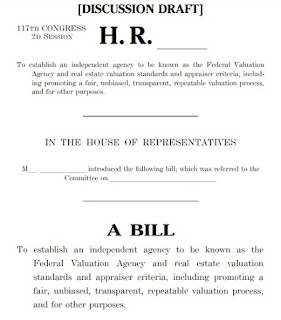

Maxine Water's bill is about more than discrimination. It's also about the complaint process and changing the appraisal regulatory system. The Bill would remove states as the investigatory authority and turns it over to the federal government. If a complaint is filed, the federal government can ask for 24 months of all the appraiser's appraisals. Even HUD complaints only ask for 12 months. This is clearly huge pressure to meet contract price for the borrower even though we appraisers work for the lender.

ASC stated that TAF isn't accountable to the public. All proposed changes to Standards and Qualifications are public and open for comment. TAF answers questions from appraisers and others for clarification. They are transparent and available.

Based on the Bill ASC will be given new powers and responsibilities when they have a limited track record. For the past six years ASC was supposed to make a national list of all appraisers giving them a unique number. They have received millions of dollars to help accomplish this task yet have never done it. Some appraisers have licenses in more than one state so you can't just add up all of the state licensees. AMCs pay a fee to ASC for each appraiser on their roster. Some appraisers are on more than one roster. ASC has received millions yet has not compiled the list. It makes no sense to give them even more power and responsibility.

It's important to know how many appraisers there are because of the current arguments stating there are not enough appraisers. Most feel the shortage of appraisers is actually just a shortage of appraisers who are licensed and willing to do appraisals for lending purposes. Many don't do lender work anymore because of all the new legislation and layers of extra work.

ASC has also failed to track the national complaint hotline. Now Waters wants the ASC to be in charge of investigating 24 months of appraisals in complaints. If ASC can't do the former, they clearly can't do the later. The Dodd Frank Act put ASC in charge of developing AVM standards yet ASC has not done this within the last 12 years. There is no reason to give ASC more responsibilities when they can't even handle their current responsibilities.

Jim Park of ASC stated in congressional testimony last Thursday in front of the US Senate that Appraisers had “…driven up service times and appraisal fees to unacceptable levels….” top of page 3 https://www.banking.senate.gov/imo/media/doc/Park%20Testimony%203-24-22.pdf

This is false. As an appraiser I received $300 for an appraisal in 1984. 1990 it was $350. It's still just about the same amount over 30 years later. Because of the Dodd Frank Act AMCs were mandated to be the middle man between lenders and appraisers. They raised the fees and now take a huge chunk. The AMC receives about $650-$1,800 and pays the appraiser about $350. The AMCs charge whatever they like then make appraisers bid for the assignment. They take the lowest bid and pocket the rest as profit. Dodd Frank mandated AMCs is the reason why fees are higher today. The fees paid to the appraiser have not kept up with inflation even though the amount of work required today is at least twice as much.

Mr. Park made a discriminatory, ageist statement when stating old appraisers are hard to teach new information. I'm 55 and I always instantly embrace all new technology. I used one of the first laser measuring devices in the 1980's. I use LiDAR today. I ditched the typewriter and paper forms for computer software before any other appraiser I know. I had one of the first real estate websites on the internet in 1997. I had one of the first digital cameras. I use mobile appraisal software. I've tested the new 3D home interior scanners. I made my own computer program to pull MLS data in 1004 format in the '90's. Appraisers love new technology because it can make our job faster and better. We teach ourselves new tricks.

HUD themselves are responsible for a shortage in the number of appraisers who can complete mortgage lending appraisals. After passage of the Housing and Economic Recovery Act of 2008 (HERA), the Dept of Housing and Urban Development no longer permitted the “Licensed” category of real estate appraisers to conduct appraisals, instead only the “Certified” category of real estate appraisers could complete appraisals for the FHA Insurance program. Before HERA passed, there were 30,286 Licensed Appraisers. Today, there are only 7,321 Licensed Appraisers, because the majority of lenders moved away from hiring Licensed Appraisers after HERA was passed.

HUD has never released documentation showing the number of alleged discrimination complaints against appraisers. Why is the cause of the lack of transparency? They claim to record every complaint they receive. They even release annual reports. Those annual reports have not noted instances of discriminatory appraisals. Why are they not disclosing discrimination complaints? It is likely because, up until last year, the number of complaints has been too few and likely dismissed. It is reported they have roughly 100 allegations currently, none of which have been resolved in the mandatory 100 days. Why are they holding on to the cases?

I was forced to send in multiple FOIA requests to get the results of investigations which I'm following here on my blog, i.e Austin v Miller in Marin, California; Carlette Duffy in Indianapolis, Indiana, Sanders Horton in Jacksonville, Florida and Cora Robinson in Oakland, California. This is the standard reply to my requests. They state I must get the complainant to sign a notarized statement with their name, date of birth, nation of origin, home address ... stating they agree to the release of the documents and information. Of course they will say no. I've been making FOIA requests for over 25 years and have never had a reply like this ever. Some appraisers and I are now contemplating fundraising to hire an attorney to sue HUD to get the results of the legitimate FOIA requests. In the meantime I appealed the FOIA denials. HUD also is the first agency to ever force me to make multiple initial FOIA requests for the same information. This is unprecedented lack of transparency and a violation of the FOIA.

The ASC study was actually made by the advocacy group the National Fair Housing Alliance NFHA. They are a private non-profit organization. They were given $250,000 to study the Standards and Qualifications for appraisers. Instead their report is on the appraisal regulatory structure and TAF's authority. The ASC is responsible for monitoring the states and their enforcement procedures. TAF sets the standards and qualifications. Blaming TAF for ASC's failure of enforcement mechanisms makes absolutely no sense.

No member of the ASB or the AQB was contacted or interviewed for the new Bill. There are errors in the report that Jim Park (ASC) would know are obviously incorrect, yet he let the study be published to support his narrative. The NFHA Advocates who authored the study indicated they had insufficient time to complete extensive research for this study, yet were able to draw conclusions, nonetheless.

All major legislation passed that affects appraisers has had a significant negative consequence to appraisers and the appraiser’s business. The appraiser community has not had a voice at the table to provide expertise about the valuation profession. I contacted every member of the PAVE Task Force asking to be involved, to attend meetings, to receive documents and communications as a Latino woman appraiser with over 35 year of experience. I didn't even get a reply. I was blocked from even being informed about what was happening. I'm now forced to send in another FOIA request just to get public information which should have been released.

While Jim Park was an appraiser he's not actively appraising today. He has no idea what appraisers deal with on a daily basis. Prior to the Dodd Frank legislation, there were appraisers willing to function as supervisors and the trainee/supervisor model was functioning, After Dodd Frank, most appraisers had to shut down their small businesses and become individual single-owner shops. Lenders, after Dodd Frank, largely stopped allowing trainee appraisers to inspect the property without the supervisor present, yet lenders will gladly hire third-party non-appraisers to collect data on the property. The lenders do not allow the trainee model to add value to an appraisers’ work. You cannot blame the appraisers for a system that does not allow a new generation of appraisers to be trained.

Mary Cummins of Cummins Real Estate is a certified residential licensed appraiser in Los Angeles, California. Mary Cummins is licensed by the California Bureau of Real Estate appraisers and has over 35 years of experience.

- Mary Cummins LinkedIn

- Mary Cummins Meet up

- Cummins Real Estate on Facebook

- Mary Cummins Real Estate blog

- Cummins Real Estate on Google maps

- Mary Cummins of Animal Advocates

- Mary Cummins biography resume short

- Mary Cummins Real Estate Services

- Animal Advocates fan page at Facebook.com

- Mary Cummins

- Mary Cummins Animal Advocates on Flickr photos

- Mary Cummins Animal Advocates on Twitter.com

- Mary Cummins on MySpace.com

- Mary Cummins on YouTube.com videos

- Mary Cummins of Animal Advocates on Classmates

- Mary Cummins on VK

No comments:

Post a Comment