/report/comments-on-the-pave-report )(Ref. This articles shows other major errors in the paper. "

B. Waters misread a Freddie Mac study i.e. Freddie Mac, Racial and Ethnic Valuation Gaps in Home Purchase Appraisals. Freddie Mac actually stated "First, our analysis has not yet determined the full root cause of the gap." Danny Wiley of Freddie Mac stated "We have not reached any conclusion for cause of the gaps or correlation." The gap could have many causes such as revitalizing areas and condition. AVMs assume average condition, average everything. Perhaps the homes appraised by appraisers over AVM values were in better condition than average, better than average location, better than average view, upgrades... AVMs do not see the property. They don't know the condition or if it even exists.

AEI replied to Freddie Mac's study.

2. Appraisers: Industry Diversity and Alternative Methodologies

Waters again selectively chooses information. While it's true that most appraisers are white the same is true for the US population as a whole and even real estate agents. The spotlight today is only real estate appraisers because of a very misleading paper promoted by Joe Biden, Marcia Fudge and now Maxine Waters.

3. Appraisals: Evidence of Racial Home Devaluation

A. Waters again mischaracterizes Perry's paper. This is a false interpretation of the skewed data. "A 2018 study by the Brookings Institute (Andre Perry) found that in the average metropolitan area, homes in neighborhoods where the share of the population is 50% Black are valued at roughly half the price as homes in neighborhoods with no Black residents. Further, the study found that differences in home and neighborhood quality do not fully explain the disparities in property values.23 Specifically, the study found that “homes of similar quality in neighborhoods with similar amenities are worth 23 percent less in majority black neighborhoods, compared to those with very few or no black residents” and “across all majority black neighborhoods, owner-occupied homes are undervalued by $48,000 per home on average, amounting to $156 billion in cumulative losses.”

Perry did not control for location which is the most important factor in home value. This is a case of correlation. Blacks make and have less money than whites so they buy less expensive homes in less expensive areas. The home values came from Zillow. Zillow states their zestimates are not appraisals or home valuations. No home was "undervalued" by any amount. There are no "losses."

B. Waters misstates the results of the Freddie Mac study. "Freddie Mac in 2021 analyzed what share of appraisers produced a significant Black-White and Latinx-White appraisal gap where homes in Black and Latinx census tracts are valued below the contract price compared to those in White census tracts." As stated above Freddie Mac stated they came to no conclusion for the cause of appraisal gaps. This article explains "appraisal gap." This was a comparison in appraisal gaps between two census tract areas and not different races, colors, ethnicities of the buyers, sellers, owners.

C. Waters misstates the results of the Fannie Mae study. "Fannie Mae found that White homes in both majority-White and majority-Black neighborhoods were overvalued compared against both AVMs while Black homes in each neighborhood type were devalued." Fannie Mae made it's own proprietary AVM and will not disclose their algorithm. There is no "overvalued" in the study. There is only over or under the AVM. AVMs are not accurate. They only consider the most average home in average condition. They do not include views, upgrades, location in a neighborhood, added amenities... This article explains the problems with AVMs. The most likely cause of the differences is again the income, wealth gap between white, black. Whites have more money and buy more expensive homes. They are most likely buying the more improved, upgraded homes with views in the same neighborhood as blacks.

D. Waters misstates the results of another study. "Federal Housing Finance Agency (FHFA) conducted a key word search for millions of appraisals for transactions backed by Fannie Mae and Freddie Mac and found that individual appraisers included overt references to race, ethnicity, and other prohibited bases under federal fair lending laws in their appraisal reports." From the actual report, "From millions of appraisals submitted annually, a keyword search resulted in thousands of potential race-related flags." That is 1,000/1,000,000 = .001% or 1/1,000th of 1%. This is a minuscule amount. While there should be no such references they did not say or show the references affected the value. One of the alleged race-related words was "gentrification" which the government itself and Maxine Waters use all the time. The correct term is "revitalization" which is a normal real estate cycle.

4. Industry Regulation

Appraisers and the appraisal industry are controlled by Title XI of the Financial Institutions Reform, Recovery, and Enforcement Act of 1989 about 33 years. ASC is a federal government agency which govern and control the industry. TAF is authorized by Congress as the source for appraisal standards and qualifications. ASB and ASQ are under TAF. Previously Maxine Waters incorrectly stated that the Appraisal Institute controls appraisers and the industry. I had tried to meet with Waters to correct this and many other false statements she's repeatedly made about appraisers and appraising. AI is a private non-profit organization which promotes the appraisal profession. It costs up to $15,000 to become an AI MAI appraiser. AI does not speak for all appraisers but a few. I am not a member.

Waters now wants to start a new federal agency to replace ASC, ASB, AQB and TAF because she doesn't understand how these agencies work. They have been working together since 1989. Now Waters wants to disrupt an entire industry to cater to her friends at the private non-profit Fair Housing Alliance.

5. Administrative Action

A. PAVE Task Force Report

The PAVE Task Force Report was just released.

https://mary--cummins.blogspot.com/2022/03/pave-task-force-action-plan-from-white.html

B. ASC report

The private non-profit Fair Housing Alliance released their report. They included false and mischaracterized information including Andre Perry's paper. Here is my reply.

https://mary--cummins.blogspot.com/2022/01/identifying-bias-and-barriers-promoting.html

C. DOJ Statement of Interest in case Austin v Miller

DOJ filed a Statement of Interest in the case. That case has been covered extensively in this article linked below. Per black Plaintiffs' Reply they wanted the white real estate appraiser to only use sold comparables from Mill Valley and Sausalito two "white" areas which are worth about twice as much as their home, area in a "black" area in Marin City. Mill Valley is over a mile away and has one of the best school systems in the state. Austins stated it's "racist" to use sold comparables from their own neighborhood because it's "black" just like they are. These are actual quotes from their legal filing. Appraisers must use the most similar homes in the same area by law. Home values are based on LOCATION, LOCATION, LOCATION. Every home owner would love to use Beverly Hills comps to appraise their home in South Los Angeles but you can't. I wanted to speak to Waters about her false misrepresentation of this case but Waters office would never set the meeting. I sent a letter which I will post later. Waters is clearly just listening to summaries by people with their own agenda.

https://mary--cummins.blogspot.com/2021/02/alleged-discrimination-home-appraisal.html

6. Legislative Proposal

This new agency is demanding to know the race, ethnicity, gender of all licensed appraisers. This information is not mandatory in California but the federal government will now demand it. AMCs will have to turn over the race, ethnicity and gender of all their appraisers.

On page nine it appears Maxine Waters wants actual appraisals and all information from appraisers publicly available online. Only personally identifiable information may be redacted like their name. Your home appraisal will be available with photos of the interior of your home, where your security system is located, how to break into your home, where you keep your valuables, where your safe is located, where your little kids sleep, what is the best way to break in and rob you, gun collections, religious items, family photos, where you keep your purse, home layout...?

It appears that appraisers race, ethnicity and gender information will be publicly available online as well.

Funding for fair housing testing must be provided. I will bet that the main Fair Housing nonprofit organizations National Fair Housing Alliance want money for their sting operations. The government will be funding non profits' personal agenda. They are also behind the false and frivolous alleged discrimination lawsuit Austin v Miller. They're asking for money in that lawsuit even though they were not a party to the transaction and there was no discrimination.

All state complaints must be referred to the federal government within 48 hours. The appraiser who is the subject of the complaint must hand over 24 months of appraisals of other people's homes in the investigation of any complaint. Invasion of privacy of other people. Can they get these docs in a FOIA request? Complaints must be resolved within 100 days.

If someone complains about an appraiser, the appraiser must give the borrower, owner the difference between their appraisal and another higher appraisal even if there were no damages or loss. Talk about undue influence to come in over market value. You know some borrowers will be getting their friends to make over market appraisals. What if the value is lower? The market may soon be changing. The person who doesn't like their appraisal now has up to five years to file a lawsuit against the appraiser instead of the usual 1-2 years statute of limitations.

Racism is a big problem in our country. Wasting time on issues which are not racism detracts from the real issues of racism.

Link to actual proposed new Bill.

Video of the meeting for new bill

https://financialservices.house.gov/events/eventsingle.aspx?EventID=409150

Proposed testimony for the meeting

https://docs.house.gov/Committee/Calendar/ByEvent.aspx?EventID=114561

Peter Tobias of AEI sent in testimony "Faulty Evidence and Misdiagnosed Solutions."

https://docs.house.gov/meetings/BA/BA00/20220329/114561/HHRG-117-BA00-Wstate-PeterT-20220329.pdf

Mary Cummins of Cummins Real Estate is a certified residential licensed appraiser in Los Angeles, California. Mary Cummins is licensed by the California Bureau of Real Estate appraisers and has over 35 years of experience.

- Mary Cummins LinkedIn

- Mary Cummins Meet up

- Cummins Real Estate on Facebook

- Mary Cummins Real Estate blog

- Cummins Real Estate on Google maps

- Mary Cummins of Animal Advocates

- Mary Cummins biography resume short

- Mary Cummins Real Estate Services

- Animal Advocates fan page at Facebook.com

- Mary Cummins

- Mary Cummins Animal Advocates on Flickr photos

- Mary Cummins Animal Advocates on Twitter.com

- Mary Cummins on MySpace.com

- Mary Cummins on YouTube.com videos

- Mary Cummins of Animal Advocates on Classmates

- Mary Cummins on VK

No comments:

Post a Comment